Now trading at a price of $44.0, Ventas has moved 1.5% so far today.

Ventas returned losses of -7.7% last year, with its stock price reaching a high of $50.99 and a low of $39.33. Over the same period, the stock underperformed the S&P 500 index by -30.1%. AThe company's 50-day average price was $43.24. Ventas Inc. (NYSE: VTR) is a leading S&P 500 real estate investment trust focused on delivering strong, sustainable shareholder returns by enabling exceptional environments that benefit a large and growing aging population. Based in Chicago, IL, the Large-Cap Real Estate company has 486 full time employees. Ventas has offered a 4.2% dividend yield over the last 12 months.

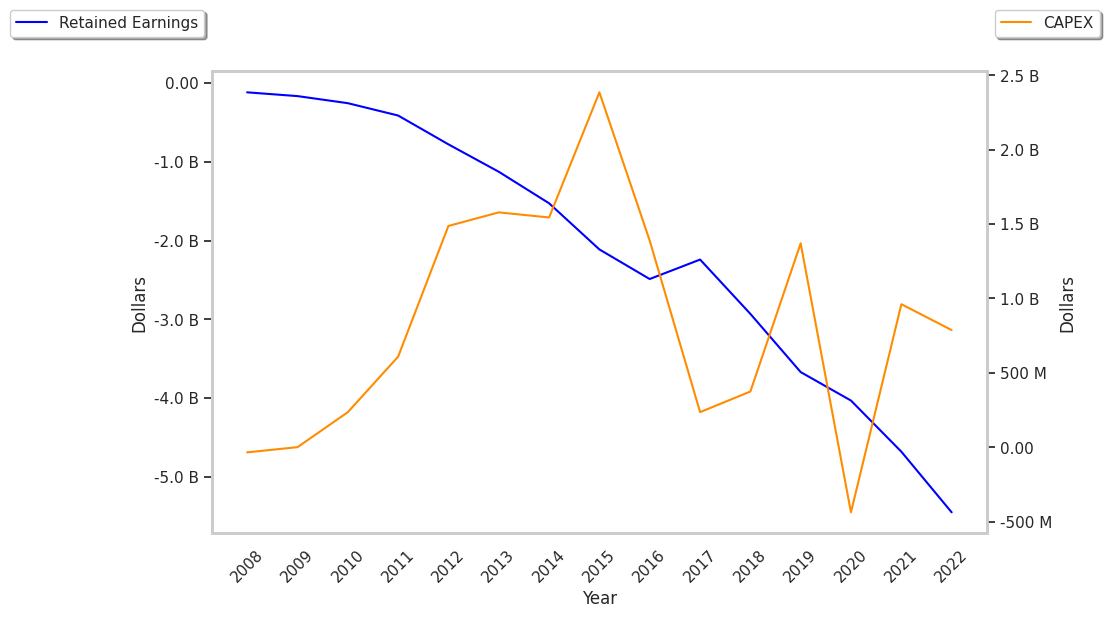

The Business Is Unprofitable and Its Balance Sheet Is Highly Leveraged:

| 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | |

|---|---|---|---|---|---|---|

| Revenue (M) | $3,746 | $3,873 | $3,795 | $3,828 | $4,129 | $4,498 |

| Operating Margins | 10% | 11% | 2% | -4% | -2% | -3% |

| Net Margins | 11% | 11% | 12% | 1% | -1% | -1% |

| Net Income (M) | $416 | $439 | $441 | $57 | -$41 | -$30 |

| Net Interest Expense (M) | $442 | $452 | $470 | $440 | $468 | $574 |

| Depreciation & Amort. (M) | $920 | $1,046 | $1,110 | $1,197 | $1,198 | $1,392 |

| Diluted Shares (M) | 359 | 370 | 377 | 386 | 403 | 406 |

| Earnings Per Share | $1.14 | $1.17 | $1.17 | $0.13 | -$0.12 | -$0.1 |

| EPS Growth | n/a | 2.63% | 0.0% | -88.89% | -192.31% | 16.67% |

| Avg. Price | $43.89 | $54.27 | $37.4 | $50.17 | $52.34 | $44.0 |

| P/E Ratio | 38.17 | 45.99 | 31.69 | 385.92 | -436.17 | -440.0 |

| Free Cash Flow (M) | $1,250 | $1,281 | $1,070 | $778 | $888 | $736 |

| CAPEX (M) | $132 | $157 | $380 | $248 | $232 | $384 |

| EV / EBITDA | 20.16 | 21.15 | 21.36 | 29.64 | 29.98 | 23.95 |

| Total Debt (M) | $10,734 | $12,159 | $11,895 | $12,028 | $12,297 | $13,491 |

| Net Debt / EBITDA | 8.17 | 8.12 | 9.65 | 11.48 | 11.03 | 10.17 |

Ventas has declining EPS growth, positive cash flows, and a highly leveraged balance sheet. On the other hand, the company has growing revenues and increasing reinvestment in the business working in its favor.

Ventas does not have a meaningful trailing P/E ratio since its earnings per share are negative. Its forward EPS guidance is negative too, at $-0.88. The average P/E ratio for the Real Estate sector is 25.55. On the other hand, the market is undervaluing Ventas in terms of its equity because its P/B ratio is 1.86. In comparison, the sector average is 2.1.

Ventas Has an Average Rating of Buy:

The 18 analysts following Ventas have set target prices ranging from $46.0 to $61.0 per share, for an average of $51.5 with a buy rating. The company is trading -14.6% away from its average target price, indicating that there is an analyst consensus of some upside potential.

Ventas has an average amount of shares sold short because 2.7% of the company's shares are sold short. Institutions own 96.0% of the company's shares, and the insider ownership rate stands at 0.58%, suggesting a small amount of insider investors. The largest shareholder is Vanguard Group Inc, whose 16% stake in the company is worth $2,815,511,204.