It's been a great afternoon session for Broadcom investors, who saw their shares rise 2.5% to a price of $1134.03 per share. At these higher prices, is the company still fairly valued? If you are thinking about investing, make sure to check the company's fundamentals before making a decision.

Broadcom's Valuation Is in Line With Its Sector Averages:

Broadcom Inc. designs, develops, and supplies various semiconductor devices with a focus on complex digital and mixed signal complementary metal oxide semiconductor based devices and analog III-V based products worldwide. The company belongs to the Technology sector, which has an average price to earnings (P/E) ratio of 35.0 and an average price to book (P/B) ratio of 7.92. In contrast, Broadcom has a trailing 12 month P/E ratio of 34.4 and a P/B ratio of 19.15.

Broadcom's PEG ratio is 1.72, which shows that the stock is probably overvalued in terms of its estimated growth. For reference, a PEG ratio near or below 1 is a potential signal that a company is undervalued.

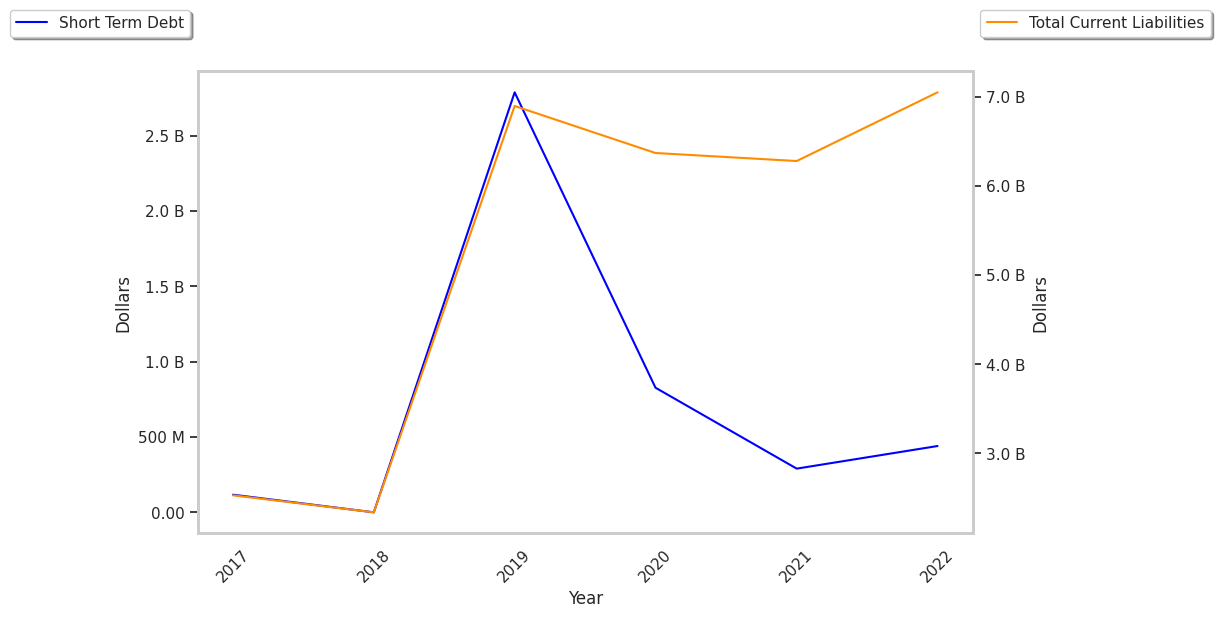

The Company Has a Highly Leveraged Balance Sheet:

| 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | |

|---|---|---|---|---|---|---|

| Revenue (MM) | $20,848 | $22,597 | $23,888 | $27,450 | $33,203 | $35,454 |

| Revenue Growth | n/a | 8.39% | 5.71% | 14.91% | 20.96% | 6.78% |

| Operating Margins | 25% | 15% | 17% | 31% | 43% | 45% |

| Net Margins | 61% | 12% | 12% | 25% | 35% | 39% |

| Net Income (MM) | $12,629 | $2,736 | $2,961 | $6,736 | $11,495 | $13,917 |

| Net Interest Expense (MM) | $628 | $1,444 | $1,777 | $1,885 | $1,737 | $1,623 |

| Depreciation & Amort. (MM) | $515 | $569 | $570 | $539 | $529 | $507 |

| Earnings Per Share | $28.44 | $6.43 | $6.33 | $15.0 | $26.53 | $32.550000000000004 |

| EPS Growth | n/a | -77.39% | -1.56% | 136.97% | 76.87% | 22.69% |

| Free Cash Flow (MM) | $8,245 | $9,265 | $11,598 | $13,321 | $16,312 | $17,371 |

| Capital Expenditures (MM) | $635 | $432 | $463 | $443 | $424 | $469 |

| Current Ratio | 3.9 | 1.44 | 1.87 | 2.64 | 2.62 | 2.5 |

| Total Debt (MM) | $17,493 | $30,491 | $41,062 | $41,499 | $39,515 | $39,341 |

| Net Debt / EBITDA | 2.34 | 6.34 | 7.3 | 3.24 | 1.84 | 1.66 |