TC Energy logged a 0.4% change during today's evening session, and is now trading at a price of $38.99 per share.

Over the last year, TC Energy logged a -2.3% change, with its stock price reaching a high of $45.18 and a low of $32.52. Over the same period, the stock underperformed the S&P 500 index by -26.0%. As of April 2023, the company's 50-day average price was $36.14. TC Energy Corporation operates as an energy infrastructure company in North America. Based in Calgary, Canada, the large-cap Utilities company has 7,477 full time employees. TC Energy has returned a 10.0% dividend yield over the last 12 months, but the company's patchy cash flow history may not sustain it for much longer.

The Company May Be Profitable, but Its Balance Sheet Is Highly Leveraged:

| 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | |

|---|---|---|---|---|---|---|

| Revenue (MM) | $13,679 | $13,255 | $12,999 | $13,387 | $14,977 | $14,977 |

| Revenue Growth | n/a | -3.1% | -1.93% | 2.98% | 11.88% | 0.0% |

| Operating Margins | 42% | 50% | 52% | 30% | 24% | 24% |

| Net Margins | 27% | 33% | 38% | 15% | 5% | 5% |

| Net Income (MM) | $3,702 | $4,433 | $4,913 | $2,046 | $785 | $785 |

| Net Interest Expense (MM) | $2,265 | $2,333 | $2,228 | $2,360 | $2,588 | $2,588 |

| Depreciation & Amort. (MM) | $2,350 | $2,464 | $2,590 | $2,522 | $2,584 | $2,584 |

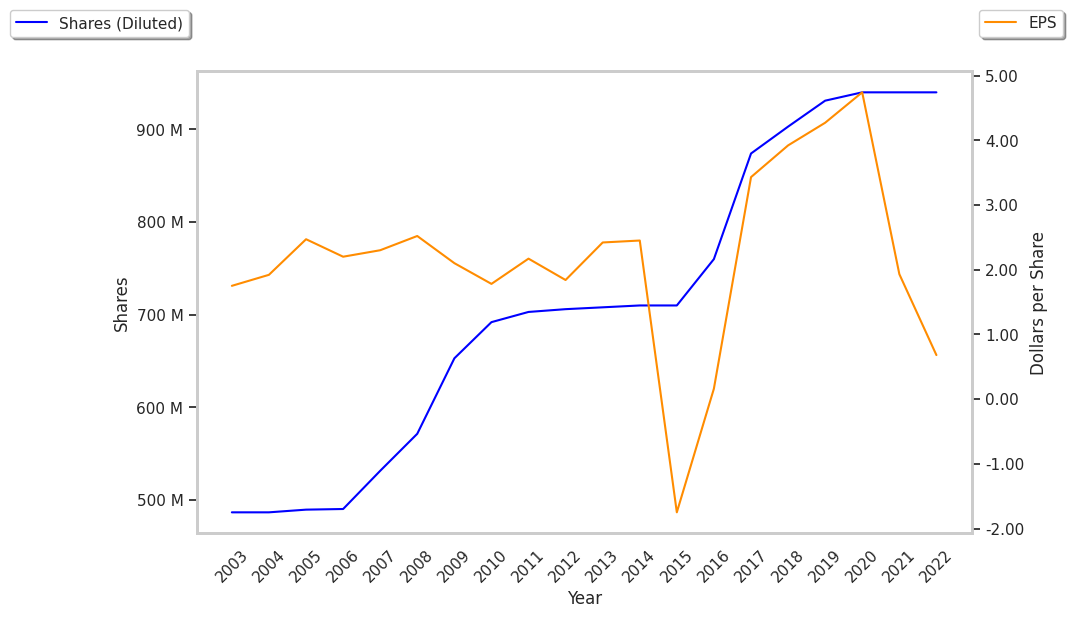

| Earnings Per Share | $3.92 | $4.27 | $4.74 | $1.86 | $0.64 | $0.64 |

| Diluted Shares (MM) | 903 | 931 | 940 | 974 | 996 | 996 |

| Free Cash Flow (MM) | -$4,374 | -$1,702 | -$1,842 | -$244 | -$2,586 | -$2,586 |

| Capital Expenditures (MM) | $10,929 | $8,784 | $8,900 | $7,134 | $8,961 | $8,961 |

| Current Ratio | 0.4 | 0.59 | 0.43 | 0.57 | 0.43 | 0.43 |

| Total Debt (MM) | $39,222 | $40,711 | $61,976 | $65,767 | $60,443 | $60,443 |

| Net Debt / EBITDA | 4.78 | 4.35 | 6.46 | 9.89 | 9.62 | 9.62 |

TC Energy does not have a meaningful trailing P/E ratio since its earnings per share are currently in the red. Based on its EPS guidance of $3.03, the company has a forward P/E ratio of 11.9. In comparison, the average P/E ratio for the Utilities sector is 17.53. On the other hand, the market is undervaluing TC Energy in terms of its equity because its P/B ratio is 1.3. In comparison, the sector average is 1.71.

TC Energy Has an Analyst Consensus of Some Upside Potential:

The 8 analysts following TC Energy have set target prices ranging from $29.25 to $72.62 per share, for an average of $43.47 with a hold rating. As of April 2023, the company is trading -16.9% away from its average target price, indicating that there is an analyst consensus of some upside potential.

The largest shareholder is Royal Bank of Canada, whose 9% stake in the company is worth $3,806,979,474.