Standing out among the Street's worst performers today is Moderna, a biotechnology company whose shares slumped -6.9% to a price of $46.83, 46.27% below its average analyst target price of $87.15.

The average analyst rating for the stock is hold. MRNA lagged the S&P 500 index by -7.0% so far today and by -69.2% over the last year, returning -33.3%.

Moderna, Inc., a biotechnology company, discovers, develops, and commercializes messenger RNA therapeutics and vaccines for the treatment of infectious diseases, immuno-oncology, rare diseases, autoimmune, and cardiovascular diseases in the United States, Europe, and internationally. The company is part of the healthcare sector. Healthcare companies work in incredibly complex markets, and their valuations can change in an instant based on a denied drug approval, a research and development breakthrough at a competitor, or a new government regulation. In the longer term, healthcare companies are affected by factors as varied as demographics and epidemiology. Investors who want to understand the healthcare market should be prepared for deep dives into a wide range of topics.

Moderna does not publish either its forward or trailing P/E ratios because their values are negative -- meaning that each share of stock represents a net earnings loss. But we can calculate these P/E ratios anyways using the stocks forward and trailing (EPS) values of $-8.65 and $-5.81. We can see that MRNA has a forward P/E ratio of -5.4 and a trailing P/E ratio of -8.1. As of the third quarter of 2024, the average Price to Earnings (P/E) ratio for US health care companies is 26.07, and the S&P 500 has an average of 29.3. The P/E ratio consists in the stock's share price divided by its earnings per share (EPS), representing how much investors are willing to spend for each dollar of the company's earnings. Earnings are the company's revenues minus the cost of goods sold, overhead, and taxes.

A significant limitation with the price to earnings analysis is that it doesn’t account for investors’ growth expectations in the company. For example, a company with a low P/E ratio may not actually be a good value if it has little growth potential. Conversely, companies with high P/E ratios may be fairly valued in terms of growth expectations.

When we divide Moderna's P/E ratio by its projected 5 year earnings growth rate, we see that it has a Price to Earnings Growth (PEG) ratio of 0.1. This tells us that the company is largely undervalued in terms of growth expectations -- but remember, these growth expectations could turn out to be wrong!

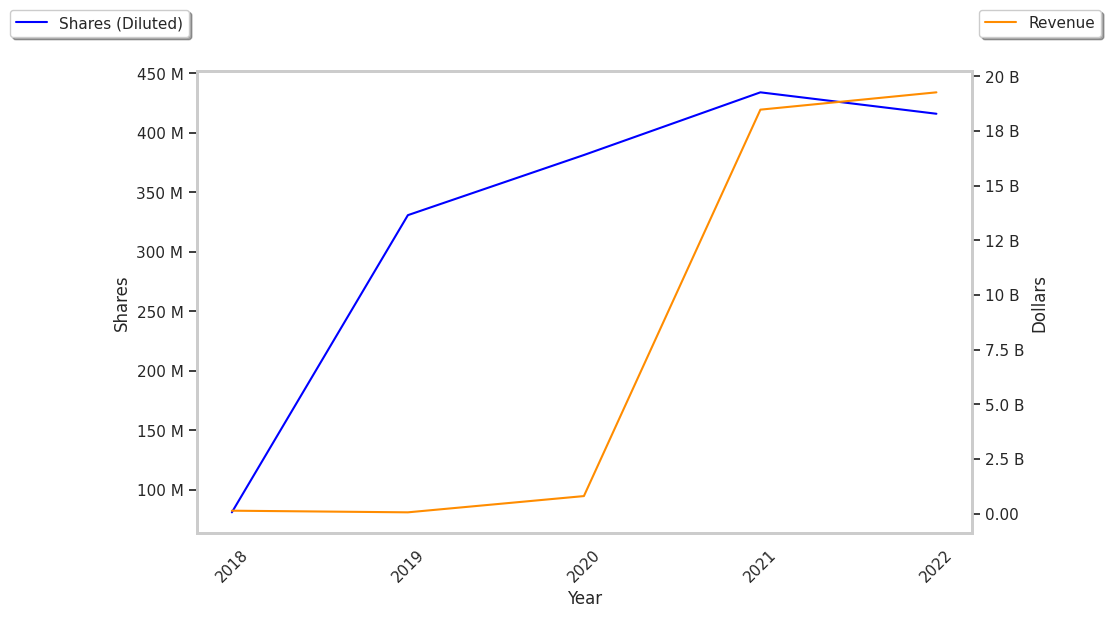

When we subtract capital expenditures from operating cash flows, we are left with the company's free cash flow, which for Moderna was $-3825000000 as of its last annual report. Free cash flow represents the amount of money available for reinvestment in the business or for payments to equity investors in the form of a dividend. In MRNA's case the cash flow outlook is weak. It's average cash flow over the last 4 years has been $2.52 Billion and they've been growing at an average rate of -54.3%.

Another valuation metric for analyzing a stock is its Price to Book (P/B) Ratio, which consists in its share price divided by its book value per share. The book value refers to the present liquidation value of the company, as if it sold all of its assets and paid off all debts). Moderna's P/B ratio indicates that the market value of the company exceeds its book value by a factor of 1.51, but is still below the average P/B ratio of the Health Care sector, which stood at 3.53 as of the third quarter of 2024.

Moderna is likely overvalued at today's prices because it has a negative P/E ratio., a lower P/B ratio than its sector average, and positive cash flows with a downwards trend. The stock has poor growth indicators because of its weak operating margins with a positive growth rate, and a negative PEG ratio. We hope this preliminary analysis will encourage you to do your own research into MRNA's fundamental values -- especially their trends over the last few years, which provide the clearest picture of the company's valuation.