It's been a great morning session for Realty Income investors, who saw their shares rise 1.5% to a price of $61.63 per share. At these higher prices, is the company still fairly valued? If you are thinking about investing, make sure to check the company's fundamentals before making a decision.

a Lower P/B Ratio Than Its Sector Average but Priced Beyond Its Margin of Safety:

Realty Income, The Monthly Dividend Company, is an S&P 500 company and member of the S&P 500 Dividend Aristocrats index. The company belongs to the Real Estate sector, which has an average price to earnings (P/E) ratio of 30.37 and an average price to book (P/B) ratio of 2.09. In contrast, Realty Income has a trailing 12 month P/E ratio of 57.1 and a P/B ratio of 1.39.

Realty Income's PEG ratio is 2.06, which shows that the stock is probably overvalued in terms of its estimated growth. For reference, a PEG ratio near or below 1 is a potential signal that a company is undervalued.

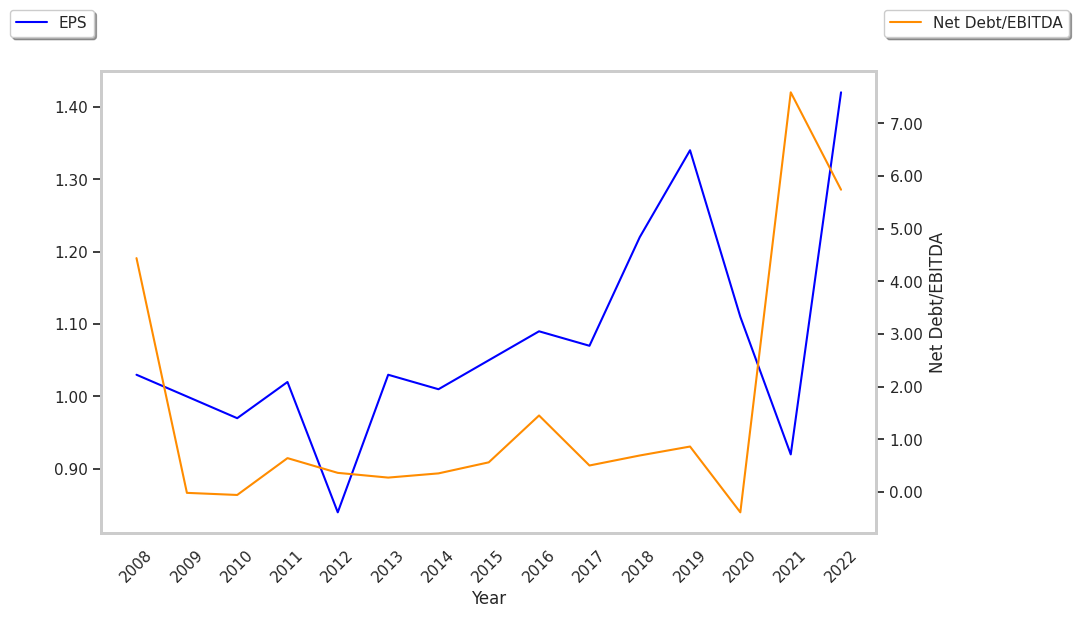

Strong Revenue Growth but a Flat EPS Growth Trend:

| 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | |

|---|---|---|---|---|---|---|

| Revenue (M) | $1,328 | $1,488 | $1,647 | $2,080 | $3,344 | $4,079 |

| Operating Margins | n/a | 30.0% | 25.0% | 19.0% | 27.0% | 23.0% |

| Net Margins | 27% | 28% | 24% | 17% | 26% | 21% |

| Net Income (M) | $364 | $436 | $395 | $359 | $869 | $872 |

| Net Interest Expense (M) | $266 | $291 | $309 | $324 | $465 | $730 |

| Depreciation & Amort. (M) | $540 | $594 | $677 | $898 | $1,670 | $1,895 |

| Diluted Shares (M) | 290 | 316 | 345 | 415 | 612 | 693 |

| Earnings Per Share | $1.26 | $1.38 | $1.14 | $0.87 | $1.42 | $1.26 |

| EPS Growth | n/a | 9.52% | -17.39% | -23.68% | 63.22% | -11.27% |

| Avg. Price | $43.27 | $58.52 | $52.53 | $59.73 | $64.45 | $61.63 |

| P/E Ratio | 34.34 | 42.41 | 45.68 | 68.66 | 45.39 | 48.91 |

| Free Cash Flow (M) | $915 | $1,045 | $1,107 | $1,303 | $2,468 | $2,890 |

| CAPEX (M) | $25 | $24 | $9 | $19 | $96 | $69 |