One of the losers of today's trading session was Taiwan Semiconductor Manufacturing Company. Shares of the Semiconductors company plunged -3.1%, and some investors may be wondering if its price of $100.63 would make a good entry point. Here's what you should know if you are considering this investment:

-

Taiwan Semiconductor Manufacturing Company has moved 34.7% over the last year, and the S&P 500 logged a change of 22.9%

-

TSM has an average analyst rating of buy and is -11.23% away from its mean target price of $113.36 per share

-

Its trailing earnings per share (EPS) is $5.35

-

Taiwan Semiconductor Manufacturing Company has a trailing 12 month Price to Earnings (P/E) ratio of 18.8 while the S&P 500 average is 15.97

-

Its forward earnings per share (EPS) is $6.12 and its forward P/E ratio is 16.4

-

The company has a Price to Book (P/B) ratio of 0.78 in contrast to the S&P 500's average ratio of 2.95

-

Taiwan Semiconductor Manufacturing Company is part of the Technology sector, which has an average P/E ratio of 35.0 and an average P/B of 7.92

-

TSM has reported YOY quarterly earnings growth of -24.9% and gross profit margins of 0.6%

-

The company has a free cash flow of $87.77 Billion, which refers to the total sum of all its inflows and outflows of cash over the last quarter

-

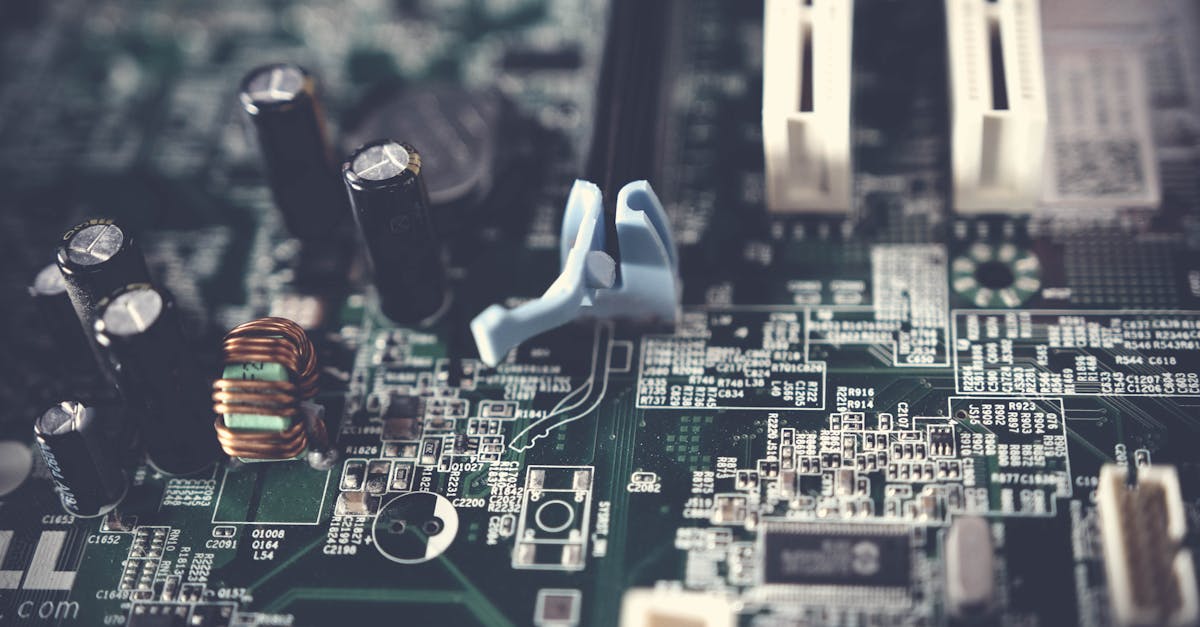

Taiwan Semiconductor Manufacturing Company Limited, together with its subsidiaries, manufactures, packages, tests, and sells integrated circuits and other semiconductor devices in Taiwan, China, Europe, the Middle East, Africa, Japan, the United States, and internationally. It provides complementary metal oxide silicon wafer fabrication processes to manufacture logic, mixed-signal, radio frequency, and embedded memory semiconductors. The company also offers customer support and engineering services, as well as manufactures masks. Its products are used in high performance computing, smartphone, Internet of things, automotive, and digital consumer electronics. The company was incorporated in 1987 and is headquartered in Hsinchu City, Taiwan.