Standing out among the Street's worst performers today is Intra-Cellular Therapies, a pharmaceutical company whose shares slumped -4.2% to a price of $72.42, 22.27% below its average analyst target price of $93.17.

The average analyst rating for the stock is buy. ITCI lagged the S&P 500 index by -4.0% so far today and by -3.9% over the last year, returning 20.5%.

Intra-Cellular Therapies, Inc., a biopharmaceutical company, focuses on the discovery, clinical development, and commercialization of small molecule drugs that address medical needs primarily in neuropsychiatric and neurological disorders by targeting intracellular signaling mechanisms in the central nervous system (CNS) in the United States. The company is part of the healthcare sector. Healthcare companies work in incredibly complex markets, and their valuations can change in an instant based on a denied drug approval, a research and development breakthrough at a competitor, or a new government regulation. In the longer term, healthcare companies are affected by factors as varied as demographics and epidemiology. Investors who want to understand the healthcare market should be prepared for deep dives into a wide range of topics.

Intra-Cellular Therapies does not release its trailing 12 month P/E ratio since its earnings per share of $-1.16 are negative over the last year. But we can calculate it ourselves, which gives us a trailing P/E ratio for ITCI of -62.4. Based on the company's positive earnings guidance of $1.07, the stock has a forward P/E ratio of 67.7. As of the second quarter of 2024, the average Price to Earnings (P/E) ratio for US health care companies is 27.53, and the S&P 500 has an average of 27.65. The P/E ratio consists in the stock's share price divided by its earnings per share (EPS), representing how much investors are willing to spend for each dollar of the company's earnings. Earnings are the company's revenues minus the cost of goods sold, overhead, and taxes.

One limitation P/E ratios is that they don't tell us to what extent future growth expectations are priced into Intra-Cellular Therapies market valuation. For example, a company with a low P/E ratio may not actually be a good value if it has little growth potential. On the other hand, it's possible for companies with high P/E ratios to be fairly valued in terms of their growth expectations.

Dividing Intra-Cellular Therapies's P/E ratio by its projected 5 year earnings growth rate gives us its Price to Earnings Growth (PEG) ratio of -0.48. Since it's negative, either the company's current P/E ratio or its growth rate is negative -- neither of which is a good sign.

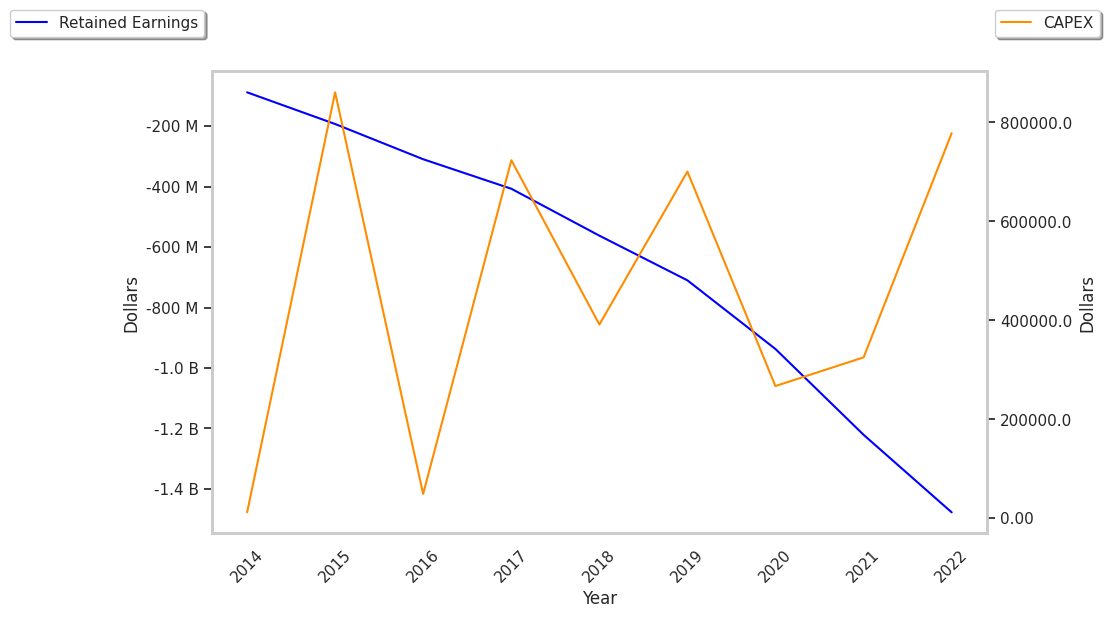

To deepen our understanding of the company's finances, we should study the effect of its depreciation and capital expenditures on the company's bottom line. We can see the effect of these additional factors in Intra-Cellular Therapies's free cash flow, which was $-124468000 as of its most recent annual report. Free cash flow represents the amount of money available for reinvestment in the business or for payments to equity investors in the form of a dividend. In ITCI's case the cash flow outlook is weak. It's average cash flow over the last 4 years has been $-188814169.5 and they've been growing at an average rate of -0.1%.

Value investors often analyze stocks through the lens of its Price to Book (P/B) Ratio (its share price divided by its book value). The book value refers to the present value of the company if the company were to sell off all of its assets and pay all of its debts today - a number whose value may differ significantly depending on the accounting method. Intra-cellular therapies's P/B ratio is 11.78 -- in other words, the market value of the company exceeds its book value by a factor of more than 11, so the company's assets may be overvalued compared to the average P/B ratio of the Health Care sector, which stands at 3.61 as of the second quarter of 2024.

Intra-Cellular Therapies is likely overvalued at today's prices because it has a negative P/E ratio., a higher than Average P/B Ratio, and negative cash flows with a flat trend. The stock has poor growth indicators because of its weak operating margins with a positive growth rate, and a negative PEG ratio. We hope this preliminary analysis will encourage you to do your own research into ITCI's fundamental values -- especially their trends over the last few years, which provide the clearest picture of the company's valuation.