Realty logged a -1.1% change during today's afternoon session, and is now trading at a price of $57.67 per share.

Realty returned losses of -7.6% last year, with its stock price reaching a high of $68.85 and a low of $45.04. Over the same period, the stock underperformed the S&P 500 index by -32.2%. As of April 2023, the company's 50-day average price was $52.96. Realty Income, The Monthly Dividend Company, is an S&P 500 company and member of the S&P 500 Dividend Aristocrats index. Based in San Diego, CA, the large-cap Real Estate company has 391 full time employees. Realty has offered a 5.2% dividend yield over the last 12 months.

The Business Has Weak Operating Margins:

| 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | |

|---|---|---|---|---|---|---|

| Revenue (MM) | $1,328 | $1,488 | $1,647 | $2,080 | $3,344 | $3,891 |

| Revenue Growth | n/a | 12.07% | 10.68% | 26.31% | 60.72% | 16.38% |

| Net Margins | 27% | 28% | 24% | 17% | 26% | 23% |

| Net Income (MM) | $365 | $437 | $397 | $361 | $872 | $885 |

| Net Interest Expense (MM) | $266 | $291 | $309 | $324 | $465 | $653 |

| Depreciation & Amort. (MM) | $540 | $594 | $677 | $898 | $1,670 | $1,857 |

| Diluted Shares (MM) | 290 | 316 | 345 | 415 | 612 | 844 |

| Free Cash Flow (MM) | -$829 | $1,045 | $1,107 | $1,303 | $2,468 | $2,752 |

| Capital Expenditures (MM) | $1,769 | $24 | $9 | $19 | $96 | $77 |

| Total Debt (MM) | $2,959 | $8,412 | $17,638 | $29,795 | $34,323 | $40,116 |

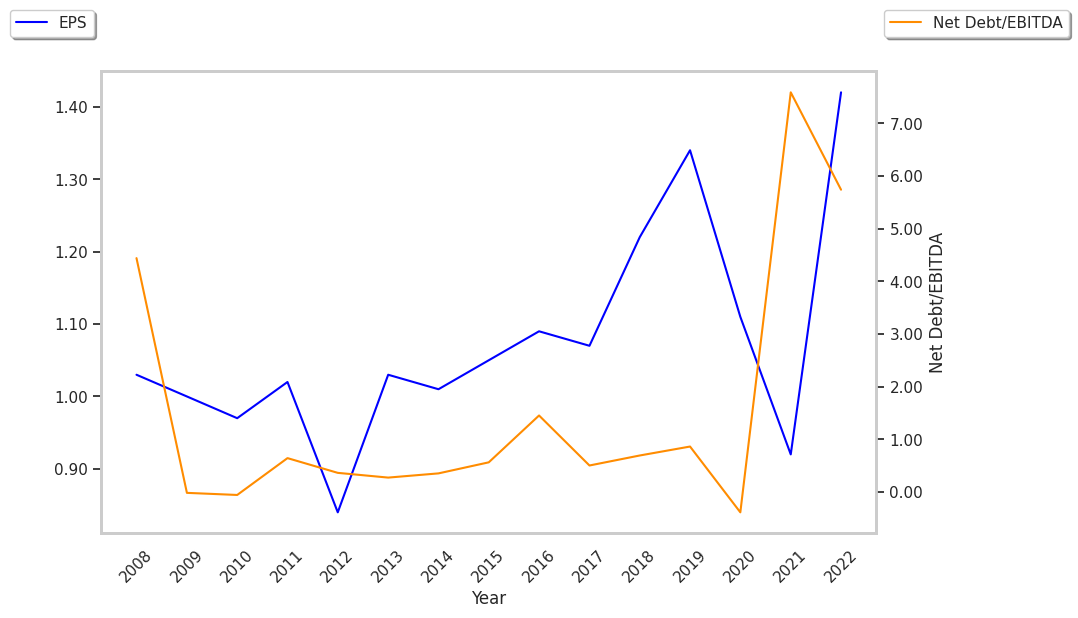

A Lower P/B Ratio Than Its Sector Average but Trades Above Its Graham Number:

Realty has a trailing twelve month P/E ratio of 40.1, compared to an average of 25.55 for the Real Estate sector. Based on its EPS guidance of $1.41, the company has a forward P/E ratio of 37.6. In contrast, the market is likely undervaluing Realty in terms of its equity because its P/B ratio is 1.32 while the sector average is 2.1. The company's shares are currently trading 73.4% above their Graham number.

Realty Has an Average Rating of Buy:

The 12 analysts following Realty have set target prices ranging from $54.0 to $74.0 per share, for an average of $60.67 with a buy rating. As of April 2023, the company is trading -12.7% away from its average target price, indicating that there is an analyst consensus of some upside potential.

Realty has an average amount of shares sold short because 4.3% of the company's shares are sold short. Institutions own 79.9% of the company's shares, and the insider ownership rate stands at 0.12%, suggesting a small amount of insider investors. The largest shareholder is Vanguard Group Inc, whose 15% stake in the company is worth $6,393,516,096.