It's been a great afternoon session for Advanced Micro Devices investors, who saw their shares rise 1.9% to a price of $134.96 per share. At these higher prices, is the company still fairly valued? If you are thinking about investing, make sure to check the company's fundamentals before making a decision.

Advanced Micro Devices's Valuation Is in Line With Its Sector Averages:

Advanced Micro Devices, Inc. operates as a semiconductor company worldwide. The company belongs to the Technology sector, which has an average price to earnings (P/E) ratio of 31.58 and an average price to book (P/B) ratio of 4.11. In contrast, Advanced Micro Devices has a trailing 12 month P/E ratio of 162.6 and a P/B ratio of 3.86.

P/E rations can be placed into context by dividing them by the firm's expected 5-year EPS growth rate, which gives us its Price to Earnings Growth (PEG) ratio. Advanced Micro Devices's PEG ratio is 1.19, which tells us the company is fairly valued in terms of growth. PEG ratios under 1 are considered an indicator of undervalued growth, but we need to keep in mind that many successful companies with excellent share performance have maintained much higher PEG ratios.

As always, a quantitative approach to a stock should be supplemented with a look at qualitative factors, such as the competence of its management team, quality of its corporate culture, and the wide variety of social and economic factors that can impact the success of its product.

Wider Gross Margins Than the Industry Average of 41.67%:

| 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | |

|---|---|---|---|---|---|---|

| Revenue (M) | $6,475 | $6,731 | $9,763 | $16,434 | $23,601 | $22,680 |

| Gross Margins | 38% | 43% | 45% | 48% | 45% | 46% |

| Net Margins | 5% | 5% | 26% | 19% | 6% | 4% |

| Net Income (M) | $337 | $341 | $2,490 | $3,162 | $1,320 | $854 |

| Net Interest Expense (M) | $18 | $94 | $47 | $34 | -$88 | $106 |

| Depreciation & Amort. (M) | $170 | $222 | $312 | $407 | $4,174 | $1,622 |

| Diluted Shares (M) | 108 | 1,188 | 1,226 | 1,229 | 1,571 | 1,625 |

| Earnings Per Share | $0.32 | $0.3 | $2.06 | $2.57 | $1571.0 | $0.53 |

| EPS Growth | n/a | -6.25% | 586.67% | 24.76% | 61028.4% | -99.97% |

| Avg. Price | $17.21 | $29.94 | $65.62 | $101.15 | $105.33 | $135.89 |

| P/E Ratio | 50.62 | 96.58 | 31.25 | 38.75 | 0.07 | 256.4 |

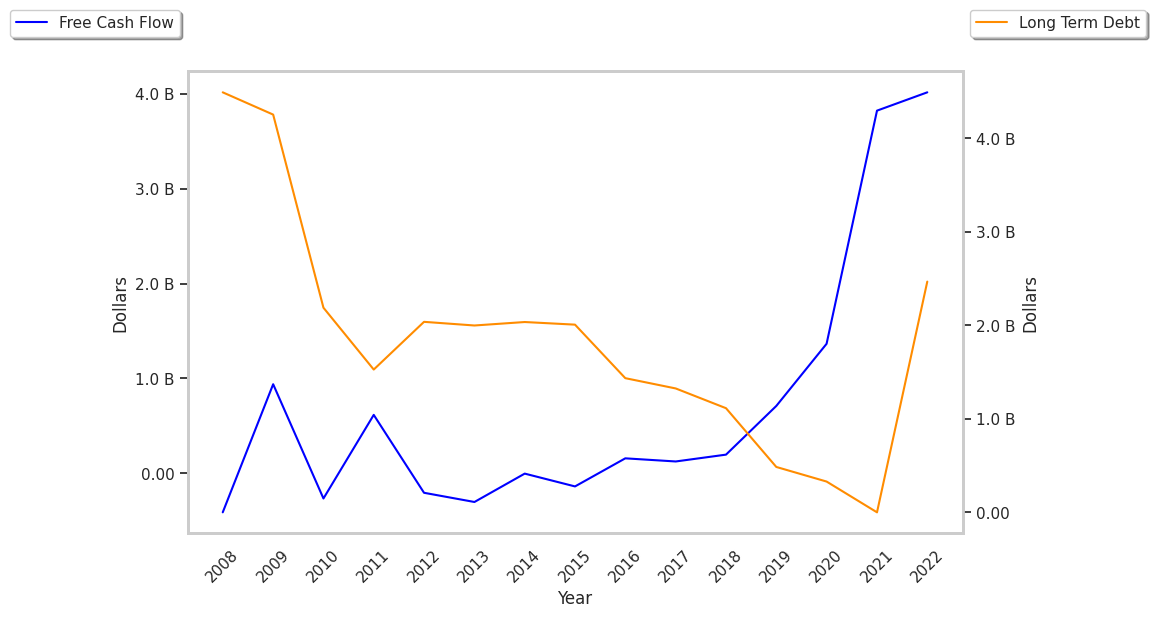

| Free Cash Flow (M) | -$129 | $276 | $777 | $3,220 | $3,115 | $1,121 |

| CAPEX (M) | $163 | $217 | $294 | $301 | $450 | $546 |

| EV / EBITDA | 27.35 | 34.14 | 44.91 | 29.59 | 23.53 | 107.99 |

| Total Debt (M) | $1,386 | $486 | $330 | $2 | $4,934 | $3,434 |

| Net Debt / EBITDA | 0.5 | -1.15 | -0.75 | -0.62 | 0.02 | -0.25 |

| Current Ratio | 1.78 | 1.95 | 2.54 | 2.02 | 2.36 | 2.51 |

Advanced Micro Devices has rapidly growing revenues and increasing reinvestment in the business, generally positive cash flows, and an excellent current ratio of 2.51. The company also benefits from wider gross margins than its peer group, positive EPS growth, and healthy leverage levels.