It's been a great evening session for Webster Financial investors, who saw their shares rise 5.1% to a price of $43.59 per share. At these higher prices, is the company still fairly valued? If you are thinking about investing, make sure to check the company's fundamentals before making a decision.

The Market May Be Undervaluing Webster Financial's Earnings and Assets:

Webster Financial Corporation operates as the bank holding company for Webster Bank, National Association that provides a range of financial products and services to individuals, families, and businesses in the United States. The company belongs to the Finance sector, which has an average price to earnings (P/E) ratio of 15.89 and an average price to book (P/B) ratio of 1.76. In contrast, Webster Financial has a trailing 12 month P/E ratio of 8.9 and a P/B ratio of 0.89.

When we divideWebster Financial's P/E ratio by its expected five-year EPS growth rate, we obtain a PEG ratio of 0.38, which indicates that the market is undervaluing the company's projected growth (a PEG ratio of 1 indicates a fairly valued company). Your analysis of the stock shouldn't end here. Rather, a good PEG ratio should alert you that it may be worthwhile to take a closer look at the stock.

Increasing Revenues but Narrowing Margins:

| 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | |

|---|---|---|---|---|---|---|

| Revenue (M) | $1,055 | $1,155 | $1,002 | $943 | $2,285 | $3,628 |

| Interest Income (M) | $907 | $955 | $891 | $901 | $2,034 | $2,337 |

| Operating Margins | 46% | 45% | 42% | 51% | 47% | 34% |

| Net Margins | 34% | 33% | 22% | 43% | 28% | 24% |

| Net Income (M) | $360 | $383 | $221 | $409 | $644 | $868 |

| Depreciation & Amort. (M) | $39 | $38 | $37 | $36 | $82 | $76 |

| Diluted Shares (M) | 92 | 92 | 90 | 90 | 168 | 172 |

| Earnings Per Share | $3.81 | $4.06 | $2.35 | $4.42 | $3.72 | $4.91 |

| EPS Growth | n/a | 6.56% | -42.12% | 88.09% | -15.84% | 31.99% |

| Avg. Price | $50.82 | $43.03 | $29.29 | $50.34 | $51.12 | $43.47 |

| P/E Ratio | 13.27 | 10.57 | 12.46 | 11.36 | 13.74 | 8.85 |

| Free Cash Flow (M) | $436 | $278 | $359 | $672 | $1,307 | $938 |

| CAPEX (M) | $33 | $26 | $21 | $17 | $29 | $40 |

| EV / EBITDA | 8.76 | 7.57 | 6.58 | 9.02 | 8.11 | 5.26 |

| Total Debt (M) | $226 | $540 | $568 | $563 | $1,073 | $1,049 |

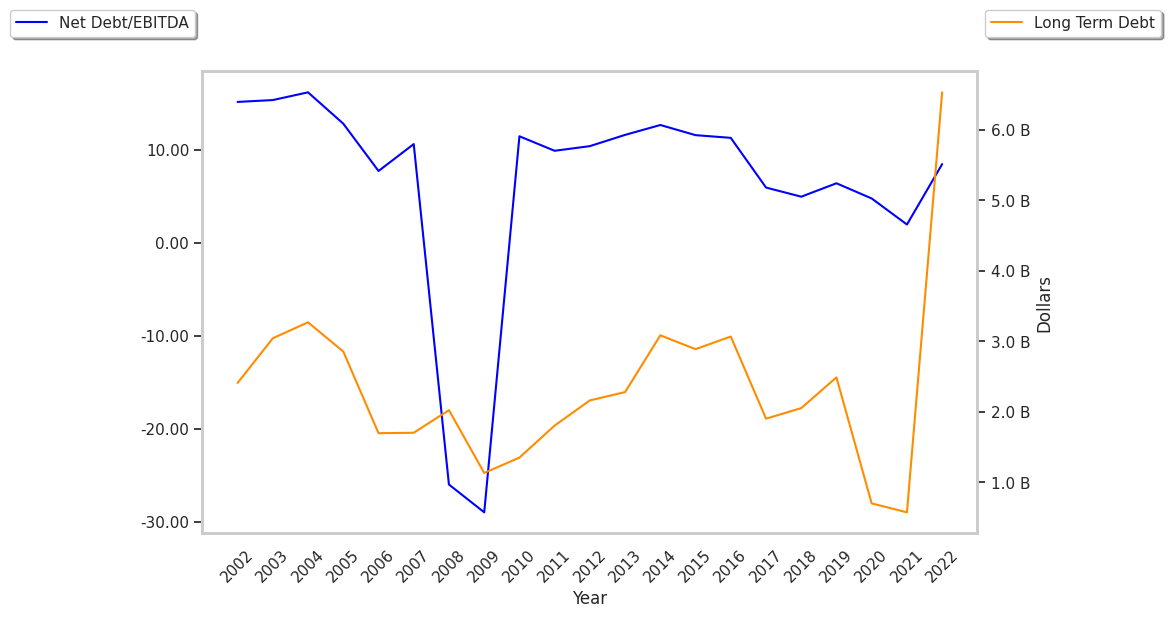

| Net Debt / EBITDA | -0.2 | 0.5 | 0.67 | 0.2 | 0.2 | -0.51 |

Webster Financial has rapidly growing revenues and increasing reinvestment in the business and generally positive cash flows. Additionally, the company's financial statements display low leverage levels and positive EPS growth. Furthermore, Webster Financial has decent net margins with a negative growth trend.