Steel Dynamics, Inc. (NASDAQ/GS: STLD) has declared a second quarter cash dividend of $0.50 per common share, payable to shareholders of record at the close of business on June 30, 2025, and is payable on or about July 11, 2025.

In terms of financial performance, Steel Dynamics reported its first quarter 2025 earnings of $2.82 per diluted share, which is a significant increase from the first quarter of 2024, where it reported earnings of $1.75 per diluted share. This represents an impressive year-over-year growth in earnings.

Steel Dynamics also announced a net sales of $4.6 billion for the first quarter of 2025, reflecting an increase from the $3.5 billion in the first quarter of 2024. This demonstrates a robust growth in net sales year-over-year.

Furthermore, the company's operating income for the first quarter of 2025 was reported at $465 million, showing an increase from the $280 million in the first quarter of 2024. This represents a substantial rise in operating income year-over-year.

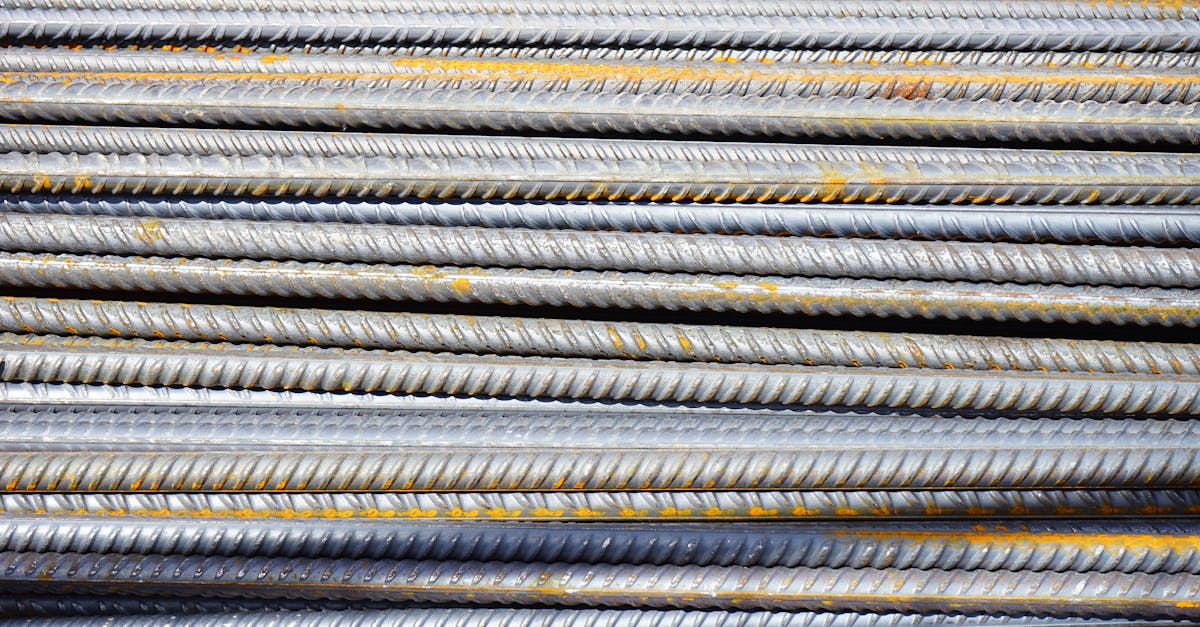

In addition, the company's steel shipments for the first quarter of 2025 were approximately 2.9 million tons, an increase from the approximately 2.7 million tons in the first quarter of 2024, showcasing a growth in steel shipments year-over-year.

Steel Dynamics, Inc. continues to be a leading industrial metals solutions company, operating with a circular manufacturing model and producing quality products with recycled scrap as the primary input. The company's commitment to diversifying its product offerings, with investments in aluminum operations, reflects its strategic approach to adapt to evolving market demands and opportunities.

Today the company's shares have moved -1.3% to a price of $127.56. If you want to know more, read the company's complete 8-K report here.