Valero Energy shares fell by -3.5% during the day's afternoon session, and are now trading at a price of $152.99. Is it time to buy the dip? To better answer that question, it's essential to check if the market is valuing the company's shares fairly in terms of its earnings and equity levels.

Valero Energy's Valuation Is in Line With Its Sector Averages:

Valero Energy Corporation manufactures, markets, and sells petroleum-based and low-carbon liquid transportation fuels and petrochemical products in the United States, Canada, the United Kingdom, Ireland, Latin America, Mexico, Peru, and internationally. The company belongs to the Energy sector, which has an average price to earnings (P/E) ratio of 14.36 and an average price to book (P/B) ratio of 2.1. In contrast, Valero Energy has a trailing 12 month P/E ratio of 7.5 and a P/B ratio of 1.92.

When we divide Valero Energy's P/E ratio by its expected EPS growth rate of the next five years, we obtain its PEG ratio of -1.04. Since it's negative, the company has negative growth expectations, and most investors will probably avoid the stock unless it has an exceptionally low P/E and P/B ratio.

Exceptional EPS Growth and Healthy Leverage Levels:

| 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | |

|---|---|---|---|---|---|---|

| Revenue (M) | $117,033 | $108,324 | $64,912 | $113,977 | $176,383 | $144,766 |

| Operating Margins | 4% | 4% | -2% | 2% | 9% | 8% |

| Net Margins | 3% | 2% | -2% | 1% | 7% | 6% |

| Net Income (M) | $3,122 | $2,422 | -$1,421 | $930 | $11,528 | $8,835 |

| Net Interest Expense (M) | $470 | $454 | $563 | $603 | $562 | $592 |

| Depreciation & Amort. (M) | $52 | $53 | $48 | $47 | $45 | $43 |

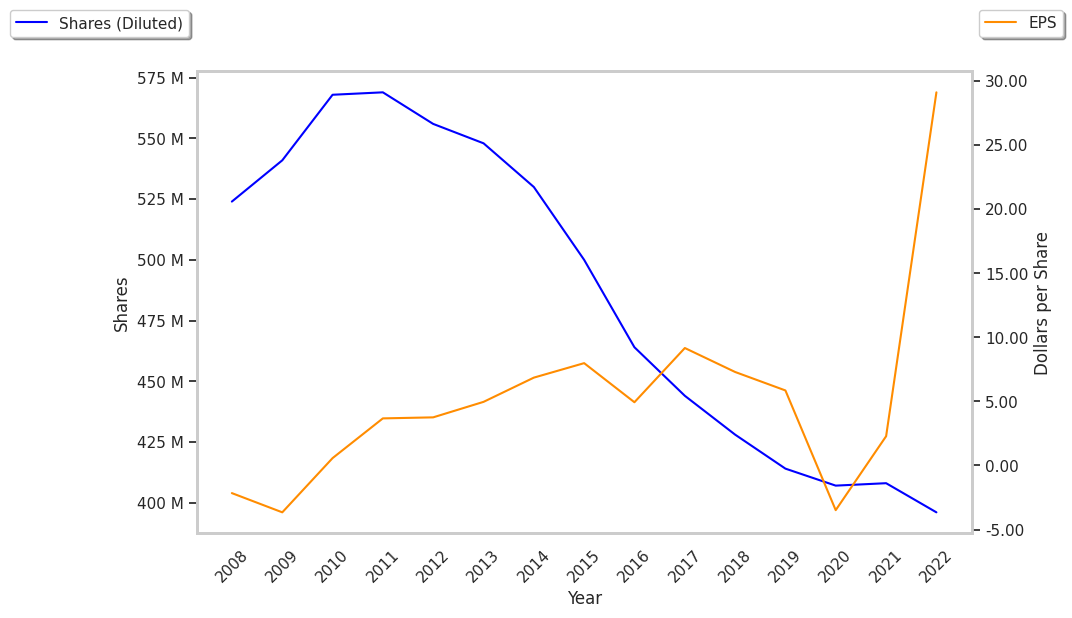

| Diluted Shares (M) | 428 | 414 | 407 | 407 | 396 | 353 |

| Earnings Per Share | $7.29 | $5.84 | -$3.5 | $2.27 | $29.04 | $24.92 |

| EPS Growth | n/a | -19.89% | -159.93% | 164.86% | 1179.3% | -14.19% |

| Avg. Price | $80.88 | $70.38 | $50.56 | $66.27 | $98.73 | $152.47 |

| P/E Ratio | 11.08 | 12.05 | -14.45 | 29.19 | 3.4 | 6.12 |

| Free Cash Flow (M) | $3,456 | $5,389 | -$66 | $5,859 | $12,574 | $9,229 |

| EV / EBITDA | 8.9 | 9.38 | -20.94 | 16.91 | 3.0 | 5.27 |

| Total Debt (M) | $9,109 | $9,672 | $14,677 | $13,870 | $11,635 | $11,524 |

| Net Debt / EBITDA | 1.33 | 1.82 | -7.42 | 4.48 | 0.43 | 0.51 |

| Current Ratio | 1.65 | 1.44 | 1.71 | 1.26 | 1.38 | 1.56 |

Valero Energy has exceptional EPS growth and generally positive cash flows. Additionally, the company's financial statements display a decent current ratio of 1.56 and healthy leverage levels. Furthermore, Valero Energy has weak operating margins with a positive growth rate.