Today we're going to take a closer look at large-cap Health Care company Humana, whose shares are currently trading at $375.91. We've been asking ourselves whether the company is under or over valued at today's prices... let's perform a brief value analysis to find out!

Humana Is Fairly Valued:

Humana Inc., together with its subsidiaries, operates as a health and well-being company in the United States. The company belongs to the Health Care sector, which has an average price to earnings (P/E) ratio of 30.21 and an average price to book (P/B) ratio of 4.08. In contrast, Humana has a trailing 12 month P/E ratio of 18.8 and a P/B ratio of 2.83.

Humana's PEG ratio is 3.78, which shows that the stock is probably overvalued in terms of its estimated growth. For reference, a PEG ratio near or below 1 is a potential signal that a company is undervalued.

Strong Revenue Growth With Increasing Reinvestment in the Business:

| 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | |

|---|---|---|---|---|---|---|

| Revenue (MM) | $56,912 | $64,888 | $77,155 | $83,064 | $92,870 | $102,351 |

| Revenue Growth | n/a | 14.01% | 18.9% | 7.66% | 11.81% | 10.21% |

| Operating Margins | 5% | 5% | 6% | 4% | 4% | 4% |

| Net Margins | 3% | 4% | 4% | 4% | 3% | 3% |

| Net Income (MM) | $1,683 | $2,707 | $3,367 | $2,933 | $2,806 | $3,015 |

| Net Interest Expense (MM) | $218 | $242 | $283 | $326 | $401 | $455 |

| Depreciation & Amort. (MM) | $444 | $505 | $528 | $640 | $749 | $822 |

| Earnings Per Share | $12.16 | $20.1 | $25.31 | $22.67 | $22.08 | $24.16 |

| EPS Growth | n/a | 65.3% | 25.92% | -10.43% | -2.6% | 9.42% |

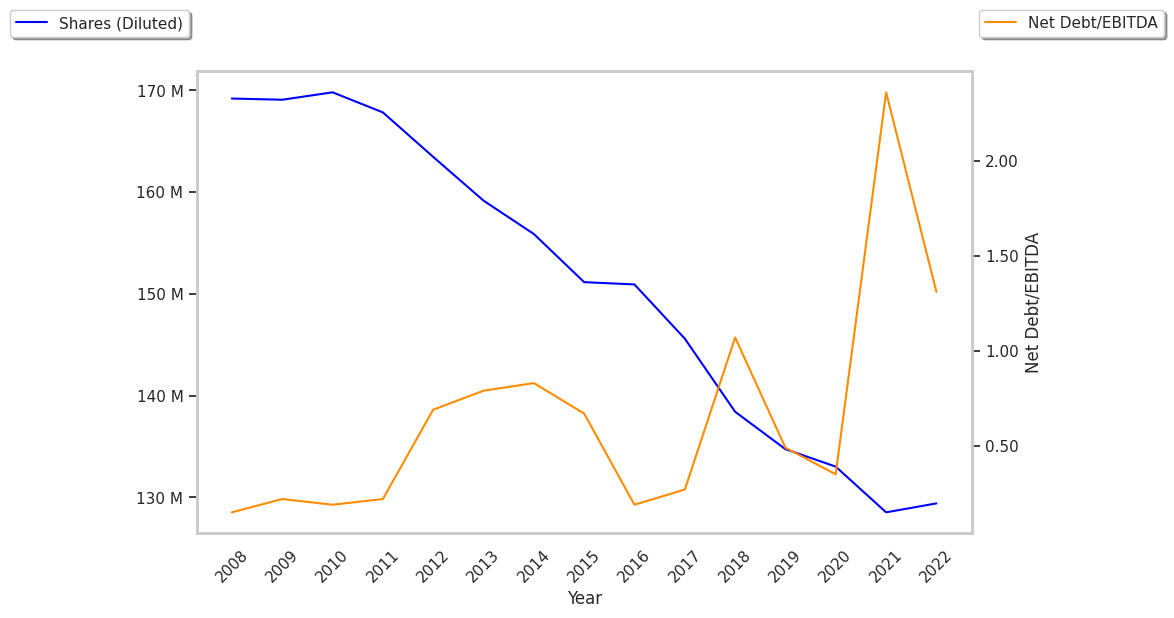

| Diluted Shares (MM) | 138 | 135 | 133 | 129 | 127 | 124 |

| Free Cash Flow (MM) | $1,561 | $4,548 | $4,675 | $946 | $3,467 | $5,009 |

| Capital Expenditures (MM) | $612 | $736 | $964 | $1,316 | $1,120 | $979 |

| Current Ratio | 1.68 | 1.82 | 1.77 | 1.62 | 1.52 | 1.37 |

| Total Debt (MM) | $6,069 | $5,666 | $6,660 | $12,494 | $11,126 | $2,245 |

| Net Debt / EBITDA | 1.05 | 0.44 | 0.36 | 2.4 | 1.33 | -2.43 |

Humana has rapidly growing revenues and increasing reinvestment in the business, generally positive cash flows, and a strong EPS growth trend. However, the firm has weak operating margins with a stable trend. Finally, we note that Humana has just enough current assets to cover current liabilities.