A strong performer from today's afternoon trading session is International Paper, whose shares rose 1.1% to $54.45 per share. For those of you thinking about investing in the stock, here is a brief value analysis of the stock using the company's basic fundamental ratios.

International Paper's Valuation Is in Line With Its Sector Averages:

International Paper Company produces and sells renewable fiber-based packaging and pulp products in North America, Latin America, Europe, and North Africa. The company belongs to the Basic Materials sector, which has an average price to earnings (P/E) ratio of 24.53 and an average price to book (P/B) ratio of 2.64. In contrast, International Paper has a trailing 12 month P/E ratio of 46.5 and a P/B ratio of 2.19.

International Paper has moved 48.9% over the last year compared to 24.2% for the S&P 500 -- a difference of 24.6%. International Paper has a 52 week high of $60.36 and a 52 week low of $32.7.

The Company's Revenues Are Declining:

| 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | |

|---|---|---|---|---|---|---|

| Revenue (M) | $23,306 | $18,317 | $17,565 | $19,363 | $21,161 | $18,916 |

| Operating Margins | 8% | 5% | 2% | 5% | 7% | 2% |

| Net Margins | 9% | 7% | 3% | 9% | 7% | 2% |

| Net Income (M) | $2,012 | $1,220 | $482 | $1,752 | $1,504 | $288 |

| Net Interest Expense (M) | -$536 | -$499 | -$446 | -$337 | -$325 | -$231 |

| Depreciation & Amort. (M) | $1,328 | $1,072 | $1,091 | $1,097 | $1,040 | $1,432 |

| Diluted Shares (M) | 414 | 399 | 396 | 392 | 367 | 349 |

| Earnings Per Share | $4.85 | $3.07 | $1.22 | $4.47 | $4.1 | $0.82 |

| EPS Growth | n/a | -36.7% | -60.26% | 266.39% | -8.28% | -80.0% |

| Avg. Price | $39.58 | $34.76 | $32.74 | $48.32 | $43.4 | $54.45 |

| P/E Ratio | 8.06 | 11.21 | 26.62 | 10.74 | 10.48 | 65.6 |

| Free Cash Flow (M) | $1,654 | $2,473 | $2,400 | $1,550 | $1,243 | $692 |

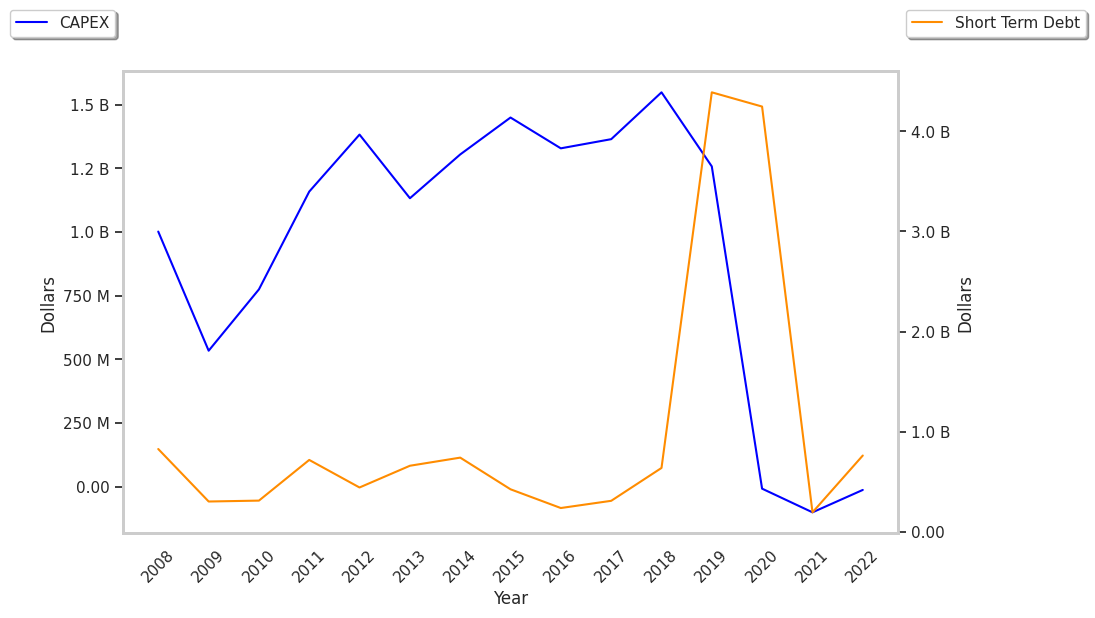

| CAPEX (M) | $1,572 | $1,137 | $663 | $480 | $931 | $1,141 |

| EV / EBITDA | 8.49 | 11.62 | 14.3 | 10.72 | 7.83 | 12.95 |

| Total Debt (M) | $10,654 | $9,765 | $8,068 | $5,579 | $5,579 | $5,593 |

| Net Debt / EBITDA | 3.24 | 4.64 | 5.26 | 2.04 | 1.87 | 2.47 |

| Current Ratio | 1.49 | 0.77 | 1.36 | 1.71 | 1.35 | 1.67 |

International Paper's financial statements include several red flags such as declining revenues and decreasing reinvestment in the business, weak operating margins with a negative growth trend, and declining EPS growth. Additionally, the firm has positive cash flows. On the other hand, the company benefits from a decent current ratio of 1.67 and healthy leverage levels.