A strong performer from today's afternoon trading session is Enterprise Products, whose shares rose 1.5% to $31.49 per share. For those of you thinking about investing in the stock, here is a brief value analysis of the stock using the company's basic fundamental ratios.

a Very Low P/E Ratio but Priced at a Premium:

Enterprise Products Partners L.P. provides midstream energy services to producers and consumers of natural gas, natural gas liquids (NGLs), crude oil, petrochemicals, and refined products. The company belongs to the Utilities sector, which has an average price to earnings (P/E) ratio of 20.52 and an average price to book (P/B) ratio of 2.2. In contrast, Enterprise Products has a trailing 12 month P/E ratio of 11.8 and a P/B ratio of 2.41.

Enterprise Products has moved 20.1% over the last year compared to 26.3% for the S&P 500 -- a difference of -6.2%. Enterprise Products has a 52 week high of $34.63 and a 52 week low of $26.12.

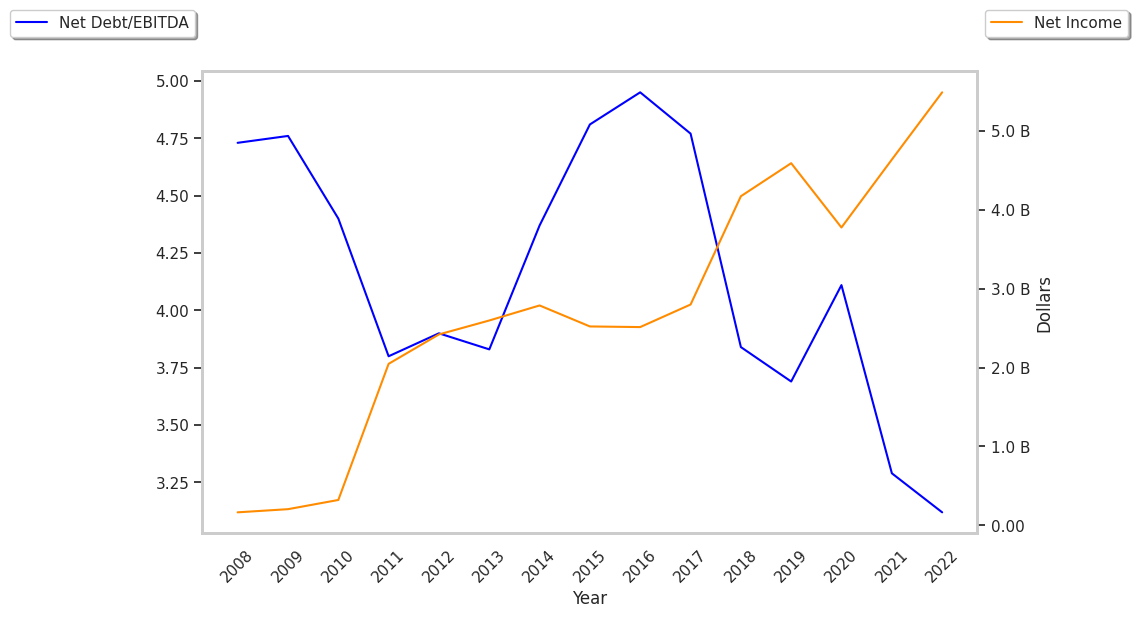

The Firm Has a Highly Leveraged Balance Sheet:

| 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | |

|---|---|---|---|---|---|---|

| Revenue (M) | $36,534 | $32,789 | $27,200 | $40,807 | $58,186 | $49,715 |

| Operating Margins | 15% | 19% | 19% | 15% | 12% | 14% |

| Net Margins | 11% | 14% | 14% | 11% | 9% | 11% |

| Net Income (M) | $4,172 | $4,591 | $3,775 | $4,634 | $5,487 | $5,529 |

| Net Interest Expense (M) | $1,097 | $1,243 | $1,287 | $1,283 | $1,244 | $1,269 |

| Depreciation & Amort. (M) | $1,792 | $1,949 | $2,072 | $151 | $177 | $201 |

| Diluted Shares (M) | 2,187 | 2,202 | 2,202 | 2,203 | 2,199 | 2,194 |

| Earnings Per Share | $1.91 | $2.09 | $1.71 | $2.1 | $2.5 | $2.52 |

| EPS Growth | n/a | 9.42% | -18.18% | 22.81% | 19.05% | 0.8% |

| Avg. Price | $18.89 | $20.7 | $15.22 | $19.63 | $23.14 | $31.49 |

| P/E Ratio | 9.79 | 9.86 | 8.85 | 9.26 | 9.18 | 12.35 |

| Free Cash Flow (M) | $1,903 | $1,989 | $2,603 | $6,290 | $6,075 | $4,303 |

| CAPEX (M) | $4,223 | $4,532 | $3,288 | $2,223 | $1,964 | $3,266 |

| EV / EBITDA | 9.26 | 9.03 | 8.74 | 11.12 | 11.09 | 13.59 |

| Total Debt (M) | $26,178 | $27,625 | $29,866 | $29,535 | $28,295 | $28,748 |

| Net Debt / EBITDA | 3.59 | 3.4 | 4.05 | 4.27 | 3.98 | 4.01 |

| Current Ratio | 0.85 | 0.86 | 1.1 | 1.14 | 0.86 | 0.93 |

Enterprise Products has weak operating margins with a stable trend, not enough current assets to cover current liabilities because its current ratio is 0.93, and a highly leveraged balance sheet. On the other hand, the company benefits from generally positive cash flows and positive EPS growth. Furthermore, Enterprise Products has growing revenues and decreasing reinvestment in the business.