Atlas Energy Solutions has recently released its 10-K report, providing an insight into its financial performance and operations. The company, based in Austin, Texas, specializes in providing proppant and logistics services to the oil and natural gas industry within the Permian Basin of West Texas and New Mexico. Atlas Energy Solutions Inc. was founded in 2017 and operates proppant production and processing facilities, including two facilities near Kermit, Texas and a third facility near Monahans, Texas. As of December 31, 2023, the Kermit and Monahans facilities have a combined annual production capacity of 16.5 million tons.

The company recently entered into an Agreement and Plan of Merger with Hi-Crush, pursuant to which Atlas will acquire substantially all of Hi-Crush’s Permian Basin proppant production and North American logistics businesses and operations. The aggregate consideration to be paid to the Hi-Crush stockholders in the Hi-Crush Transaction will consist of cash consideration of $150 million at the closing of the Hi-Crush Transaction, 9.7 million shares of Atlas’s Common Stock, and a secured PIK toggle seller note in an initial aggregate principal amount of $125 million.

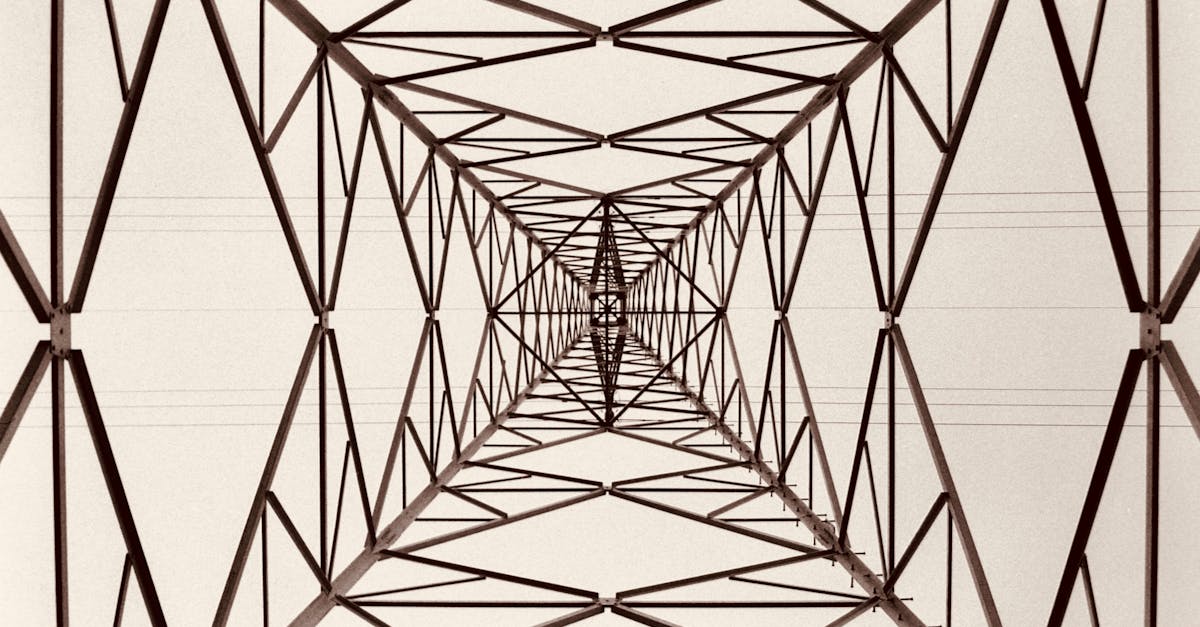

Atlas Energy Solutions also completed its initial public offering in March 2023, generating $324.0 million of gross proceeds and net proceeds of approximately $291.2 million. The company has undergone significant operational developments, including expanding its Kermit production capacity and adding trucks and trailers to its fit-for-purpose trucking fleet. Additionally, construction of the Dune Express, an overland conveyor infrastructure solution, is underway and expected to be in service during the fourth quarter of 2024.

Financially, the company entered into a term loan credit facility with Stonebriar, extending a term loan credit facility comprised of a $180.0 million single advance term loan and commitments to provide up to $100.0 million of delayed draw term loans. The Initial Term Loan is payable in eighty-four consecutive monthly installments and a final payment of the remaining outstanding principal balance at maturity, bearing interest at a rate equal to 9.50% per annum.

In terms of recent trends and outlook, the company highlighted that drilling and completions activities for oil and gas are highly correlated to oil and gas prices, which averaged $77.61 per barrel in 2023. Despite the volatility in the oil and gas markets, Atlas Energy Solutions sees potential positive long-term trends developing, including increased proppant demand driven by longer lateral wells and improved completion efficiencies.

The company generates revenue by mining, processing, and distributing proppant to customers under supply agreements or as spot sales at prevailing market rates. Revenue also includes charges for sand logistics services provided to customers, fluctuating based on several factors, including the volume of proppant transported, the distance between facilities and customers, and prevailing freight rates. Operating costs primarily stem from direct and indirect labor, freight charges, utility costs, fuel and maintenance costs, and royalties.

As a result of these announcements, the company's shares have moved 8.1% on the market, and are now trading at a price of $19.81. Check out the company's full 10-K submission here.