Shares of Technology sector company NetEase moved 4.4% today, and are now trading at a price of $93.19. The large-cap stock's daily volume was 4,697,631 compared to its average volume of 1,760,962. The S&P 500 index returned a -0.0% performance.

NetEase, Inc. engages in online games, music streaming, online intelligent learning services, and internet content services businesses in China and internationally . The company is based in Hangzhou and has 31,119 full time employees. Its market capitalization is $60,798,279,680. NetEase currently offers its equity investors a dividend that yields 13.9% per year.

27 analysts are following NetEase and have set target prices ranging from $87.98 to $167.96 per share. On average, they have given the company a rating of buy. At today's prices, NTES is trading -30.76% away from its average analyst target price of $134.59 per share.

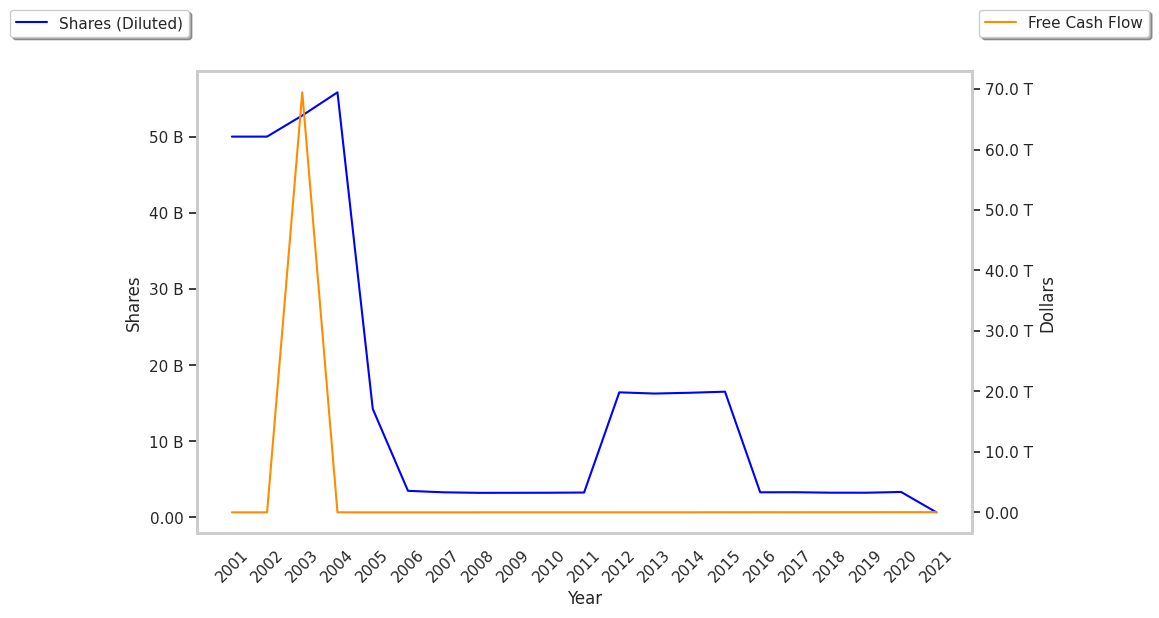

Over the last year, NTES's share price has increased by 23.0%, which represents a difference of -1.6% when compared to the S&P 500. The stock's 52 week high is $118.9 per share whereas its 52 week low is $72.08. With average free cash flows of $3.07 Billion that have been growing at an average rate of 15.0% over the last 6 years, NetEase is in a position to continue its strong stock performance trend.

| Date Reported | Cash Flow from Operations ($ k) | Capital expenditures ($ k) | Free Cash Flow ($ k) | YoY Growth (%) |

|---|---|---|---|---|

| 2023 | 4,017,461 | 304,510 | 3,712,951 | 0.0 |

| 2022 | 4,017,461 | 304,510 | 3,712,951 | 1.44 |

| 2021 | 3,911,547 | 251,362 | 3,660,185 | 0.54 |

| 2020 | 3,814,281 | 173,731 | 3,640,550 | 72.92 |

| 2019 | 2,472,990 | 367,704 | 2,105,286 | 32.95 |

| 2018 | 1,951,260 | 367,704 | 1,583,556 |