It's been a great afternoon session for Nucor investors, who saw their shares rise 1.2% to a price of $172.82 per share. At these higher prices, is the company still fairly valued? If you are thinking about investing, make sure to check the company's fundamentals before making a decision.

The Market May Be Undervaluing Nucor's Earnings and Assets:

Nucor Corporation engages in manufacture and sale of steel and steel products. The company belongs to the Industrials sector, which has an average price to earnings (P/E) ratio of 22.19 and an average price to book (P/B) ratio of 4.06. In contrast, Nucor has a trailing 12 month P/E ratio of 8.7 and a P/B ratio of 2.08.

When we divide Nucor's P/E ratio by its expected EPS growth rate of the next five years, we obtain its PEG ratio of -1.28. Since it's negative, the company has negative growth expectations, and most investors will probably avoid the stock unless it has an exceptionally low P/E and P/B ratio.

Growing Revenues With Increasing Reinvestment in the Business:

| 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | |

|---|---|---|---|---|---|---|

| Revenue (MM) | $25,067 | $22,589 | $20,140 | $36,484 | $41,512 | $35,733 |

| Revenue Growth | n/a | -9.89% | -10.84% | 81.15% | 13.78% | -13.92% |

| Operating Margins | 13% | 8% | 4% | 25% | 25% | 19% |

| Net Margins | 10% | 6% | 4% | 20% | 19% | 15% |

| Net Income (MM) | $2,481 | $1,371 | $836 | $7,122 | $8,080 | $5,366 |

| Net Interest Expense (MM) | $161 | $157 | $167 | $163 | $219 | $243 |

| Depreciation & Amort. (MM) | $631 | $649 | $702 | $735 | $827 | $898 |

| Earnings Per Share | $7.42 | $4.14 | $2.36 | $23.16 | $28.79 | $19.72 |

| EPS Growth | n/a | -44.2% | -43.0% | 881.36% | 24.31% | -31.5% |

| Diluted Shares (MM) | 317 | 306 | 303 | 293 | 263 | 222 |

| Free Cash Flow (MM) | $1,411 | $1,332 | $1,154 | $4,609 | $8,124 | $6,111 |

| Capital Expenditures (MM) | $983 | $1,477 | $1,543 | $1,622 | $1,948 | $2,014 |

| Current Ratio | 3.08 | 3.34 | 3.61 | 2.48 | 3.39 | 3.72 |

| Total Debt (MM) | $4,402 | $4,451 | $5,416 | $5,685 | $6,762 | $6,640 |

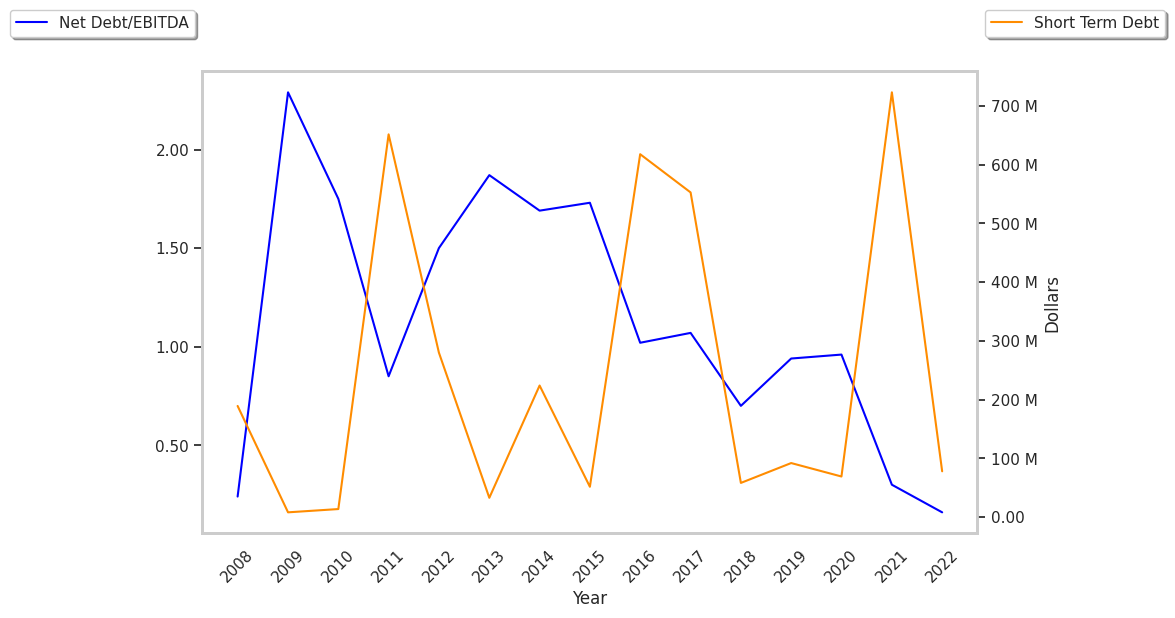

| Net Debt / EBITDA | 0.78 | 1.2 | 1.81 | 0.33 | 0.22 | 0.1 |

Nucor has growing revenues and increasing reinvestment in the business and low leverage. Additionally, the company's financial statements display a strong EPS growth trend and irregular cash flows. However, the firm has weak operating margins with a positive growth rate.