Large-cap Telecommunications company Arista Networks has logged a -1.4% change today on a trading volume of 804,916. The average volume for the stock is 1,788,665.

Arista Networks, Inc. engages in the development, marketing, and sale of data-driven, client to cloud networking solutions for data center, campus, and routing environments in the Americas, Europe, the Middle East, Africa, and the Asia-Pacific. Based in Santa Clara, United States the company has 4,023 full time employees and a market cap of $126,141,849,600.

The company is now trading 6.97% away from its average analyst target price of $375.37 per share. The 19 analysts following the stock have set target prices ranging from $265.0 to $480.0, and on average give Arista Networks a rating of buy.

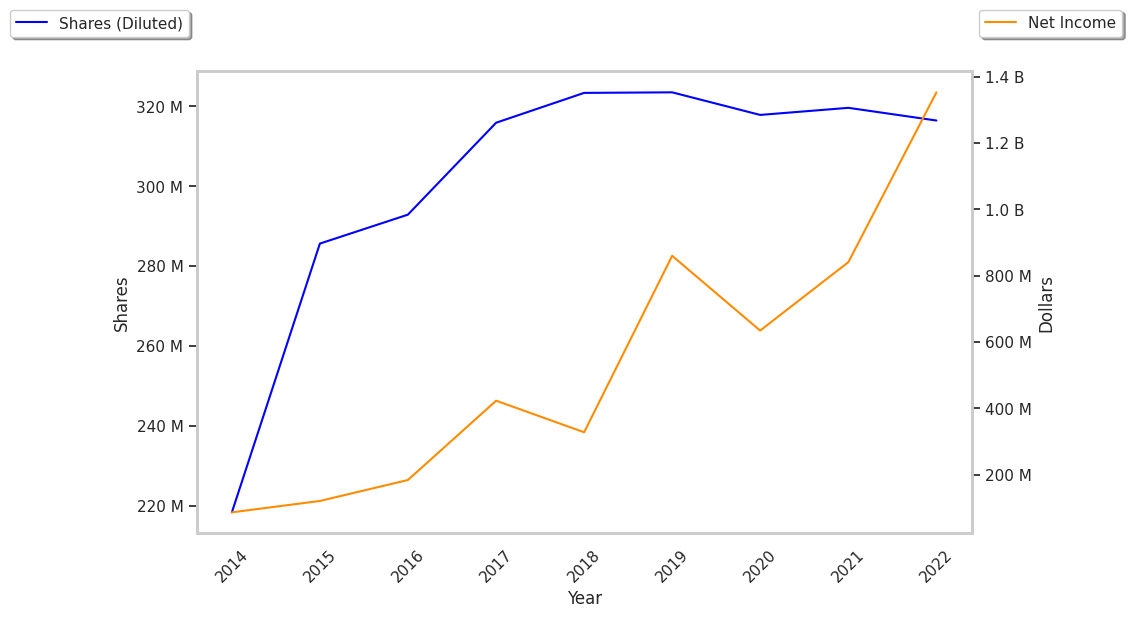

Over the last 52 weeks, ANET stock has risen 118.9%, which amounts to a 80.6% difference compared to the S&P 500. The stock's 52 week high is $422.73 whereas its 52 week low is $168.25 per share. Based on Arista Networks's average net margin growth of 15.5% over the last 6 years, its core business is on track for profitability and its strong stock performance may continue in the long term.

| Date Reported | Total Revenue ($ k) | Net Profit ($ k) | Net Margins (%) |

|---|---|---|---|

| 2023 | 5,860,168 | 2,087,321 | 36 |

| 2022 | 4,381,310 | 1,352,446 | 31 |

| 2021 | 2,948,037 | 840,854 | 28 |

| 2020 | 2,317,512 | 634,557 | 27 |

| 2019 | 2,410,706 | 859,867 | 36 |

| 2018 | 2,151,369 | 328,115 | 15 |