More and more people are talking about Analog Devices over the last few weeks. Is it worth buying the Semiconductors stock at a price of $185.68? Only time will tell. The information below will give you a basic idea of what this investment may entail:

-

Analog Devices has moved -5.9% over the last year, and the S&P 500 logged a change of 19.4%

-

ADI has an average analyst rating of buy and is -10.15% away from its mean target price of $206.66 per share

-

Its trailing earnings per share (EPS) is $6.56

-

Analog Devices has a trailing 12 month Price to Earnings (P/E) ratio of 28.3 while the S&P 500 average is 15.97

-

Its forward earnings per share (EPS) is $8.69 and its forward P/E ratio is 21.4

-

The company has a Price to Book (P/B) ratio of 2.59 in contrast to the S&P 500's average ratio of 2.95

-

Analog Devices is part of the Technology sector, which has an average P/E ratio of 35.0 and an average P/B of 7.92

-

ADI has reported YOY quarterly earnings growth of -45.3% and gross profit margins of 0.6%

-

The company has a free cash flow of $3.31 Billion, which refers to the total sum of all its inflows and outflows of cash over the last quarter

-

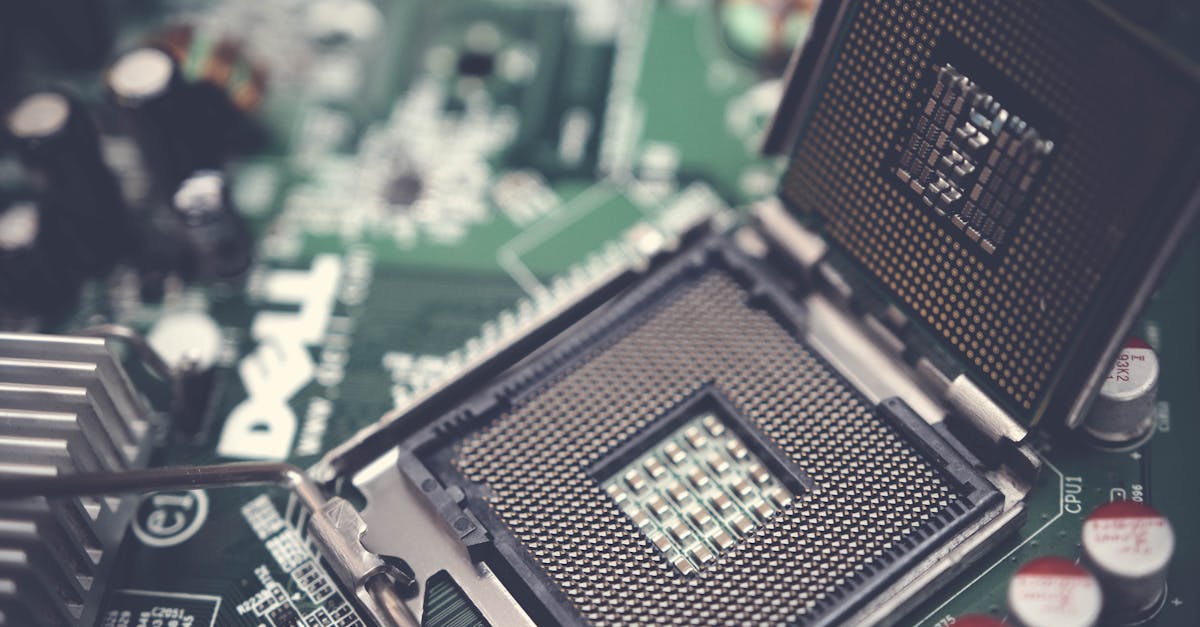

Analog Devices, Inc. designs, manufactures, tests, and markets integrated circuits (ICs), software, and subsystems products in the United States, rest of North and South America, Europe, Japan, China, and rest of Asia. The company provides data converter products, which translate real-world analog signals into digital data, as well as translates digital data into analog signals; power management and reference products for power conversion, driver monitoring, sequencing, and energy management applications in the automotive, communications, industrial, and consumer markets; and power ICs that include performance, integration, and software design simulation tools for accurate power supply designs. It also offers amplifiers to condition analog signals; and radio frequency and microwave ICs to support cellular infrastructure; and micro-electro-mechanical systems technology solutions, including accelerometers used to sense acceleration, gyroscopes for sense rotation, inertial measurement units to sense multiple degrees of freedom, and broadband switches for radio and instrument systems, as well as isolators. In addition, the company provides digital signal processing and system products for numeric calculations. It serves clients in the industrial, automotive, consumer, instrumentation, aerospace, defense and healthcare, and communications markets through a direct sales force, third-party distributors, and independent sales representatives, as well as online. Analog Devices, Inc. was incorporated in 1965 and is headquartered in Wilmington, Massachusetts.