Nucor may be undervalued with mixed growth prospects, but the 9 analysts following the company give it an rating of hold. Their target prices range from $39.0 to $210.0 per share, for an average of $168.33. At today's price of $187.28, Nucor is trading 11.26% away from its average target price, suggesting there is an analyst belief that shares are overpriced for the stock.

Nucor Corporation engages in manufacture and sale of steel and steel products. The large-cap Industrials company is based in Charlotte, NC. Nucor has provided a 1.1% dividend yield over the last 12 months.

Nucor has a trailing twelve month P/E ratio of 10.4, compared to an average of 22.19 for the Industrials sector. Considering its EPS guidance of $12.34, the company has a forward P/E ratio of 15.2.

Furthermore, the market is potentially undervaluing Nucor in terms of its book value because its P/B ratio is 2.21. In comparison, the sector average P/B ratio is 4.06. The company's shares are currently 2.0% below their Graham number, indicating that its shares have a margin of safety.

| 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | |

|---|---|---|---|---|---|---|

| Revenue (MM) | $25,067 | $22,589 | $20,140 | $36,484 | $41,512 | $35,733 |

| Revenue Growth | n/a | -9.89% | -10.84% | 81.15% | 13.78% | -13.92% |

| Operating Margins | 13% | 8% | 4% | 25% | 25% | 19% |

| Net Margins | 9% | 6% | 4% | 19% | 18% | 14% |

| Net Income (MM) | $2,361 | $1,271 | $721 | $6,827 | $7,607 | $4,995 |

| Net Interest Expense (MM) | $161 | $157 | $167 | $163 | $219 | $243 |

| Depreciation & Amort. (MM) | $631 | $649 | $702 | $735 | $827 | $898 |

| Earnings Per Share | $7.42 | $4.14 | $2.36 | $23.16 | $28.79 | $19.72 |

| EPS Growth | n/a | -44.2% | -43.0% | 881.36% | 24.31% | -31.5% |

| Diluted Shares (MM) | 317 | 306 | 303 | 293 | 263 | 249 |

| Free Cash Flow (MM) | $1,411 | $1,332 | $1,154 | $4,609 | $8,124 | $6,111 |

| Capital Expenditures (MM) | $983 | $1,477 | $1,543 | $1,622 | $1,948 | $2,014 |

| Current Ratio | 3.08 | 3.34 | 3.61 | 2.48 | 3.39 | 3.72 |

| Total Debt (MM) | $4,291 | $4,321 | $5,283 | $5,577 | $6,642 | $6,621 |

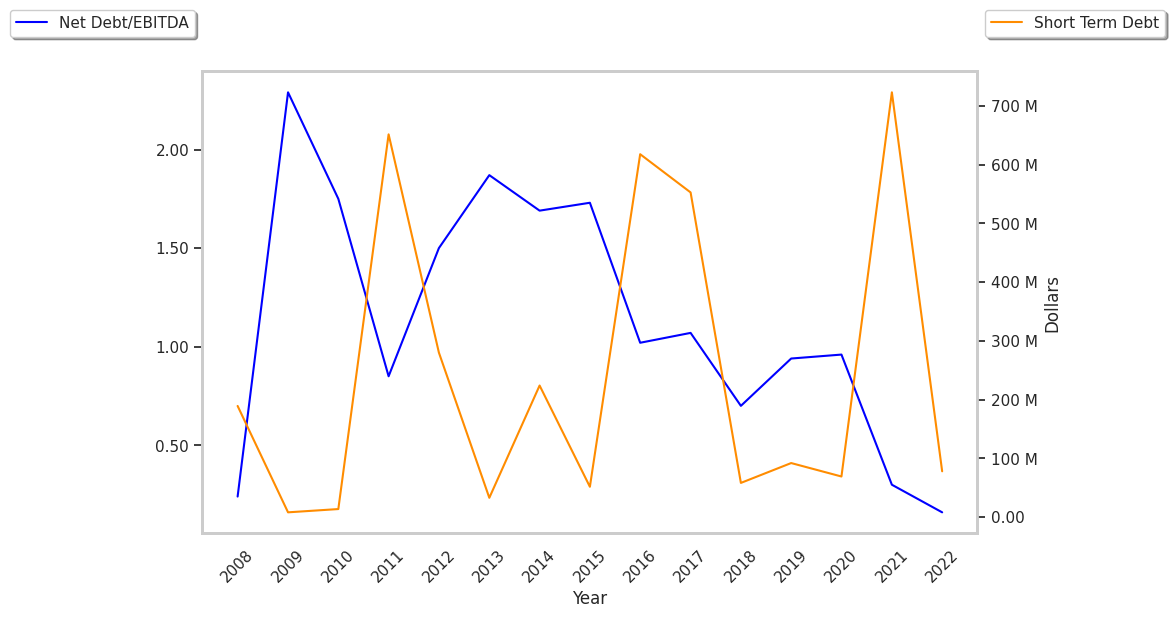

| Net Debt / EBITDA | 0.75 | 1.15 | 1.72 | 0.32 | 0.21 | 0.1 |