We've been asking ourselves recently if the market has placed a fair valuation on PepsiCo. Let's dive into some of the fundamental values of this large-cap Consumer Staples company to determine if there might be an opportunity here for value-minded investors.

The Market May Be Overvaluing PepsiCo's Earnings and Assets:

PepsiCo, Inc. manufactures, markets, distributes, and sells various beverages and convenient foods worldwide. The company belongs to the Consumer Staples sector, which has an average price to earnings (P/E) ratio of 21.21 and an average price to book (P/B) ratio of 4.12. In contrast, PepsiCo has a trailing 12 month P/E ratio of 27.8 and a P/B ratio of 12.21.

PepsiCo's PEG ratio is 2.58, which shows that the stock is probably overvalued in terms of its estimated growth. For reference, a PEG ratio near or below 1 is a potential signal that a company is undervalued.

Growing Revenues With Increasing Reinvestment in the Business:

| 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | |

|---|---|---|---|---|---|---|

| Revenue (MM) | $64,661 | $67,161 | $70,372 | $79,474 | $86,392 | $149,564 |

| Revenue Growth | n/a | 3.87% | 4.78% | 12.93% | 8.7% | 73.12% |

| Operating Margins | 16% | 15% | 14% | 14% | 13% | 16% |

| Net Margins | 19% | 11% | 10% | 10% | 10% | 12% |

| Net Income (MM) | $12,559 | $7,353 | $7,175 | $7,679 | $8,978 | $18,433 |

| Net Interest Expense (MM) | $1,219 | $935 | $1,128 | $1,863 | $939 | $1,405 |

| Depreciation & Amort. (MM) | $2,399 | $2,432 | $2,548 | $2,710 | $2,763 | $2,882 |

| Earnings Per Share | $8.78 | $5.2 | $5.12 | $5.49 | $6.42 | $13.23 |

| EPS Growth | n/a | -40.77% | -1.54% | 7.23% | 16.94% | 106.07% |

| Diluted Shares (MM) | 1,428 | 1,411 | 1,395 | 1,389 | 1,387 | 5,535 |

| Free Cash Flow (MM) | $6,133 | $5,417 | $6,373 | $6,991 | $5,604 | $6,947 |

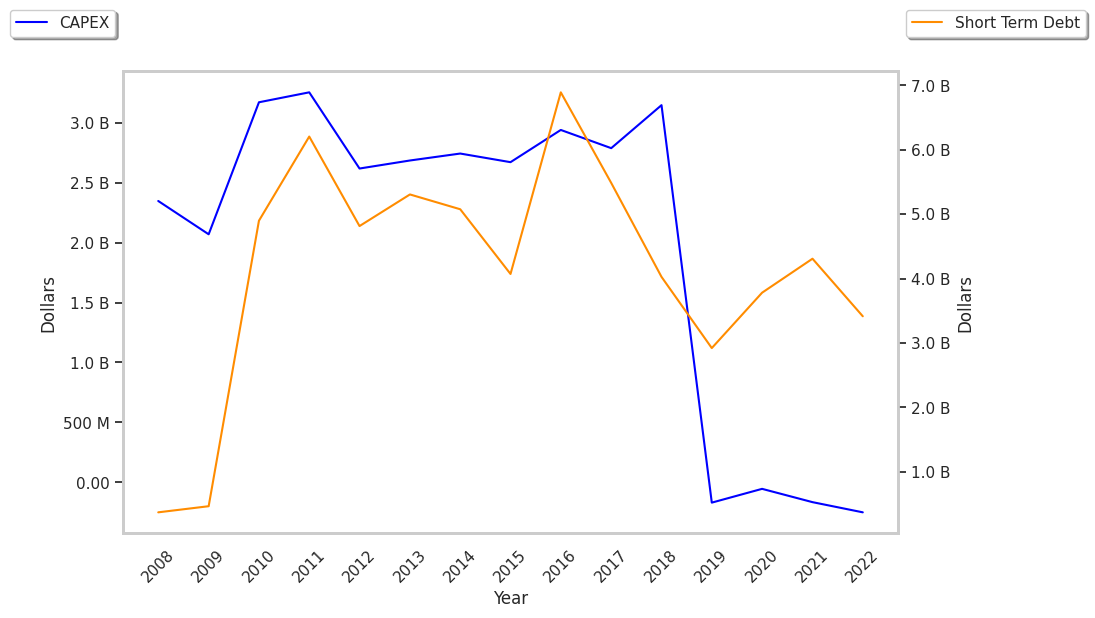

| Capital Expenditures (MM) | $3,282 | $4,232 | $4,240 | $4,625 | $5,207 | $5,188 |

| Current Ratio | 0.99 | 0.86 | 0.98 | 0.83 | 0.8 | 0.88 |

| Total Debt (MM) | $35,992 | $34,118 | $46,542 | $43,338 | $42,590 | $48,465 |

| Net Debt / EBITDA | 2.18 | 2.25 | 3.04 | 2.72 | 2.64 | 1.42 |

PepsiCo has growing revenues and increasing reinvestment in the business, positive EPS growth, and healthy leverage. However, the firm suffers from weak operating margins with a stable trend and irregular cash flows.