Standing out among the Street's worst performers today is Cheniere Energy, a oil & gas transmission company whose shares slumped -4.1% to a price of $239.31, not far from its average analyst target price of $240.91.

The average analyst rating for the stock is buy. LNG underperformed the S&P 500 index by -5.0% during today's morning session, but outpaced it by 26.7% over the last year with a return of 51.0%.

Cheniere Energy, Inc., an energy infrastructure company, primarily engages in the liquefied natural gas (LNG) related businesses in the United States. The company is a utility stock. Historically, the utilities sector has proven to be a safe haven during economic downturns, as they provide an essential service that is always in demand. Investors also tend to choose these stocks because they generally pay attractive dividends. But there is no telling if this will continue in the future.

Utilities tend to have high debt levels because of the enormous capital requirements of maintaining their infrastructure. In periods of rising interest rates, a high debt load can prove disastrous for a company. Another source of uncertainty facing the sector is the imminent rollout of new Federal clean power regulations which will increase costs for utilities, but also provide subsidies for the sector -- at least initially.

Cheniere Energy's trailing 12 month P/E ratio is 15.2, based on its trailing EPS of $15.73. The company has a forward P/E ratio of 20.6 according to its forward EPS of $11.31 -- which is an estimate of what its earnings will look like in the next quarter. As of the third quarter of 2024, the average Price to Earnings (P/E) ratio for US utilities companies is 20.52, and the S&P 500 has an average of 29.3. The P/E ratio consists in the stock's share price divided by its earnings per share (EPS), representing how much investors are willing to spend for each dollar of the company's earnings. Earnings are the company's revenues minus the cost of goods sold, overhead, and taxes.

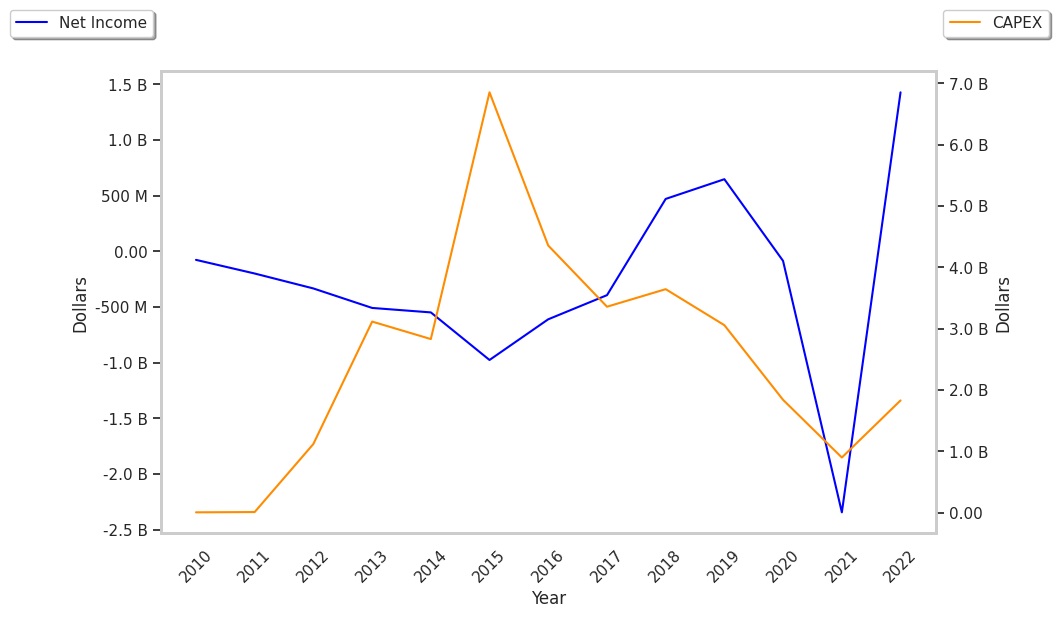

To deepen our understanding of the company's finances, we should study the effect of its depreciation and capital expenditures on the company's bottom line. We can see the effect of these additional factors in Cheniere Energy's free cash flow, which was $6.3 Billion as of its most recent annual report. Over the last 4 years, the company's average free cash flow has been $2.17 Billion and they've been growing at an average rate of 36.9%. With such strong cash flows, the company can not only re-invest in its business, it can afford to offer regular returns to its equity investors in the form of dividends. Over the last 12 months, investors in LNG have received an annualized dividend yield of 0.7% on their capital.

Another valuation metric for analyzing a stock is its Price to Book (P/B) Ratio, which consists in its share price divided by its book value per share. The book value refers to the present liquidation value of the company, as if it sold all of its assets and paid off all debts). Cheniere energy's P/B ratio is 10.57 -- in other words, the market value of the company exceeds its book value by a factor of more than 10, so the company's assets may be overvalued compared to the average P/B ratio of the Utilities sector, which stands at 2.2 as of the third quarter of 2024.

Since it has a Very low P/E ratio, a higher than Average P/B Ratio, and generally positive cash flows with an upwards trend, Cheniere Energy is likely undervalued at today's prices. The company has strong growth indicators because of a PEG ratio of less than 1 and strong operating margins with a positive growth rate. We hope you enjoyed this overview of LNG's fundamentals. Be sure to check the numbers for yourself, especially focusing on their trends over the last few years.