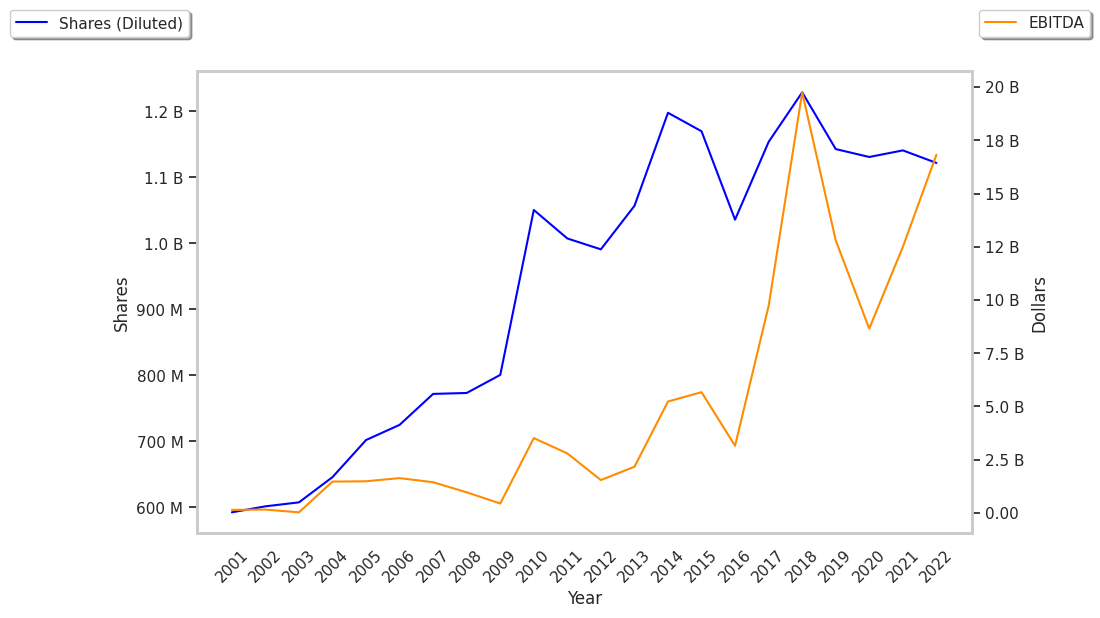

Falling -3.6% today, shares of Micron Technology are giving us reason to question their average rating of buy. Did analysts get things wrong about this stock? Let's dive into the numbers to see whether MU is overvalued at today's price of $98.39 per share.

The first step in determining whether a stock is overvalued is to check its price to book (P/B) ratio. This is perhaps the most basic measure of a company's valuation, which is its market value divided by its book value. Book value refers to the sum of all of the company's assets minus its liabilities -- you can also think of it as the company's equity value.

Traditionally, value investors would look for companies with a ratio of less than 1 (meaning that the market value was smaller than the company's book value), but such opportunities are very rare these days. So we tend to look for company's whose valuations are less than their sector and market average. The P/B ratio for Micron Technology is 2.42, compared to its sector average of 3.91 and the S&P 500's average P/B of 4.74.

Modernly, the most common metric for valuing a company is its Price to Earnings (P/E) ratio. It's simply today's stock price of 98.39 divided by either its trailing or forward earnings, which for Micron Technology are $0.7 and $12.87 respectively. Based on these values, the company's trailing P/E ratio is 140.6 and its forward P/E ratio is 7.6. By way of comparison, the average P/E ratio of the Technology sector is 30.01 and the average P/E ratio of the S&P 500 is 29.3.

If a company is overvalued in terms of its earnings, we also need to check if it has the ability to meet its financial obligations. One way to check this is via the so called Quick Ratio or Acid Test, which is the sum of its current assets, inventory, and prepaid expenses divided by its current liabilities. Micron Technology's Quick ratio is 1.592, which indicates that that its total liquid assets are sufficient to meets its current liabilities.

Investors are undoubtedly attracted by Micron Technology's dividend of $0.5%. But can the company keep up these payments? Dividends are paid out from levered free cash flow, which is the money left over after the company has accounted for all expenses and income -- including those unrelated to its core business. In Micron Technology's case, the cash flows are negative which calls into question the firm's ability to sustain its dividends.

Shares of Micron Technology appear to be overvalued at today's prices — despite the positive outlook from analysts. But sometimes stocks with inflated valuations turn out to be strong performances for years, and even decades, such as Amazon. So be sure to do your own due diligence if you are interested in taking a long position in MU.