Shares of Cognizant Technology Solutions have moved 1.4% today, and are now trading at a price of $75.73. In contrast, the S&P 500 index saw a -0.0% change. Today's trading volume is 3,232,741 compared to the stock's average volume of 3,244,119.

Cognizant Technology Solutions Corporation, a professional services company, provides consulting and technology, and outsourcing services in North America, Europe, and internationally. Based in Teaneck, United States the company has 346,600 full time employees and a market cap of $37,972,008,960. Cognizant Technology Solutions currently offers its equity investors a dividend that yields 1.6% per year.

The company is now trading 6.23% away from its average analyst target price of $71.29 per share. The 24 analysts following the stock have set target prices ranging from $60.0 to $87.0, and on average give Cognizant Technology Solutions a rating of hold.

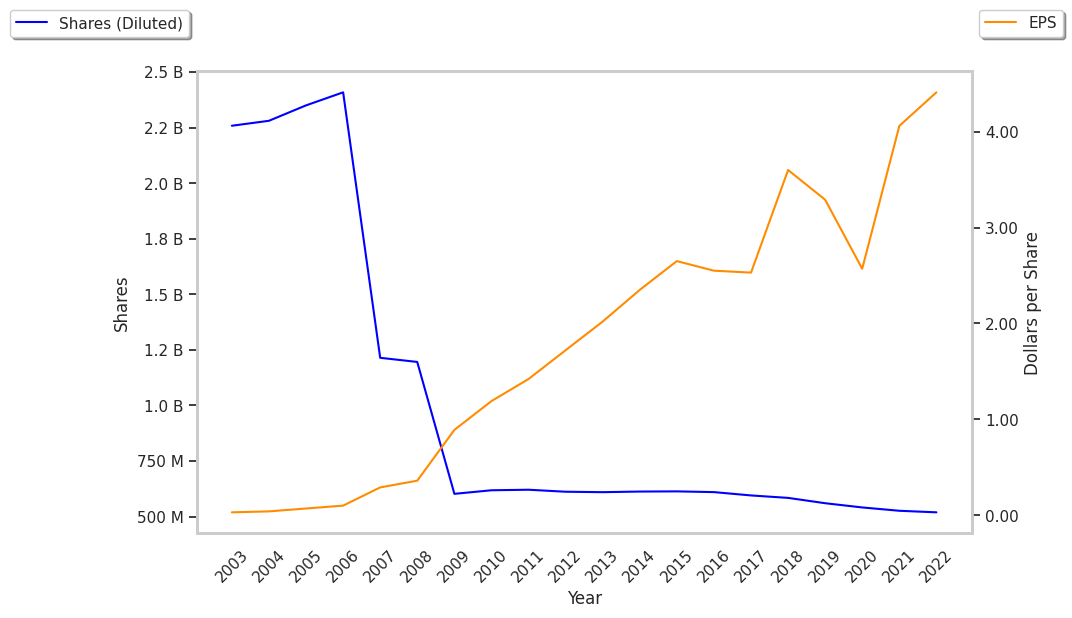

Over the last 52 weeks, CTSH stock has risen 34.4%, which amounts to a 11.9% difference compared to the S&P 500. The stock's 52 week high is $76.64 whereas its 52 week low is $54.25 per share. With its net margins declining an average -3.1% over the last 6 years, Cognizant Technology Solutions may not have a strong enough profitability trend to support its stock price.

| Date Reported | Total Revenue ($ k) | Net Profit ($ k) | Net Margins (%) | YoY Growth (%) |

|---|---|---|---|---|

| 2023 | 19,434,000 | 2,089,000 | 11 | -8.33 |

| 2022 | 19,428,000 | 2,290,000 | 12 | 0.0 |

| 2021 | 18,507,000 | 2,137,000 | 12 | 50.0 |

| 2020 | 16,652,000 | 1,392,000 | 8 | -27.27 |

| 2019 | 16,783,000 | 1,842,000 | 11 | -15.38 |

| 2018 | 16,125,000 | 2,101,000 | 13 |