Valero Energy logged a 2.2% change during today's afternoon session, and is now trading at a price of $140.84 per share.

Valero Energy returned gains of 7.6% last year, with its stock price reaching a high of $152.2 and a low of $104.18. Over the same period, the stock underperformed the S&P 500 index by -13.0%. The company's 50-day average price was $129.28. Valero Energy Corporation manufactures, markets, and sells transportation fuels and petrochemical products in the United States, Canada, the United Kingdom, Ireland, Latin America, and internationally. The large-cap Energy company is based in San Antonio, TX. Valero Energy has offered a 3.0% dividend yield over the last 12 months.

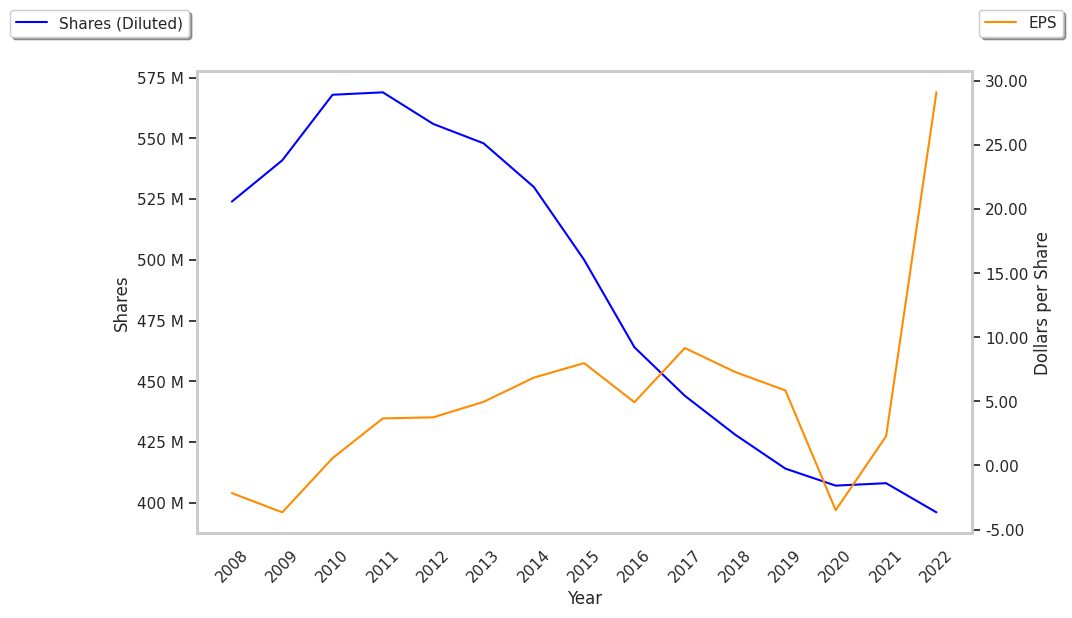

The Company Enjoys Exceptional EPS Growth:

| 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | |

|---|---|---|---|---|---|---|

| Revenue (MM) | $117,033 | $108,324 | $64,912 | $113,977 | $176,383 | $151,098 |

| Revenue Growth | n/a | -7.44% | -40.08% | 75.59% | 54.75% | -14.34% |

| Operating Margins | 4% | 4% | -2% | 2% | 9% | 10% |

| Net Margins | 3% | 2% | -2% | 1% | 7% | 7% |

| Net Income (MM) | $3,122 | $2,422 | -$1,421 | $930 | $11,528 | $10,746 |

| Net Interest Expense (MM) | $470 | $454 | $563 | $603 | $562 | $580 |

| Depreciation & Amort. (MM) | $52 | $53 | $48 | $47 | $45 | $43 |

| Earnings Per Share | $7.29 | $5.84 | -$3.5 | $2.27 | $29.04 | $29.25 |

| EPS Growth | n/a | -19.89% | -159.93% | 164.86% | 1179.3% | 0.72% |

| Diluted Shares (MM) | 428 | 414 | 407 | 407 | 396 | 349 |

| Free Cash Flow (MM) | $3,456 | $5,531 | -$66 | $5,859 | $12,574 | $12,086 |

| Current Ratio | 1.65 | 1.44 | 1.71 | 1.26 | 1.38 | 1.51 |

| Total Debt (MM) | $9,109 | $9,672 | $14,677 | $13,870 | $11,635 | $11,441 |

| Net Debt / EBITDA | 1.33 | 1.82 | -7.42 | 4.48 | 0.43 | 0.38 |

Valero Energy has exceptional EPS growth, generally positive cash flows, and healthy leverage levels. Furthermore, Valero Energy has weak operating margins with a positive growth rate and just enough current assets to cover current liabilities.

Trades Below Its Graham Number but Has an Elevated P/B Ratio:

Valero Energy has a trailing twelve month P/E ratio of 5.2, compared to an average of 8.53 for the Energy sector. Based on its EPS guidance of $13.06, the company has a forward P/E ratio of 9.9. The 8.7% compound average growth rate of Valero Energy's historical and projected earnings per share yields a PEG ratio of 0.6. This suggests that its shares are undervalued. The market is placing a fair value on Valero Energy's equity, since its P/B ratio of 1.85 is comparable to its sector average of 1.78. The company's shares are currently trading -36.4% below their Graham number.

Valero Energy Has an Analyst Consensus of Some Upside Potential:

The 16 analysts following Valero Energy have set target prices ranging from $135.0 to $170.0 per share, for an average of $150.19 with a buy rating. The company is trading -6.2% away from its average target price, indicating that there is an analyst consensus of some upside potential.

Valero Energy has an average amount of shares sold short because 3.0% of the company's shares are sold short. Institutions own 80.6% of the company's shares, and the insider ownership rate stands at 0.48%, suggesting a small amount of insider investors. The largest shareholder is Vanguard Group Inc, whose 10% stake in the company is worth $4,671,354,849.