Now trading at a price of $67.25, General Mills has moved 1.6% so far today.

General Mills returned losses of -24.0% last year, with its stock price reaching a high of $90.89 and a low of $60.33. Over the same period, the stock underperformed the S&P 500 index by -47.4%. AThe company's 50-day average price was $66.27. General Mills, Inc. manufactures and markets branded consumer foods worldwide. Based in Minneapolis, MN, the Large-Cap Consumer Staples company has 34,000 full time employees. General Mills has offered a 3.5% dividend yield over the last 12 months.

Wider Gross Margins Than the Industry Average of 14.39%:

| 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | |

|---|---|---|---|---|---|---|

| Revenue (M) | $15,740 | $16,865 | $17,627 | $18,127 | $18,993 | $20,094 |

| Gross Margins | 16% | 15% | 17% | 17% | 18% | 17% |

| Net Margins | 14% | 10% | 12% | 13% | 14% | 13% |

| Net Income (M) | $2,131 | $1,753 | $2,181 | $2,340 | $2,707 | $2,594 |

| Net Interest Expense (M) | $374 | $522 | $466 | $420 | $380 | $382 |

| Depreciation & Amort. (M) | $619 | $620 | $595 | $601 | $570 | $547 |

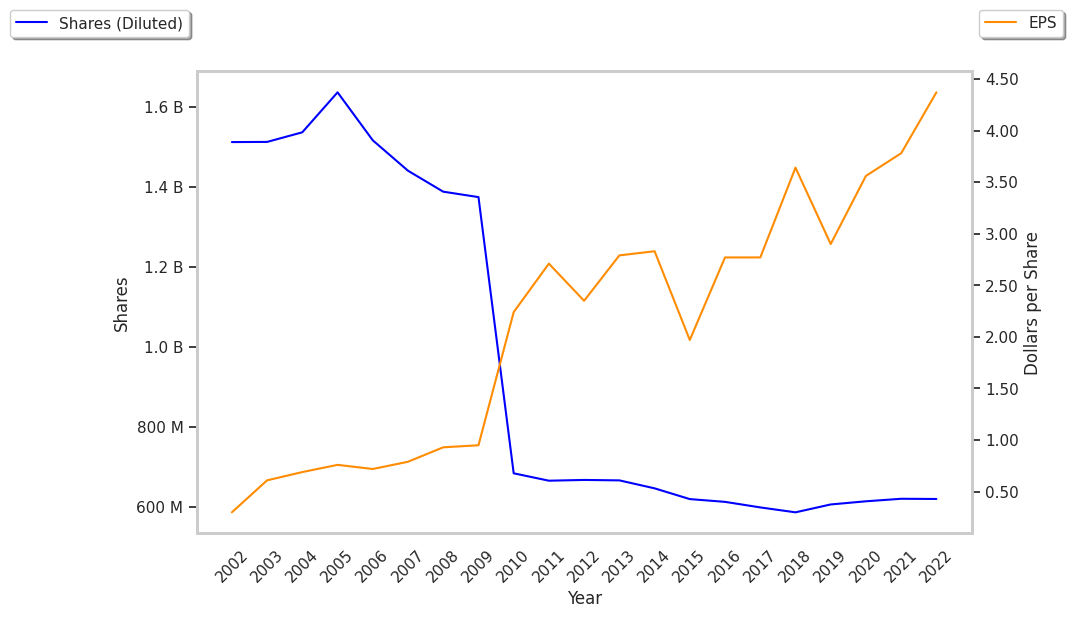

| Diluted Shares (M) | 604 | 612 | 620 | 613 | 602 | 583 |

| Earnings Per Share | $3.64 | $2.9 | $3.56 | $3.78 | $4.42 | $4.31 |

| EPS Growth | n/a | -20.33% | 22.76% | 6.18% | 16.93% | -2.49% |

| Avg. Price | $44.43 | $38.86 | $44.69 | $53.68 | $56.93 | $66.24 |

| P/E Ratio | 12.04 | 13.31 | 12.45 | 14.09 | 12.76 | 15.19 |

| Free Cash Flow (M) | $2,218 | $2,269 | $3,215 | $2,452 | $2,747 | $2,089 |

| CAPEX (M) | $623 | $538 | $461 | $531 | $569 | $690 |

| EV / EBITDA | 12.67 | 10.99 | 10.03 | 11.04 | 10.91 | 12.66 |

| Total Debt (M) | $12,669 | $11,625 | $10,929 | $9,787 | $10,809 | $12,240 |

| Net Debt / EBITDA | 3.99 | 3.53 | 2.35 | 2.34 | 2.51 | 2.93 |

| Current Ratio | 0.58 | 0.61 | 0.76 | 0.85 | 0.58 | 0.64 |

General Mills has growing revenues and increasing reinvestment in the business, wider gross margins than its peer group, and positive EPS growth. However, the firm has not enough current assets to cover current liabilities because its current ratio is 0.64. Finally, we note that General Mills has positive cash flows and significant leverage levels.

a Very Low P/E Ratio but Trades Above Its Graham Number:

General Mills has a trailing twelve month P/E ratio of 15.2, compared to an average of 21.21 for the Consumer Staples sector. Based on its EPS guidance of $4.69, the company has a forward P/E ratio of 14.1. The 3.7% compound average growth rate of General Mills's historical and projected earnings per share yields a PEG ratio of 4.12. This suggests that these shares are overvalued. In contrast, the market is likely undervaluing General Mills in terms of its equity because its P/B ratio is 4.02 while the sector average is 4.12. The company's shares are currently trading 70.3% below their Graham number.

There's an Analyst Consensus of Some Upside Potential for General Mills:

The 18 analysts following General Mills have set target prices ranging from $61.0 to $77.0 per share, for an average of $70.97 with a hold rating. The company is trading -5.2% away from its average target price, indicating that there is an analyst consensus of some upside potential.

General Mills has an average amount of shares sold short because 2.8% of the company's shares are sold short. Institutions own 80.7% of the company's shares, and the insider ownership rate stands at 0.21%, suggesting a small amount of insider investors. The largest shareholder is Blackrock Inc., whose 10% stake in the company is worth $3,666,497,438.