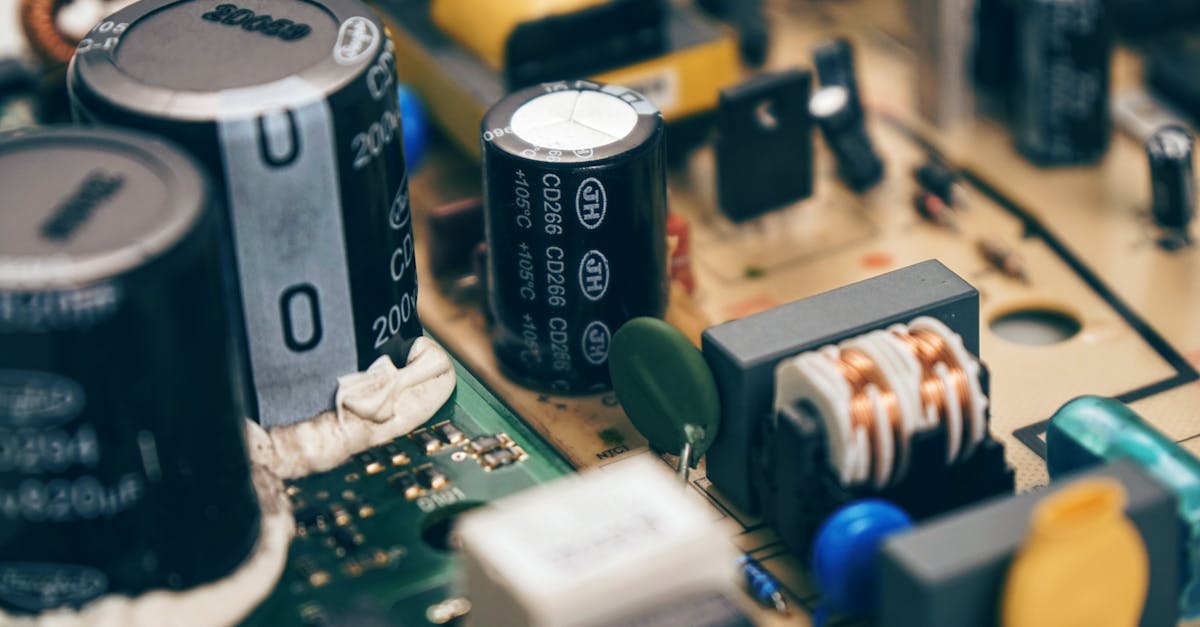

ON Semiconductor Corporation has recently released its 10-K report, providing a detailed look at its financial performance and operations for the year ended December 31, 2024. The company operates through its Power Solutions Group, Advanced Solutions Group, and Intelligent Sensing Group, providing intelligent power technologies for the automotive industry, as well as analog, discrete, module, and integrated semiconductor products for various applications.

In 2024, ON Semiconductor reported a revenue of $7,082.3 million, reflecting a 14.2% decrease from $8,253.0 million in 2023. The net income attributable to ON Semiconductor was $1,572.8 million in 2024, compared to $2,183.7 million in 2023. The operating income for 2024 totaled $1,767.7 million, a decrease from $2,538.7 million in 2023. The gross margin decreased by approximately 170 basis points to 45.4% in 2024 from 47.1% in 2023, primarily due to decreased demand in the automotive and industrial end-markets resulting in lower sales volumes and underutilization of manufacturing facilities.

The semiconductor industry, including ON Semiconductor, experienced a softening demand and uncertainty in 2024 due to macroeconomic factors and the geopolitical environment. As a result, the company actively managed and took corrective actions in its manufacturing capacity and spending to align with forecasted demand. ON Semiconductor also evaluated cost-saving initiatives to align its overall cost structure, capital investments, and other expenditures with expected revenue, spending, and capacity levels to offset softening demand and increased manufacturing and operating costs.

The company's revenue by geographic location, based on sales billed from the respective country or regions, showed a decline across all segments. Revenue from the Power Solutions Group (PSG) decreased by approximately 13.7%, revenue from the Advanced Solutions Group (AMG) decreased by approximately 14.7%, and revenue from the Intelligent Sensing Group (ISG) decreased by approximately 14.5% in 2024 compared to 2023.

ON Semiconductor's gross profit for 2024 was $3,216.1 million, representing a decrease of $667.4 million or approximately 17.2% from 2023. This decrease was primarily due to the decline in sales volume in both existing products and new products, partially offset by a reduction in lower-margin manufacturing services revenue at the EFK location.

The company's operating expenses also saw changes in 2024 compared to 2023. Research and development expenses increased by approximately 6%, while selling and marketing expenses decreased by approximately 2%. General and administrative expenses increased by approximately 4%, and restructuring, asset impairments, and other charges increased by $59.0 million, primarily due to severance and asset impairment charges associated with the 2024 business realignment efforts.

ON Semiconductor's liquidity and capital resources as of December 31, 2024, included cash and cash equivalents of approximately $2,691.3 million, short-term investments of $300.0 million, and approximately $1.1 billion available for future borrowings under its Revolving Credit Facility. The company outlined its principal sources of liquidity, including cash on hand, cash generated from operations, available borrowings, and potential debt or equity issuances to fund its cash requirements.

The market has reacted to these announcements by moving the company's shares -7.0% to a price of $47.66. Check out the company's full 10-K submission here.