Shares of Charter Communications have moved -2.3% today, and are now trading at a price of $260.5. In contrast, the S&P 500 index saw a -1.0% change. Today's trading volume is 1,048,469 compared to the stock's average volume of 1,719,411.

Charter Communications, Inc. operates as a broadband connectivity and cable operator company serving residential and commercial customers in the United States. Based in Stamford, United States the company has 101,100 full time employees and a market cap of $37,612,552,192.

The company is now trading -29.46% away from its average analyst target price of $369.27 per share. The 20 analysts following the stock have set target prices ranging from $220.0 to $660.0, and on average give Charter Communications a rating of hold.

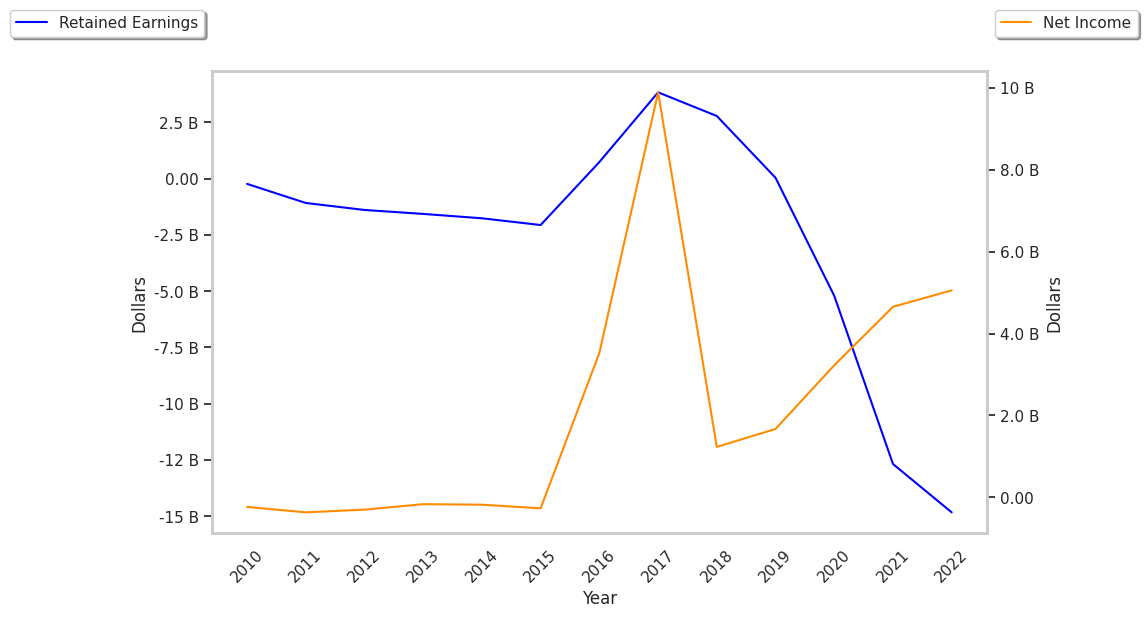

Over the last 12 months CHTR shares have declined by -24.8%, which represents a difference of -48.2% when compared to the S&P 500. The stock's 52 week high is $458.3 per share and its 52 week low is $258.56. Based on Charter Communications's average net margin growth of 18.6% over the last 6 years, its core business remains strong and the stock price may recover in the long term.

| Date Reported | Total Revenue ($ k) | Net Profit ($ k) | Net Margins (%) | YoY Growth (%) |

|---|---|---|---|---|

| 2023 | 54,607,000 | 4,557,000 | 8 | -11.11 |

| 2022 | 54,022,000 | 5,055,000 | 9 | 0.0 |

| 2021 | 51,682,000 | 4,654,000 | 9 | 28.57 |

| 2020 | 48,097,000 | 3,222,000 | 7 | 75.0 |

| 2019 | 45,764,000 | 1,668,000 | 4 | 33.33 |

| 2018 | 43,634,000 | 1,230,000 | 3 |