The best investors are not afraid to go against the grain. And an investment in Trane Technologies, which has an average analyst rating of only hold, would certainly fit the bill. Might patient investors be able to find value in this stock? Let's dive into numbers and see for ourselves.

Over the last year, Trane Technologies shares have moved 22.7% while trading between the prices of $298.15 and $422.0. This represents a 12.9% difference compared to the S&P 500, which moved 9.8% over the last 52 weeks.

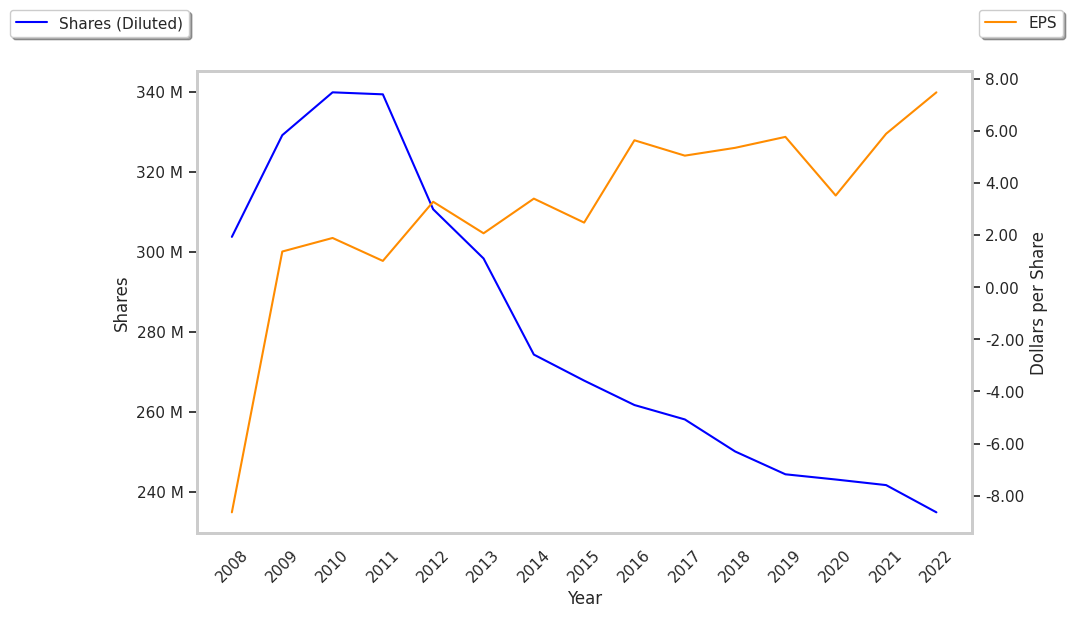

At its current price of $399.59 per share, TT has a trailing price to earnings (P/E) ratio of 32.9 based on its 12 month trailing earnings per share of $12.15. Considering its future earnings estimates of $12.65 per share, the stock's forward P/E ratio is 31.6. In comparison, the average P/E ratio of the Industrials sector is 24.03 and the average P/E ratio of the S&P 500 is 29.3.

We can also compare the ratio of Trane Technologies's price to its book value. A company's book value refers to its present equity value: what is left when we subtract its liabilities from its assets. TT has a book value of 11.92, with anything close or below one indicating a potentially undervalued company.

A comparison of the share price versus company earnings and book value should be balanced by an analysis of the company's ability to pay its liabilities. One popular metric is the Quick Ratio, or Acid Test, which is the company's current assets minus its inventory and prepaid expenses divided by its current liabilities. Trane Technologies's quick ratio is 0.7. Generally speaking, a quick ratio above 1 signifies that the company is able to meet its liabilities.

The final element of our analysis will touch on Trane Technologies's capacity to generate cash for the benefit of its shareholders or for reinvesting in the business. For this, we look at the company's levered free cash flow, which is the sum of all incoming and outgoing cash flows, including the servicing of current debt and liabilities. Trane Technologies has a free cash flow of $2.78 Billion, which it uses to pay its shareholders a 0.9% dividend.

At Market Inference, we will keep monitoring Trane Technologies to see if the contrarian thesis in this stock will be vindicated. Going against the grain can be an excellent way for investors to extract value from the stock market, but it's never a good idea to apply a strategy for its own sake. Do your own research and make sure that the facts support your decision.