Now trading at a price of $407.81, MongoDB has moved -7.1% so far today.

MongoDB returned gains of 96.3% last year, with its stock price reaching a high of $509.62 and a low of $189.59. Over the same period, the stock outperformed the S&P 500 index by 67.6%. More recently, the company's 50-day average price was $423.01. MongoDB, Inc. provides general purpose database platform worldwide. Based in New York, NY, the Large-Cap Technology company has 4,849 full time employees. MongoDB has not offered a dividend during the last year.

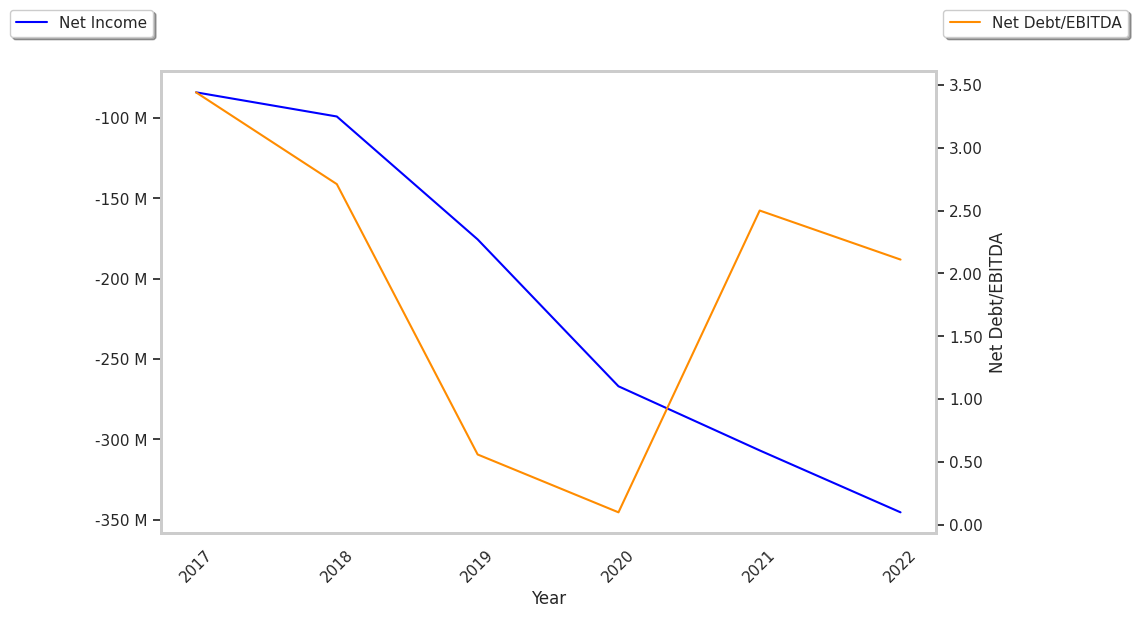

The Firm Has a Declining EPS Growth Trend:

| 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | |

|---|---|---|---|---|---|---|

| Revenue (k) | $154,519 | $267,016 | $421,720 | $590,380 | $873,782 | $1,284,040 |

| Gross Margins | 80% | 72% | 70% | 70% | 70% | 73% |

| Net Margins | -54% | -37% | -42% | -45% | -35% | 2% |

| Net Income (k) | -$83,973 | -$99,011 | -$175,522 | -$266,944 | -$306,866 | $24,948 |

| Net Interest Expense (k) | $895 | $10,290 | $20,983 | $56,107 | $11,316 | -$9,797 |

| Depreciation & Amort. (k) | $3,703 | $5,792 | $12,783 | $14,177 | $13,671 | $16,110 |

| Diluted Shares (k) | 23,718 | 52,035 | 55,939 | 58,985 | 64,563 | 68,628 |

| Earnings Per Share | -$3.54 | -$1.9 | -$3.14 | -$4.53 | -$4.75 | -$5.03 |

| EPS Growth | n/a | 46.33% | -65.26% | -44.27% | -4.86% | -5.89% |

| Avg. Price | $55.33 | $131.13 | $207.79 | $395.41 | $349.86 | $414.99 |

| P/E Ratio | -15.63 | -69.02 | -66.18 | -87.29 | -73.65 | -82.5 |

| CAPEX (k) | $2,135 | $6,848 | $3,564 | $11,773 | $8,072 | $7,244 |

| Current Ratio | 3.41 | 2.57 | 4.06 | 4.75 | 4.1 | 4.74 |

MongoDB does not have a meaningful trailing P/E ratio since its earnings per share are currently in the red. Based on its EPS guidance of $3.34, the company has a forward P/E ratio of 126.6. In comparison, the average P/E ratio for the Technology sector is 35.0. Furthermore, MongoDB is likely overvalued compared to the book value of its equity, since its P/B ratio of 30.33 is higher than the sector average of 7.92.

Analysts Give MongoDB an Average Rating of Buy:

The 29 analysts following MongoDB have set target prices ranging from $272.0 to $700.0 per share, for an average of $470.52 with a buy rating. The company is trading -13.3% away from its average target price, indicating that there is an analyst consensus of some upside potential.

MongoDB has an average amount of shares sold short because 5.3% of the company's shares are sold short. Institutions own 93.5% of the company's shares, and the insider ownership rate stands at 3.37%, suggesting a large amount of insider shareholders. The largest shareholder is Vanguard Group Inc, whose 9% stake in the company is worth $2,790,409,857.