Today we're going to take a closer look at large-cap Technology company Adobe, whose shares are currently trading at $585.91. We've been asking ourselves whether the company is under or over valued at today's prices... let's perform a brief value analysis to find out!

Adobe's P/B and P/E Ratios Are Higher Than Average:

Adobe Inc., together with its subsidiaries, operates as a diversified software company worldwide. The company belongs to the Technology sector, which has an average price to earnings (P/E) ratio of 35.0 and an average price to book (P/B) ratio of 7.92. In contrast, Adobe has a trailing 12 month P/E ratio of 49.6 and a P/B ratio of 16.14.

Adobe's PEG ratio is 2.28, which shows that the stock is probably overvalued in terms of its estimated growth. For reference, a PEG ratio near or below 1 is a potential signal that a company is undervalued.

Growing Revenues With Increasing Reinvestment in the Business:

| 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | |

|---|---|---|---|---|---|---|

| Revenue (MM) | $9,030 | $11,171 | $12,868 | $15,785 | $17,606 | $18,886 |

| Revenue Growth | n/a | 23.71% | 15.19% | 22.67% | 11.54% | 7.27% |

| Operating Margins | 31% | 28% | 33% | 37% | 35% | 34% |

| Net Margins | 28% | 26% | 41% | 31% | 27% | 27% |

| Net Income (MM) | $2,591 | $2,951 | $5,260 | $4,822 | $4,756 | $5,121 |

| Net Interest Expense (MM) | $89 | $157 | $116 | $113 | $112 | $113 |

| Depreciation & Amort. (MM) | $346 | $757 | $757 | $788 | $856 | $865 |

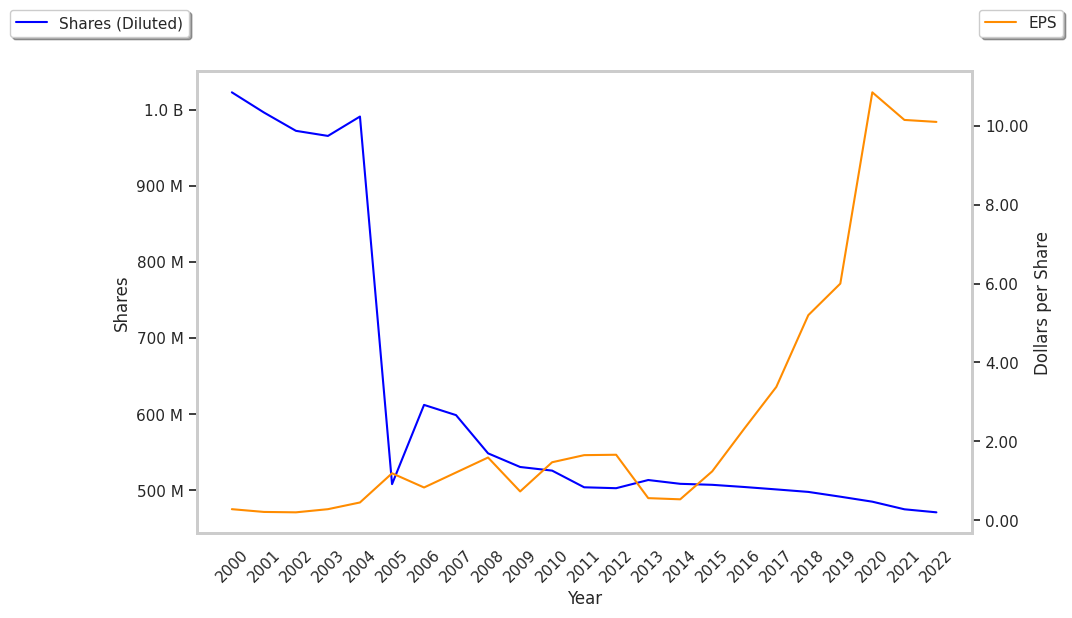

| Earnings Per Share | $5.2 | $6.0 | $10.83 | $10.02 | $10.1 | $11.11 |

| EPS Growth | n/a | 15.38% | 80.5% | -7.48% | 0.8% | 10.0% |

| Diluted Shares (MM) | 498 | 492 | 486 | 481 | 471 | 430 |

| Free Cash Flow (MM) | $3,762 | $4,027 | $5,308 | $6,882 | $7,396 | $7,626 |

| Capital Expenditures (MM) | $267 | $395 | $419 | $348 | $442 | $404 |

| Current Ratio | 1.13 | 0.79 | 1.48 | 1.25 | 1.11 | 1.25 |

| Total Debt (MM) | $4,147 | $4,138 | $4,117 | $4,123 | $4,129 | $3,633 |

| Net Debt / EBITDA | 0.79 | 0.37 | -0.07 | 0.04 | -0.02 | -0.4 |

Adobe benefits from growing revenues and increasing reinvestment in the business, low leverage, and decent operating margins with a stable trend. The company's financial statements show a strong EPS growth trend and irregular cash flows.