Biotechnology company Moderna is taking Wall Street by surprise today, falling to $106.67 and marking a -3.5% change compared to the S&P 500, which moved 0.0%. MRNA is -12.52% below its average analyst target price of $121.94, which implies there is more upside for the stock.

As such, the average analyst rates it at buy. Over the last year, Moderna has underperfomed the S&P 500 by -54.6%, moving -25.0%.

Moderna, Inc., a biotechnology company, discovers, develops, and commercializes messenger RNA therapeutics and vaccines for the treatment of infectious diseases, immuno-oncology, rare diseases, autoimmune, and cardiovascular diseases in the United States, Europe, and internationally. The company is categorized within the healthcare sector. The catalysts that drive valuations in this sector are complex. From demographics, regulations, scientific breakthroughs, to the emergence of new diseases, healthcare companies see their prices swing on the basis of a variety of factors.

Moderna does not publish either its forward or trailing P/E ratios because their values are negative -- meaning that each share of stock represents a net earnings loss. But we can calculate these P/E ratios anyways using the stocks forward and trailing (EPS) values of $-4.76 and $-12.33. We can see that MRNA has a forward P/E ratio of -22.4 and a trailing P/E ratio of -8.7. The P/E ratio is the company's share price divided by its earnings per share. In other words, it represents how much investors are willing to spend for each dollar of the company's earnings (revenues minus the cost of goods sold, taxes, and overhead). As of the first quarter of 2023, the health care sector has an average P/E ratio of 30.21, and the average for the S&P 500 is 15.97.

A significant limitation with the price to earnings analysis is that it doesn’t account for investors’ growth expectations in the company. For example, a company with a low P/E ratio may not actually be a good value if it has little growth potential. Conversely, companies with high P/E ratios may be fairly valued in terms of growth expectations.

When we divide Moderna's P/E ratio by its projected 5 year earnings growth rate, we see that it has a Price to Earnings Growth (PEG) ratio of 0.35. This tells us that the company is largely undervalued in terms of growth expectations -- but remember, these growth expectations could turn out to be wrong!

Value investors often analyze stocks through the lens of its Price to Book (P/B) Ratio (its share price divided by its book value). The book value refers to the present value of the company if the company were to sell off all of its assets and pay all of its debts today - a number whose value may differ significantly depending on the accounting method. Moderna's P/B ratio indicates that the market value of the company exceeds its book value by a factor of 2.94, but is still below the average P/B ratio of the Health Care sector, which stood at 4.08 as of the first quarter of 2023.

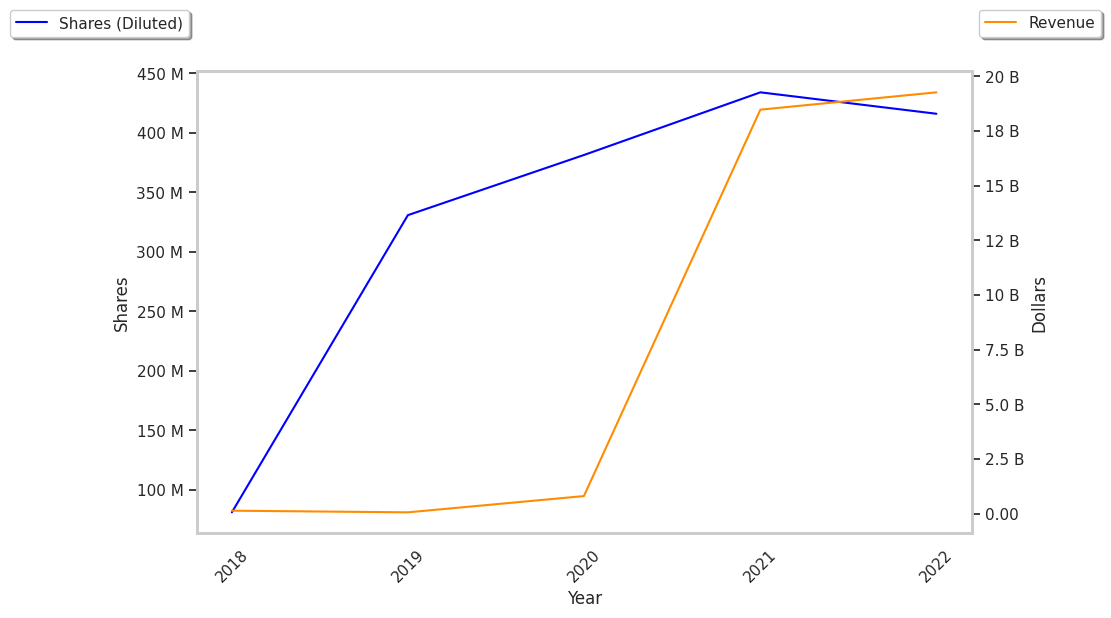

Moderna is likely overvalued at today's prices because it has a negative P/E ratio., a lower P/B ratio than its sector average, and No published cashflows with an unknown trend. The stock has poor growth indicators because of its weak operating margins with a positive growth rate, and no PEG ratio. We hope this preliminary analysis will encourage you to do your own research into MRNA's fundamental values -- especially their trends over the last few years, which provide the clearest picture of the company's valuation.