Ultra Clean Holdings, Inc. (NASDAQ: UCTT) has released its financial results for the fourth quarter and full year ended December 27, 2024. The company reported total revenue of $563.3 million for the fourth quarter, representing a 4.2% increase from the previous quarter's total revenue of $540.4 million. The gross margin decreased from 17.3% in the prior quarter to 16.3% in the fourth quarter of 2024. Additionally, the operating margin decreased from 4.7% to 4.6%, and the company reported a net income of $16.3 million or $0.36 per diluted share, compared to a net loss of $(2.3) million or $(0.05) per diluted share in the prior quarter.

On a non-GAAP basis, Ultra Clean Holdings, Inc. reported a gross margin of 16.8% for the fourth quarter of 2024, down from 17.8% in the prior quarter. The operating margin also decreased from 7.3% to 7.0%, while the net income increased to $22.9 million or $0.51 per diluted share, compared to $15.9 million or $0.35 per diluted share in the prior quarter.

For the full year 2024, the company reported total revenue of $2,097.6 million, a significant increase from the previous year's total revenue of $1,734.5 million. The gross margin improved from 16.0% in the prior year to 17.0% in 2024, and the operating margin increased from 2.0% to 4.3%. The company reported a net income of $23.7 million or $0.52 per diluted share, compared to a net loss of $(31.1) million or $(0.70) per diluted share in the prior year.

On a non-GAAP basis, Ultra Clean Holdings, Inc. reported a gross margin of 17.5% for the full year 2024, up from 16.6% in the prior year. The operating margin also increased from 4.9% to 6.9%, and the net income rose to $65.2 million or $1.44 per diluted share, compared to $25.2 million or $0.56 per diluted share in the prior year.

Looking ahead, the company expects first quarter 2025 revenue in the range of $505 million to $555 million. The company also provided guidance for GAAP diluted net income (loss) per share to be between $(0.11) and $0.09 and non-GAAP diluted net income per share to be between $0.22 and $0.42.

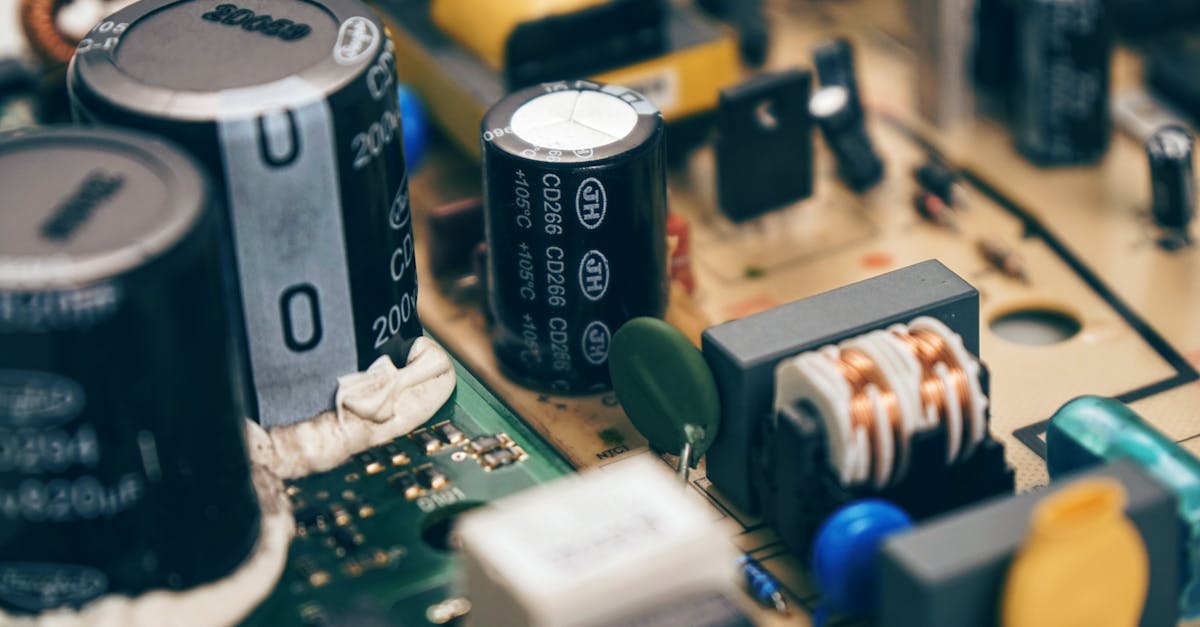

Ultra Clean Holdings, Inc. is a leading developer and supplier of critical subsystems, components, parts, and ultra-high purity cleaning and analytical services, primarily for the semiconductor industry. The company's ability to outperform the overall WFE market and its strategic investments for long-term growth indicate a positive outlook for its future performance. The market has reacted to these announcements by moving the company's shares -21.7% to a price of $28.24. Check out the company's full 8-K submission here.