Today we're going to take a closer look at large-cap Technology company HP, whose shares are currently trading at $29.52. We've been asking ourselves whether the company is under or over valued at today's prices... let's perform a brief value analysis to find out!

HP Is Overvalued:

HP Inc. provides personal computing and other access devices, imaging and printing products, and related technologies, solutions, and services in the United States and internationally. The company belongs to the Technology sector, which has an average price to earnings (P/E) ratio of 35.0. In contrast, HP has a trailing 12 month P/E ratio of 9.1 based on its earnings per share of $3.26.

There is an important limit on the usefulness of P/E ratios. Since the P/E ratio is the share price divided by earnings per share, the ratio is determined partially by market sentiment on the stock. Sometimes a negative sentiment translates to a lower market price and therefore a lower P/E ratio -- and there might be good reasons for this negative sentiment.

One of the main reasons not to blindly invest in a company with a low P/E ratio is that it might have low growth expectations. Low growth correlates with low stock performance, so it's useful to factor growth into the valuation process. One of the easiest ways to do this is to divide the company's P/E ratio by its expected growth rate, which results in the price to earnings growth, or PEG ratio.

When we do this for HP, we obtain a PEG ratio of 1.11, which tells us the company is fairly valued in terms of growth. PEG ratios under 1 are considered an indicator of undervalued growth, but we need to keep in mind that many successful companys with excellent share performance have maintained much higher PEG ratios.

As always, a quantitave approach to a stock should be supplemented with a look at qualitative factors, such as the competence of its management team, quality of its corporate culture, and the wide variety of social and economic factors that can impact the success of its product.

Shareholders Are Confronted With a Declining EPS Growth Trend:

| 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | |

|---|---|---|---|---|---|---|

| Revenue (MM) | $58,472 | $58,756 | $56,638 | $63,460 | $62,910 | $54,675 |

| Revenue Growth | n/a | 0.49% | -3.6% | 12.04% | -0.87% | -13.09% |

| Gross Margins | 7% | 7% | 6% | 8% | 7% | 6% |

| Operating Margins | 7% | 7% | 6% | 12% | 7% | 6% |

| Net Margins | 9% | 5% | 5% | 10% | 5% | 4% |

| Net Income (MM) | $5,327 | $3,152 | $2,815 | $6,541 | $3,132 | $2,266 |

| Net Interest Expense (MM) | -$818 | -$1,354 | -$231 | $2,209 | -$235 | -$451 |

| Depreciation & Amort. (MM) | $528 | $744 | $789 | $785 | $780 | $847 |

| Earnings Per Share | $3.26 | $2.07 | $1.98 | $5.36 | $2.98 | $2.31 |

| EPS Growth | n/a | -36.5% | -4.35% | 170.71% | -44.4% | -22.48% |

| Diluted Shares (MM) | 1,634 | 1,524 | 1,420 | 1,220 | 1,050 | 855 |

| Free Cash Flow (MM) | $3,982 | $3,983 | $3,736 | $5,827 | $3,672 | $2,897 |

| Capital Expenditures (MM) | $546 | $671 | $580 | $582 | $791 | $603 |

| Current Ratio | 0.85 | 0.8 | 0.79 | 0.76 | 0.75 | 0.69 |

| Long Term Debt (MM) | $4,524 | $4,780 | $5,543 | $6,386 | $10,796 | $9,236 |

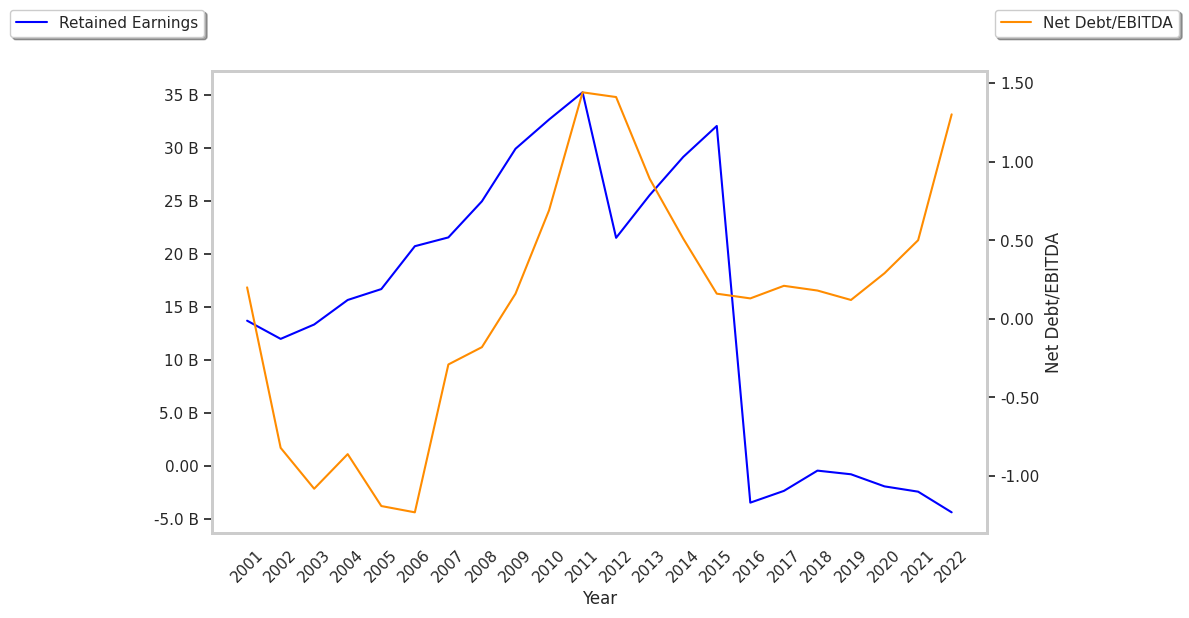

| Net Debt / EBITDA | 0.19 | 0.13 | 0.32 | 0.38 | 1.47 | 1.99 |

HP has slimmer gross margins than its peers, weak operating margins with a stable trend, and declining EPS growth. On the other hand, the company has healthy leverage working in its favor. Furthermore, HP has weak revenue growth and a flat capital expenditure trend and irregular cash flows.