Boeing logged a 2.9% change during today's afternoon session, and is now trading at a price of $172.12 per share.

Boeing returned losses of -18.0% last year, with its stock price reaching a high of $267.54 and a low of $159.7. Over the same period, the stock underperformed the S&P 500 index by -40.3%. AThe company's 50-day average price was $186.76. The Boeing Company, together with its subsidiaries, designs, develops, manufactures, sells, services, and supports commercial jetliners, military aircraft, satellites, missile defense, human space flight and launch systems, and services worldwide. Based in Arlington, VA, the Large-Cap Industrials company has 171,000 full time employees. Boeing has not offered a dividend during the last year.

The Company's Revenues Are Declining:

| 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | |

|---|---|---|---|---|---|---|

| Revenue (M) | $101,127 | $76,559 | $58,158 | $62,286 | $66,608 | $77,794 |

| Gross Margins | 19% | 6% | -10% | 5% | 5% | 10% |

| Net Margins | 10% | -1% | -20% | -7% | -7% | -3% |

| Net Income (M) | $10,460 | -$636 | -$11,873 | -$4,202 | -$4,935 | -$2,222 |

| Net Interest Expense (M) | $475 | $722 | $2,156 | $2,714 | $2,561 | $2,459 |

| Depreciation & Amort. (M) | $2,114 | $2,271 | $2,246 | $2,144 | $1,979 | $1,861 |

| Diluted Shares (M) | 586 | 565 | 569 | 588 | 595 | 606 |

| Earnings Per Share | $17.85 | -$1.12 | -$20.88 | -$7.15 | -$8.3 | -$3.67 |

| EPS Growth | n/a | -106.27% | -1764.29% | 65.76% | -16.08% | 55.78% |

| Avg. Price | $331.9 | $358.8 | $196.87 | $224.54 | $172.74 | $172.74 |

| P/E Ratio | 18.39 | -320.36 | -9.43 | -31.4 | -20.81 | -47.07 |

| Free Cash Flow (M) | $13,600 | -$4,280 | -$19,713 | -$4,396 | $2,290 | $4,433 |

| CAPEX (M) | $1,722 | $1,834 | $1,303 | $980 | $1,222 | $1,527 |

| EV / EBITDA | 14.29 | 745.05 | -15.84 | -249.25 | -92.92 | 131.39 |

| Total Debt (M) | $13,847 | $27,302 | $63,583 | $58,102 | $57,001 | $52,307 |

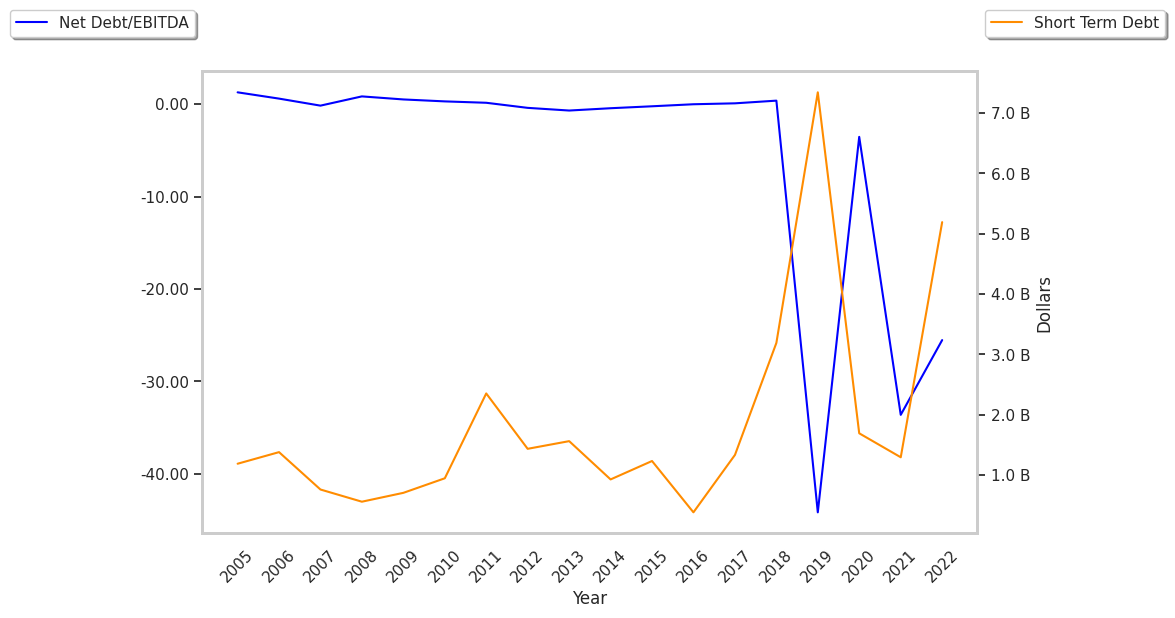

| Net Debt / EBITDA | 0.44 | 60.19 | -5.31 | -68.94 | -27.52 | 36.41 |

| Current Ratio | 1.08 | 1.05 | 1.39 | 1.33 | 1.22 | 1.14 |

Boeing suffers from declining revenues and a flat capital expenditure trend, slimmer gross margins than its peers, and declining EPS growth. The firm's financial statements also exhibit negative cash flows and a highly leveraged balance sheet. Boeing has just enough current assets to cover current liabilities, as shown by its current ratio of 1.14.

Boeing does not have a meaningful trailing P/E ratio since its earnings per share are currently in the red. Based on its EPS guidance of $6.31, the company has a forward P/E ratio of 29.6. In comparison, the average P/E ratio for the Industrials sector is 22.19.

Boeing Has an Average Rating of Buy:

The 26 analysts following Boeing have set target prices ranging from $140.0 to $300.0 per share, for an average of $226.08 with a buy rating. The company is trading -23.9% away from its average target price, indicating that there is an analyst consensus of strong upside potential.

Boeing has a very low short interest because 1.6% of the company's shares are sold short. Institutions own 65.1% of the company's shares, and the insider ownership rate stands at 0.07%, suggesting a small amount of insider investors. The largest shareholder is Vanguard Group Inc, whose 8% stake in the company is worth $8,348,156,085.