Large-cap Industrials company Baker Hughes Company has logged a 0.9% change today on a trading volume of 3,579,079. The average volume for the stock is 6,917,374.

Baker Hughes Company provides a portfolio of technologies and services to energy and industrial value chain worldwide. Based in Houston, United States the company has 57,000 full time employees and a market cap of $33,036,363,776. Baker Hughes Company currently offers its equity investors a dividend that yields 2.4% per year.

The company is now trading -21.51% away from its average analyst target price of $41.54 per share. The 25 analysts following the stock have set target prices ranging from $36.0 to $47.0, and on average give Baker Hughes Company a rating of buy.

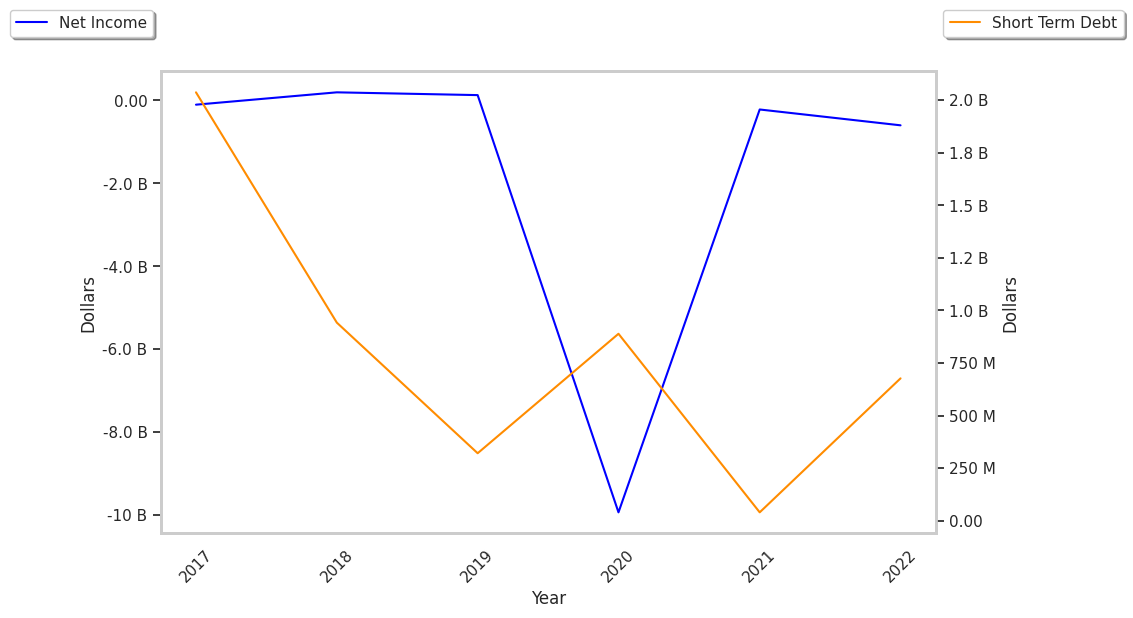

Over the last 52 weeks, BKR stock has risen 11.5%, which amounts to a -4.8% difference compared to the S&P 500. The stock's 52 week high is $37.58 whereas its 52 week low is $26.12 per share. Based on Baker Hughes Company's average net margin growth of 38.1% over the last 5 years, its core business is on track for profitability and its strong stock performance may continue in the long term.

| Date Reported | Total Revenue ($ k) | Net Profit ($ k) | Net Margins (%) |

|---|---|---|---|

| 2023 | 24,577,000 | 1,707,000 | 7 |

| 2022 | 21,156,000 | 23,000 | 0 |

| 2021 | 20,502,000 | -111,000 | -1 |

| 2020 | 20,705,000 | -5,821,000 | -28 |

| 2019 | 23,838,000 | 271,000 | 1 |

| 2018 | 22,877,000 | 283,000 | 1 |