Corning logged a -0.7% change during today's afternoon session, and is now trading at a price of $30.41 per share.

Over the last year, Corning logged a -4.1% change, with its stock price reaching a high of $37.1 and a low of $25.26. Over the same period, the stock underperformed the S&P 500 index by -28.7%. As of April 2023, the company's 50-day average price was $28.42. Corning Incorporated engages in the display technologies, optical communications, environmental technologies, specialty materials, and life sciences businesses worldwide. Based in Corning, NY, the large-cap Industrials company has 57,500 full time employees. Corning has offered a 3.6% dividend yield over the last 12 months.

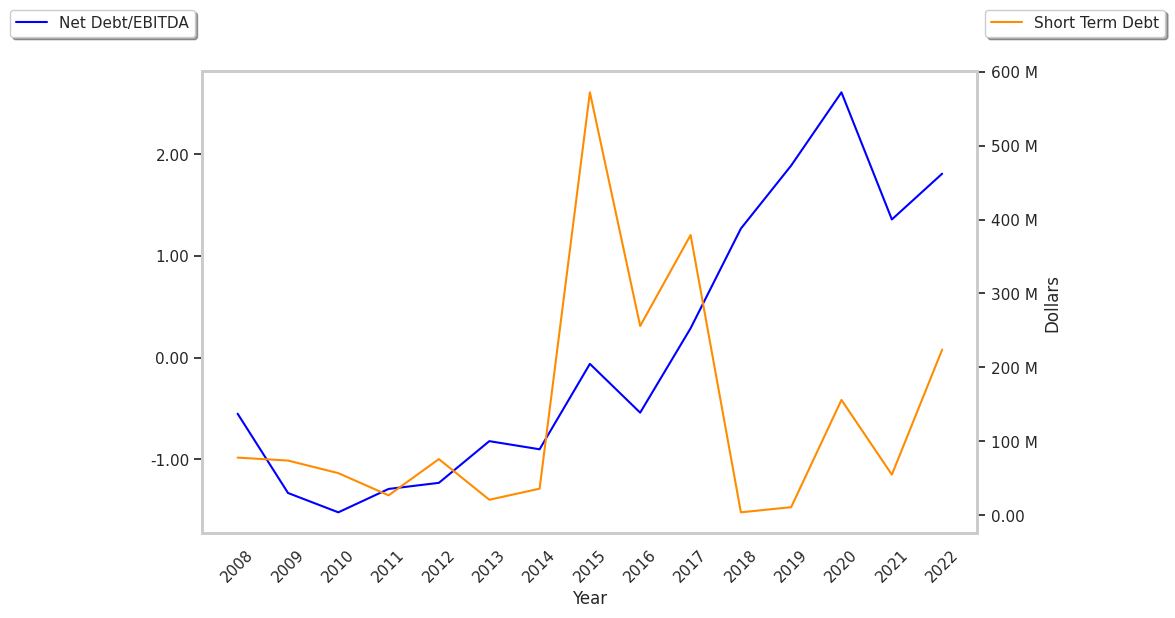

The Company Has Lacking Information on Debt Levels:

| 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | |

|---|---|---|---|---|---|---|

| Revenue (MM) | $11,290 | $11,503 | $11,303 | $14,082 | $14,189 | $13,000 |

| Revenue Growth | n/a | 1.89% | -1.74% | 24.59% | 0.76% | -8.38% |

| Operating Margins | 14% | 11% | 6% | 17% | 13% | 7% |

| Net Margins | 10% | 9% | 5% | 14% | 10% | 10% |

| Net Income (MM) | $1,090 | $979 | $523 | $1,906 | $1,386 | $1,316 |

| Net Interest Expense (MM) | $205 | $248 | $298 | $300 | $292 | $315 |

| Depreciation & Amort. (MM) | $1,199 | $1,390 | $1,399 | $1,352 | $1,329 | $1,247 |

| Earnings Per Share | $1.13 | $1.07 | $0.54 | $1.28 | $1.54 | $0.6799999999999999 |

| EPS Growth | n/a | -5.31% | -49.53% | 137.04% | 20.31% | -55.84% |

| Diluted Shares (MM) | 941 | 899 | 772 | 844 | 857 | 864 |

| Current Ratio | 2.12 | 2.12 | 2.12 | 0.23 | 0.27 | 0.33 |

Corning Has an Attractive P/B Ratio but a Worrisome P/E Ratio:

Corning has a trailing twelve month P/E ratio of 41.8, compared to an average of 22.19 for the Industrials sector. Based on its EPS guidance of $1.98, the company has a forward P/E ratio of 14.4. The 8.3% compound average growth rate of Corning's historical and projected earnings per share yields a PEG ratio of 5.01. This suggests that these shares are overvalued. In contrast, the market is likely undervaluing Corning in terms of its equity because its P/B ratio is 2.18 while the sector average is 4.06.

Analysts Give Corning an Average Rating of Buy:

The 11 analysts following Corning have set target prices ranging from $28.0 to $40.0 per share, for an average of $32.27 with a buy rating. As of April 2023, the company is trading -11.9% away from its average target price, indicating that there is an analyst consensus of some upside potential.

Corning has a very low short interest because 1.0% of the company's shares are sold short. Institutions own 69.4% of the company's shares, and the insider ownership rate stands at 9.7%, suggesting a large amount of insider shareholders. The largest shareholder is Vanguard Group Inc, whose 12% stake in the company is worth $2,987,835,779.