It hasn't been a great afternoon session for Cigna investors, who have watched their shares sink by -2.8% to a price of $290.19. Some of you might be wondering if it's time to buy the dip. If you are considering this, make sure to check the company's fundamentals first to determine if the shares are fairly valued at today's prices.

A Lower P/B Ratio Than Its Sector Average but Trades Above Its Graham Number:

The Cigna Group, together with its subsidiaries, provides insurance and related products and services in the United States. The company belongs to the Health Care sector, which has an average price to earnings (P/E) ratio of 30.21 and an average price to book (P/B) ratio of 4.08. In contrast, Cigna has a trailing 12 month P/E ratio of 16.4 and a P/B ratio of 1.86.

P/E rations can be placed into context by dividing them by the firm's expected 5-year EPS growth rate, which gives us its Price to Earnings Growth (PEG) ratio. Cigna's PEG ratio is 1.07, which tells us the company is fairly valued in terms of growth. PEG ratios under 1 are considered an indicator of undervalued growth, but we need to keep in mind that many successful companies with excellent share performance have maintained much higher PEG ratios.

As always, a quantitative approach to a stock should be supplemented with a look at qualitative factors, such as the competence of its management team, quality of its corporate culture, and the wide variety of social and economic factors that can impact the success of its product.

The Business Has Weak Operating Margins:

| 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | |

|---|---|---|---|---|---|---|

| Revenue (MM) | $48,650 | $153,566 | $160,401 | $174,078 | $180,516 | $189,902 |

| Revenue Growth | n/a | 215.65% | 4.45% | 8.53% | 3.7% | 5.2% |

| Operating Margins | 9% | 5% | 7% | 5% | 5% | 4% |

| Net Margins | 5% | 3% | 5% | 3% | 4% | 3% |

| Net Income (MM) | $2,646 | $5,120 | $8,489 | $5,415 | $6,746 | $5,451 |

| Net Interest Expense (MM) | $507 | $1,645 | -$1,438 | -$1,208 | -$1,228 | -$1,410 |

| Depreciation & Amort. (MM) | $695 | $3,651 | $2,802 | $2,923 | $2,937 | $3,005 |

| Earnings Per Share | $10.54 | $13.44 | $22.96 | $15.73 | $21.3 | $17.61 |

| EPS Growth | n/a | 27.51% | 70.83% | -31.49% | 35.41% | -17.32% |

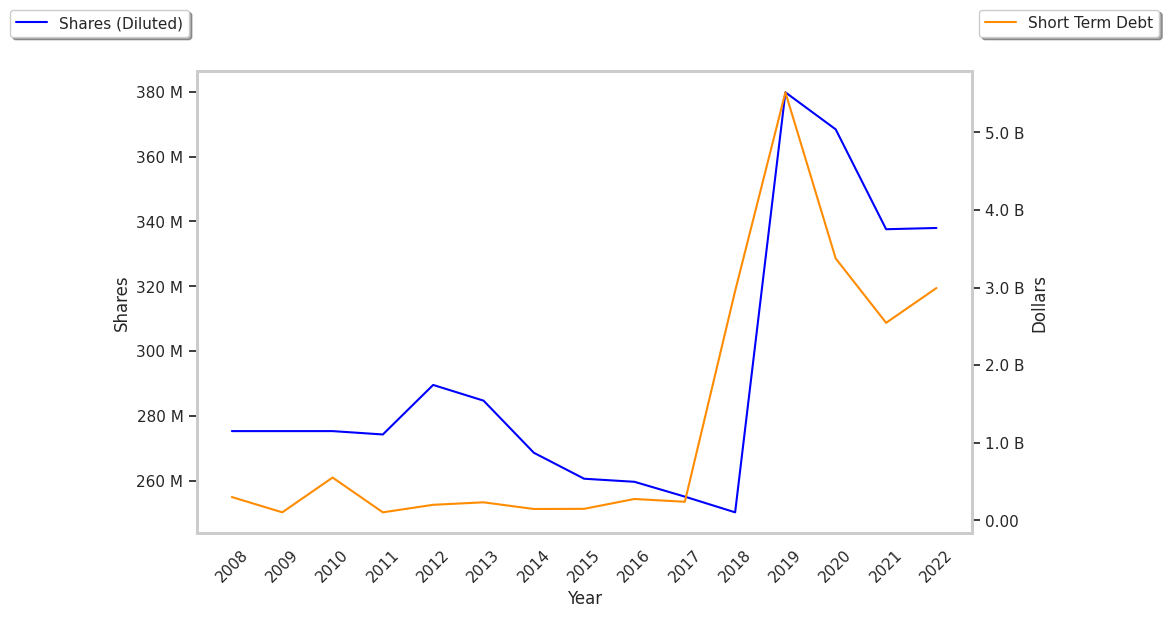

| Diluted Shares (MM) | 250 | 380 | 368 | 341 | 313 | 259 |

| Free Cash Flow (MM) | $3,242 | $8,435 | $10,350 | $7,191 | $8,656 | $12,445 |

| Current Ratio | 0.64 | 0.74 | 0.77 | 0.83 | 0.73 | 0.73 |

| Total Debt (MM) | $92,120 | $78,469 | $84,425 | $90,720 | $79,462 | $84,260 |

| Net Debt / EBITDA | 18.18 | 6.23 | 5.43 | 7.84 | 6.47 | 6.76 |

Cigna has growing revenues and no capital expenditures, positive EPS growth, and irregular cash flows. However, the firm suffers from weak operating margins with a negative growth trend and a highly leveraged balance sheet.