A strong performer from today's evening trading session is Prologis, whose shares rose 1.8% to $122.0 per share. For those of you thinking about investing in the stock, here is a brief value analysis of the stock using the company's basic fundamental ratios.

Prologis's Valuation Is in Line With Its Sector Averages:

Prologis, Inc. is the global leader in logistics real estate with a focus on high-barrier, high-growth markets. The company belongs to the Real Estate sector, which has an average price to earnings (P/E) ratio of 25.55 and an average price to book (P/B) ratio of 2.1. In contrast, Prologis has a trailing 12 month P/E ratio of 38.9 and a P/B ratio of 2.1.

When we divide Prologis's P/E ratio by its expected EPS growth rate of the next five years, we obtain its PEG ratio of -6.27. Since it's negative, the company has negative growth expectations, and most investors will probably avoid the stock unless it has an exceptionally low P/E and P/B ratio.

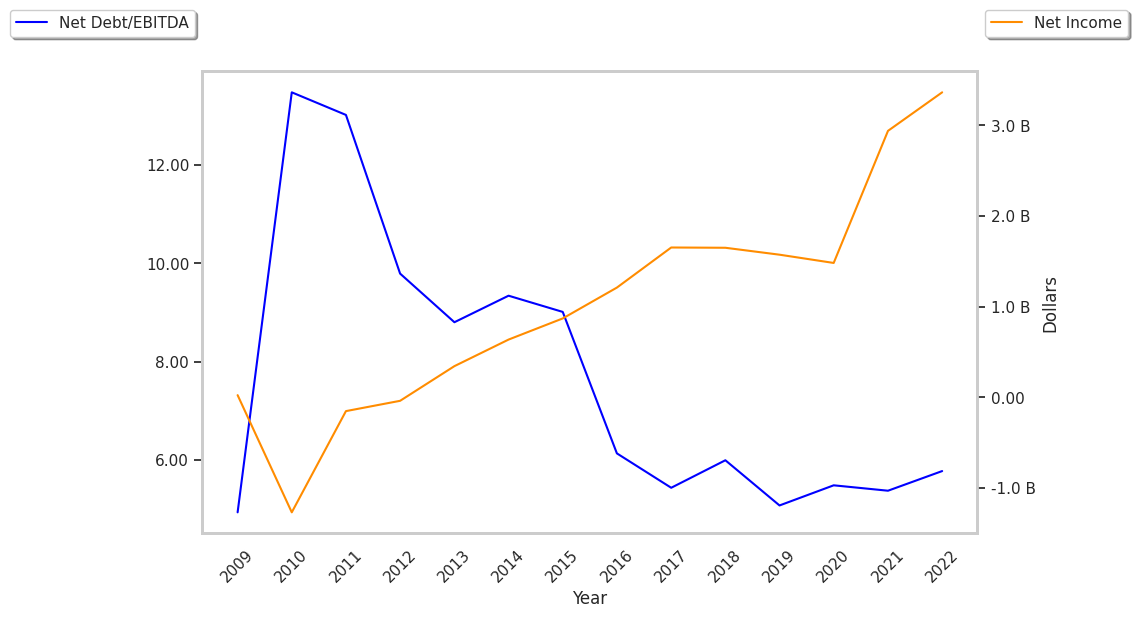

The Company May Be Profitable, but Its Balance Sheet Is Highly Leveraged:

| 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | |

|---|---|---|---|---|---|---|

| Revenue (MM) | $2,804 | $3,331 | $4,439 | $4,759 | $5,974 | $7,886 |

| Revenue Growth | n/a | 18.76% | 33.27% | 7.23% | 25.51% | 32.01% |

| Operating Margins | 67% | 56% | 48% | 70% | 62% | 47% |

| Net Margins | 65% | 51% | 36% | 66% | 60% | 41% |

| Net Income (MM) | $1,823 | $1,702 | $1,617 | $3,149 | $3,555 | $3,197 |

| Net Interest Expense (MM) | $229 | $240 | $315 | $266 | $309 | $588 |

| Depreciation & Amort. (MM) | $947 | $1,140 | $1,562 | $1,578 | $1,813 | $2,459 |

| Earnings Per Share | $2.87 | $2.46 | $2.01 | $3.94 | $4.25 | $3.24 |

| EPS Growth | n/a | -14.29% | -18.29% | 96.02% | 7.87% | -23.76% |

| Diluted Shares (MM) | 590 | 655 | 754 | 765 | 812 | 1,369 |

| Free Cash Flow (MM) | -$150 | $469 | $1,017 | $356 | $1,008 | $2,182 |

| Capital Expenditures (MM) | $1,953 | $1,795 | $1,920 | $2,640 | $3,118 | $3,394 |

| Current Ratio | 48.25 | 9.06 | 11.88 | 12.18 | 10.73 | 10.59 |

| Total Debt (MM) | $11,090 | $11,906 | $16,849 | $17,715 | $23,876 | $27,578 |

| Net Debt / EBITDA | 3.79 | 3.62 | 4.41 | 3.5 | 4.29 | 4.37 |

Prologis has growing revenues and increasing reinvestment in the business and decent operating margins with a negative growth trend. Additionally, the company's financial statements display positive EPS growth and irregular cash flows. However, the firm has a highly leveraged balance sheet.