Shares of TG Therapeutics have moved 4.9% today, and are now trading at a price of $38.86. In contrast, the S&P 500 index saw a -0.0% change. Today's trading volume is 2,180,564 compared to the stock's average volume of 2,823,419.

TG Therapeutics, Inc., a commercial stage biopharmaceutical company, focuses on the acquisition, development, and commercialization of novel treatments for B-cell mediated diseases in the United States and internationally. Based in Morrisville, United States the company has 352 full time employees and a market cap of $6,169,219,584.

The company is now trading -5.68% away from its average analyst target price of $41.2 per share. The 5 analysts following the stock have set target prices ranging from $11.0 to $53.0, and on average give TG Therapeutics a rating of buy.

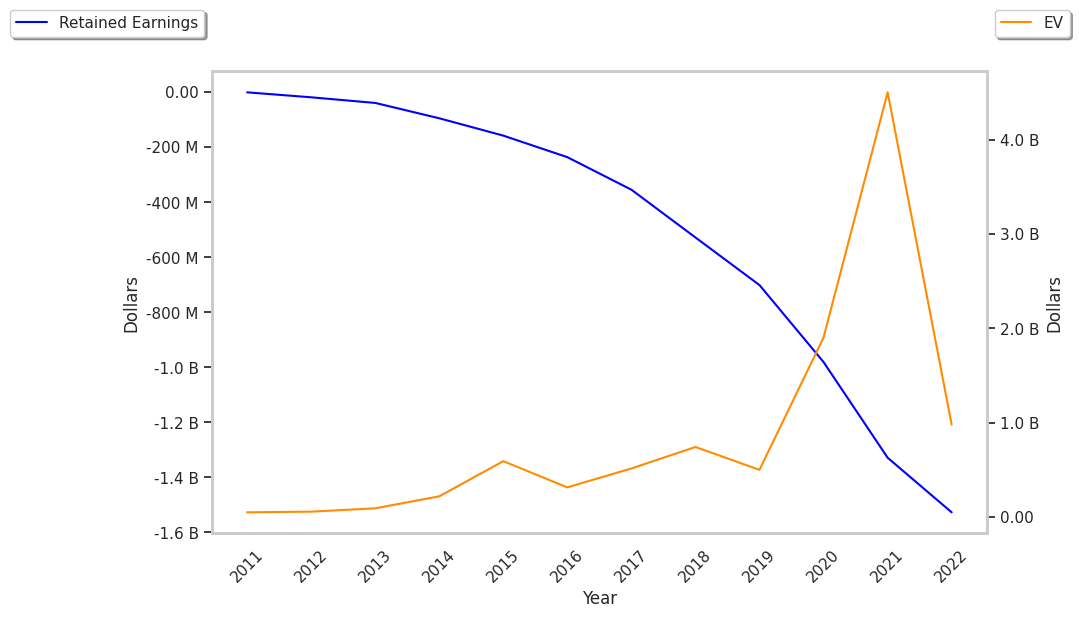

Over the last 52 weeks, TGTX stock has risen 134.3%, which amounts to a 122.7% difference compared to the S&P 500. The stock's 52 week high is $46.48 whereas its 52 week low is $15.16 per share. With its net margins declining an average 0.0% over the last 6 years, TG Therapeutics may not have a strong enough profitability trend to support its stock price.

| Date Reported | Total Revenue ($ k) | Net Profit ($ k) | Net Margins (%) | YoY Growth (%) |

|---|---|---|---|---|

| 2024 | 329,004 | 23,383 | 7 | 40.0 |

| 2023 | 233,662 | 12,672 | 5 | 100.06 |

| 2022 | 2,785 | -223,812 | -8036 | -54.42 |

| 2021 | 6,689 | -348,101 | -5204 | 97.17 |

| 2020 | 152 | -279,381 | -183803 | -61.61 |

| 2019 | 152 | -172,871 | -113731 |