Large-cap Real Estate company Prologis has logged a -1.6% change today on a trading volume of 3,650,739. The average volume for the stock is 3,741,960.

Prologis, Inc. is the global leader in logistics real estate with a focus on high-barrier, high-growth markets. Based in San Francisco, United States the company has 2,574 full time employees and a market cap of $103,731,593,216. Prologis currently offers its equity investors a dividend that yields 3.3% per year.

The company is now trading -14.47% away from its average analyst target price of $130.95 per share. The 20 analysts following the stock have set target prices ranging from $104.0 to $154.0, and on average give Prologis a rating of buy.

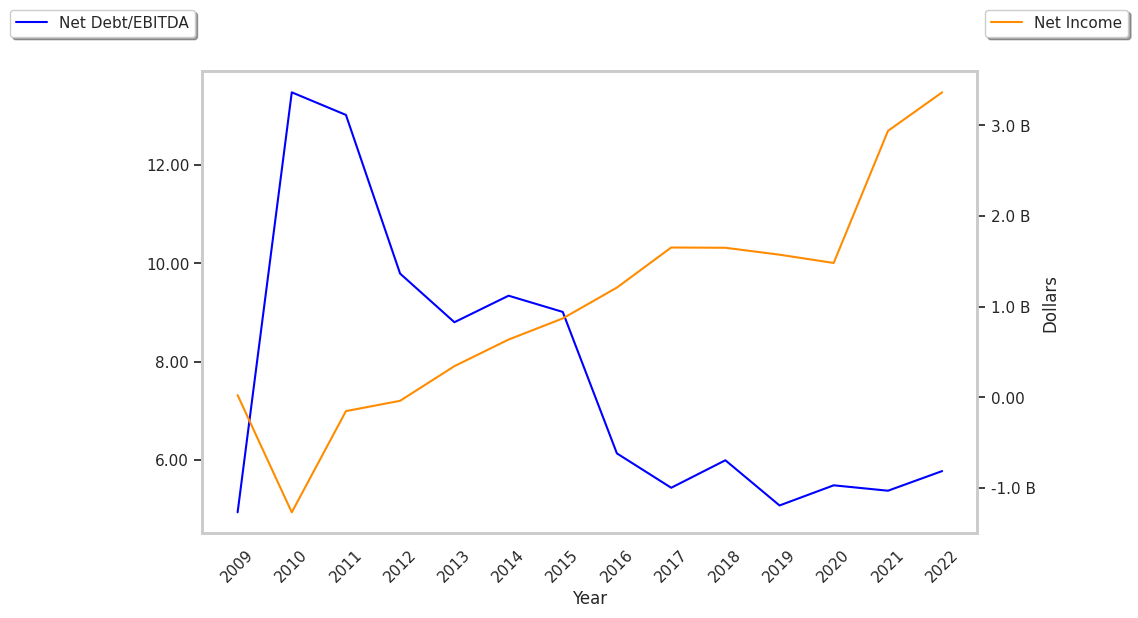

Over the last 12 months PLD shares have declined by -8.2%, which represents a difference of -40.0% when compared to the S&P 500. The stock's 52 week high is $137.52 per share and its 52 week low is $101.11. With its net margins declining an average -7.0% over the last 6 years, Prologis declining profitability gives us reason to believe its stock price will continue to underwhelm.

| Date Reported | Total Revenue ($ k) | Net Profit ($ k) | Net Margins (%) | YoY Growth (%) |

|---|---|---|---|---|

| 2023 | 8,023,469 | 3,059,214 | 38 | -32.14 |

| 2022 | 5,973,692 | 3,364,856 | 56 | -9.68 |

| 2021 | 4,759,440 | 2,939,723 | 62 | 87.88 |

| 2020 | 4,438,735 | 1,481,814 | 33 | -29.79 |

| 2019 | 3,330,621 | 1,572,959 | 47 | -20.34 |

| 2018 | 2,804,449 | 1,649,361 | 59 |