Tesla may be undervalued with strong growth indicators, but the 42 analysts following the company give it an rating of hold. Their target prices range from $24.86 to $310.0 per share, for an average of $207.64. At today's price of $200.43, Tesla is trading -3.47% away from its average target price, suggesting there is an analyst consensus of some upside potential for the stock.

Tesla, Inc. designs, develops, manufactures, leases, and sells electric vehicles, and energy generation and storage systems in the United States, China, and internationally. Based in Austin, TX, the Large-Cap Consumer Discretionary company has 140,473 full time employees. Tesla has not offered a regular dividend during the last year.

Tesla has a trailing twelve month P/E ratio of 56.5, compared to an average of 22.15 for the Consumer Discretionary sector. Considering its EPS guidance of $3.16, the company has a forward P/E ratio of 63.4.

Furthermore, Tesla is overpriced compared to its book value, since its P/B ratio of 9.63 is higher than the sector average of 3.11. The company's shares are currently 380.6% below their Graham number, indicating that its shares have a margin of safety.

| 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | |

|---|---|---|---|---|---|---|

| Revenue (M) | $21,461 | $24,578 | $31,536 | $53,823 | $81,462 | $96,773 |

| Gross Margins | 19% | 17% | 21% | 25% | 26% | 18% |

| Net Margins | -5% | -4% | 2% | 10% | 15% | 15% |

| Net Income (M) | -$976 | -$862 | $721 | $5,519 | $12,556 | $14,997 |

| Net Interest Expense (M) | $663 | $685 | $748 | $371 | $191 | $156 |

| Depreciation & Amort. (M) | $1,110 | $1,370 | $1,570 | $1,910 | $2,420 | $3,330 |

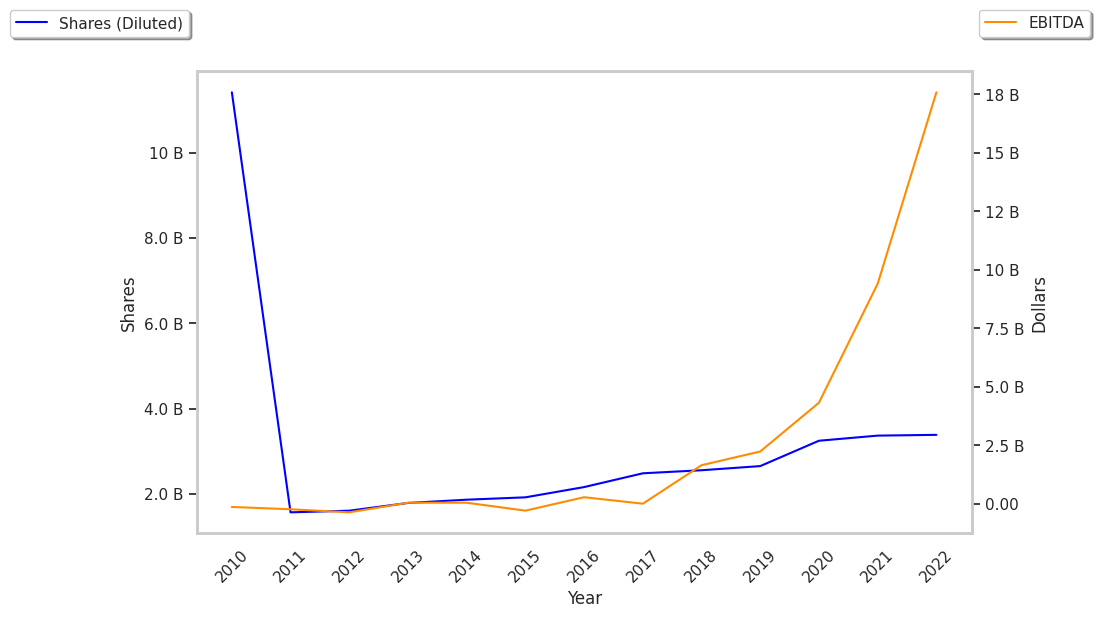

| Diluted Shares (M) | 2,559 | 2,661 | 3,249 | 3,386 | 3,475 | 3,485 |

| Earnings Per Share | -$0.38 | -$0.32 | $0.22 | $1.63 | $3.61 | $4.3 |

| EPS Growth | n/a | 15.79% | 168.75% | 640.91% | 121.47% | 19.11% |

| Avg. Price | $21.15 | $18.24 | $96.67 | $260.0 | $290.09 | $200.61 |

| P/E Ratio | -54.23 | -55.27 | 358.04 | 135.42 | 71.63 | 42.32 |

| Free Cash Flow (M) | -$3 | $1,078 | $2,786 | $5,015 | $7,566 | $4,358 |

| CAPEX (M) | $2,101 | $1,327 | $3,157 | $6,482 | $7,158 | $8,898 |

| EV / EBITDA | 85.22 | 40.58 | 71.21 | 87.33 | 55.06 | 50.98 |

| Total Debt (M) | $11,626 | $11,801 | $10,220 | $5,342 | $2,045 | $4,657 |

| Net Debt / EBITDA | 11.0 | 4.25 | -2.57 | -1.45 | -0.88 | -0.96 |

| Current Ratio | 0.83 | 1.13 | 1.88 | 1.38 | 1.53 | 1.73 |