We've been asking ourselves recently if the market has placed a fair valuation on Danaher. Let's dive into some of the fundamental values of this large-cap Industrials company to determine if there might be an opportunity here for value-minded investors.

A Lower P/B Ratio Than Its Sector Average but Trades Above Its Graham Number:

Danaher Corporation designs, manufactures, and markets professional, medical, industrial, and commercial products and services worldwide. The company belongs to the Industrials sector, which has an average price to earnings (P/E) ratio of 22.19 and an average price to book (P/B) ratio of 4.06. In contrast, Danaher has a trailing 12 month P/E ratio of 28.7 and a P/B ratio of 3.21.

When we divide Danaher's P/E ratio by its expected EPS growth rate of the next five years, we obtain its PEG ratio of -19.8. Since it's negative, the company has negative growth expectations, and most investors will probably avoid the stock unless it has an exceptionally low P/E and P/B ratio.

Growing Revenues With Increasing Reinvestment in the Business:

| 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | |

|---|---|---|---|---|---|---|

| Revenue (MM) | $19,893 | $17,911 | $22,284 | $29,453 | $31,471 | $29,566 |

| Revenue Growth | n/a | -9.96% | 24.42% | 32.17% | 6.85% | -6.05% |

| Operating Margins | 15% | 18% | 20% | 26% | 28% | 24% |

| Net Margins | 13% | 17% | 16% | 22% | 23% | 24% |

| Net Income (MM) | $2,653 | $3,008 | $3,646 | $6,433 | $7,209 | $7,209 |

| Net Interest Expense (MM) | $137 | $108 | $494 | $456 | $211 | $272 |

| Depreciation & Amort. (MM) | $562 | $564 | $1,138 | $1,450 | $1,484 | $1,511 |

| Earnings Per Share | $3.74 | $4.05 | $4.89 | $8.61 | $9.66 | $7.939999999999999 |

| EPS Growth | n/a | 8.29% | 20.74% | 76.07% | 12.2% | -17.81% |

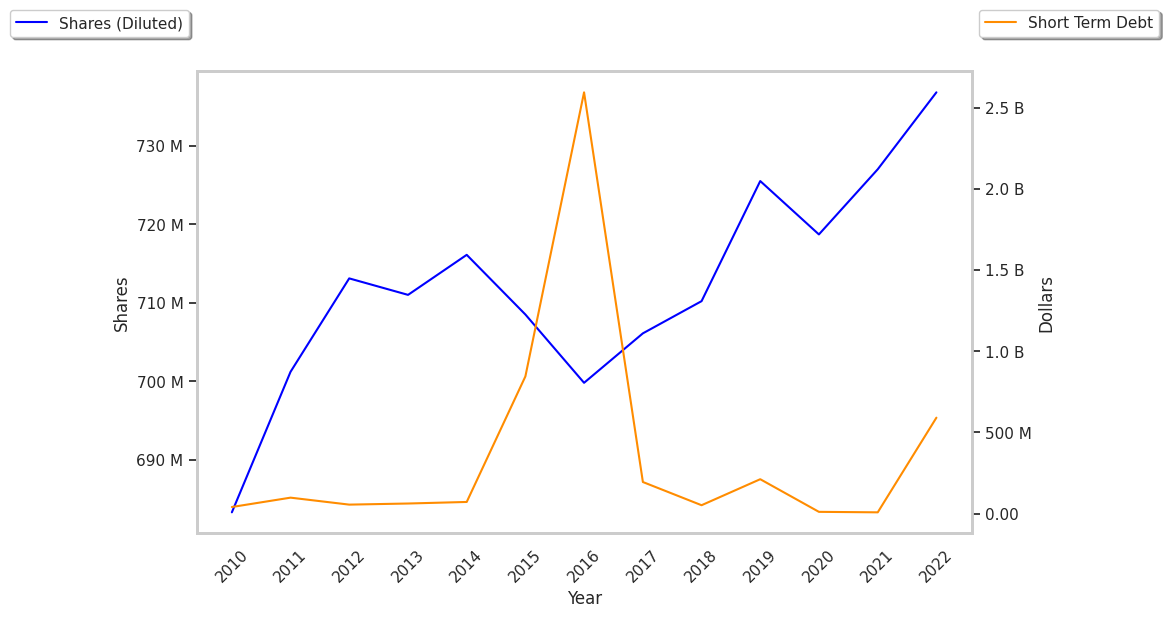

| Diluted Shares (MM) | 710 | 726 | 719 | 737 | 737 | 754 |

| Free Cash Flow (MM) | $3,438 | $3,316 | $5,424 | $7,064 | $7,367 | $7,209 |

| Capital Expenditures (MM) | $584 | $636 | $791 | $1,294 | $1,152 | $1,310 |

| Current Ratio | 1.47 | 5.19 | 1.86 | 1.43 | 1.89 | 2.26 |

| Total Debt (MM) | $9,740 | $21,729 | $21,204 | $22,176 | $19,677 | $22,060 |

| Net Debt / EBITDA | 2.48 | 0.47 | 2.69 | 2.17 | 1.35 | 1.12 |

Danaher benefits from growing revenues and increasing reinvestment in the business, decent operating margins with a positive growth rate, and a strong EPS growth trend. The company's financial statements show irregular cash flows and healthy leverage.