Large-cap Telecommunications company Verizon Communications has logged a -1.8% change today on a trading volume of 13,292,317. The average volume for the stock is 17,801,531.

Verizon Communications Inc., through its subsidiaries, engages in the provision of communications, technology, information, and entertainment products and services to consumers, businesses, and governmental entities worldwide. Based in New York, United States the company has 101,200 full time employees and a market cap of $174,110,294,016. Verizon Communications currently offers its equity investors a dividend that yields 6.3% per year.

The company is now trading -11.02% away from its average analyst target price of $46.48 per share. The 22 analysts following the stock have set target prices ranging from $37.0 to $56.0, and on average give Verizon Communications a rating of buy.

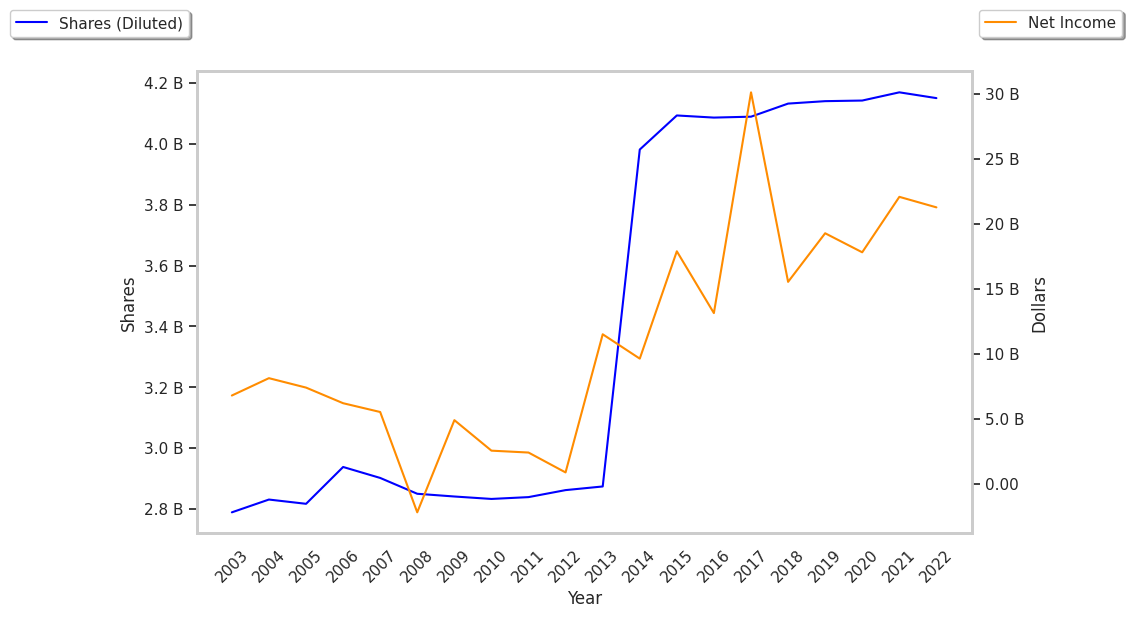

Over the last 52 weeks, VZ stock has risen 16.0%, which amounts to a -15.2% difference compared to the S&P 500. The stock's 52 week high is $45.36 whereas its 52 week low is $35.4 per share. With its net margins declining an average -5.3% over the last 6 years, Verizon Communications may not have a strong enough profitability trend to support its stock price.

| Date Reported | Total Revenue ($ k) | Net Profit ($ k) | Net Margins (%) | YoY Growth (%) |

|---|---|---|---|---|

| 2023 | 133,974,000 | 11,614,000 | 9 | -43.75 |

| 2022 | 136,835,000 | 21,256,000 | 16 | -5.88 |

| 2021 | 133,613,000 | 22,065,000 | 17 | 21.43 |

| 2020 | 128,292,000 | 17,801,000 | 14 | -6.67 |

| 2019 | 131,868,000 | 19,265,000 | 15 | 25.0 |

| 2018 | 130,863,000 | 15,528,000 | 12 |