Dow shares fell by -1.2% during the day's morning session, and are now trading at a price of $38.92. Is it time to buy the dip? To better answer that question, it's essential to check if the market is valuing the company's shares fairly in terms of its earnings and equity levels.

a Lower P/B Ratio Than Its Sector Average but Its Shares Are Expensive:

Dow Inc., through its subsidiaries, engages in the provision of various materials science solutions for packaging, infrastructure, mobility, and consumer applications in the United States, Canada, Europe, the Middle East, Africa, India, the Asia Pacific, and Latin America. The company belongs to the Industrials sector, which has an average price to earnings (P/E) ratio of 25.42 and an average price to book (P/B) ratio of 3.2. In contrast, Dow has a trailing 12 month P/E ratio of 25.9 and a P/B ratio of 1.49.

Dow has moved -27.4% over the last year compared to 23.8% for the S&P 500 -- a difference of -51.2%. Dow has a 52 week high of $60.69 and a 52 week low of $38.33.

Increasing Revenues but Narrowing Margins:

| 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | |

|---|---|---|---|---|---|---|

| Revenue (M) | $49,604 | $42,951 | $38,542 | $54,968 | $56,902 | $44,622 |

| Operating Margins | 8% | -3% | 5% | 15% | 11% | 1% |

| Net Margins | 9% | -3% | 3% | 12% | 8% | 1% |

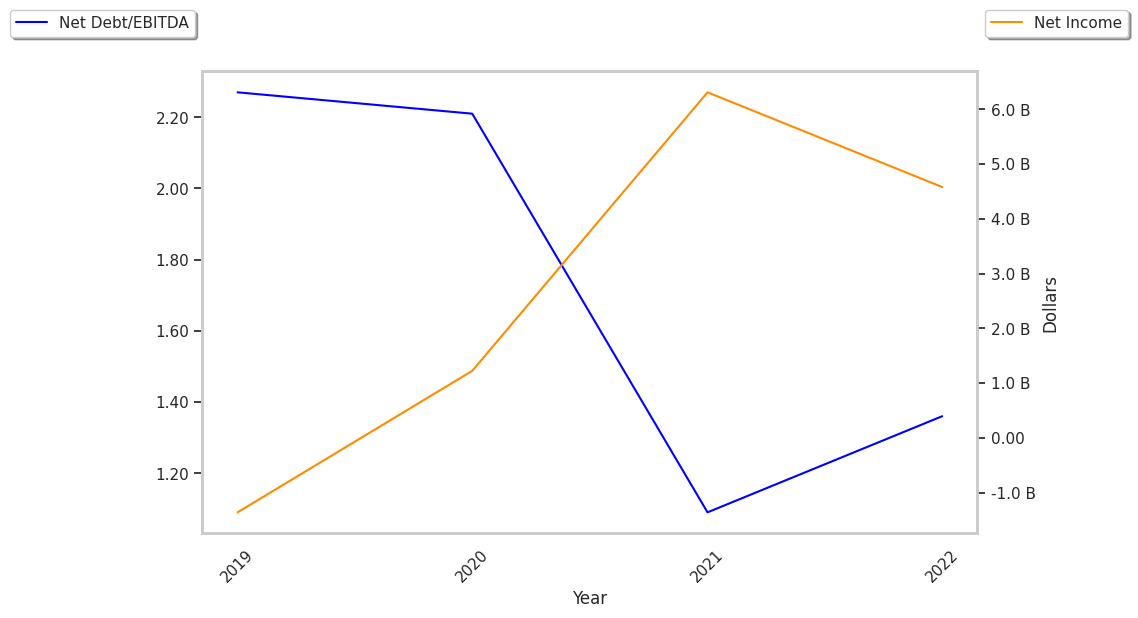

| Net Income (M) | $4,641 | -$1,272 | $1,294 | $6,405 | $4,640 | $660 |

| Net Interest Expense (M) | $1,063 | $933 | $827 | $731 | $662 | $746 |

| Depreciation & Amort. (M) | $2,174 | $419 | $2,874 | $2,842 | $2,758 | $2,611 |

| Diluted Shares (M) | 747 | 742 | 742 | 749 | 726 | 709 |

| Earnings Per Share | $6.21 | -$1.84 | $1.64 | $8.38 | $6.28 | $0.82 |

| EPS Growth | n/a | -129.63% | 189.13% | 410.98% | -25.06% | -86.94% |

| Free Cash Flow (M) | $2,163 | $3,969 | $7,067 | $9,923 | $5,652 | $2,840 |

| CAPEX (M) | $2,091 | $1,961 | $841 | $2,914 | $1,823 | $2,356 |

| Total Debt (M) | $19,591 | $15,975 | $16,491 | $14,280 | $14,698 | $14,907 |

| Net Debt / EBITDA | 2.85 | -16.43 | 2.3 | 1.03 | 1.22 | 3.65 |

| Current Ratio | 2.53 | 1.57 | 1.72 | 1.58 | 1.81 | 1.77 |

Dow has weak operating margins with a negative growth trend, declining EPS growth, and a highly leveraged balance sheet. On the other hand, the company benefits from slight revenue growth and increasing reinvestment in the business and a decent current ratio of 1.77. Furthermore, Dow has positive cash flows.