Medical Specialities company Natera is taking Wall Street by surprise today, falling to $149.46 and marking a -5.5% change compared to the S&P 500, which moved -0.0%. NTRA is -22.47% below its average analyst target price of $192.78, which implies there is more upside for the stock.

As such, the average analyst rates it at buy. Over the last year, Natera shares have outstripped the S&P 500 by 27.6%, with a price change of 38.2%.

Natera, Inc., a diagnostics company, provides molecular testing services worldwide. The company is categorized within the healthcare sector. The catalysts that drive valuations in this sector are complex. From demographics, regulations, scientific breakthroughs, to the emergence of new diseases, healthcare companies see their prices swing on the basis of a variety of factors.

Natera does not publish either its forward or trailing P/E ratios because their values are negative -- meaning that each share of stock represents a net earnings loss. But we can calculate these P/E ratios anyways using the stocks forward and trailing (EPS) values of $-1.21 and $-1.47. We can see that NTRA has a forward P/E ratio of -123.5 and a trailing P/E ratio of -101.7. The P/E ratio is the company's share price divided by its earnings per share. In other words, it represents how much investors are willing to spend for each dollar of the company's earnings (revenues minus the cost of goods sold, taxes, and overhead). As of the third quarter of 2024, the health care sector has an average P/E ratio of 22.94, and the average for the S&P 500 is 29.3.

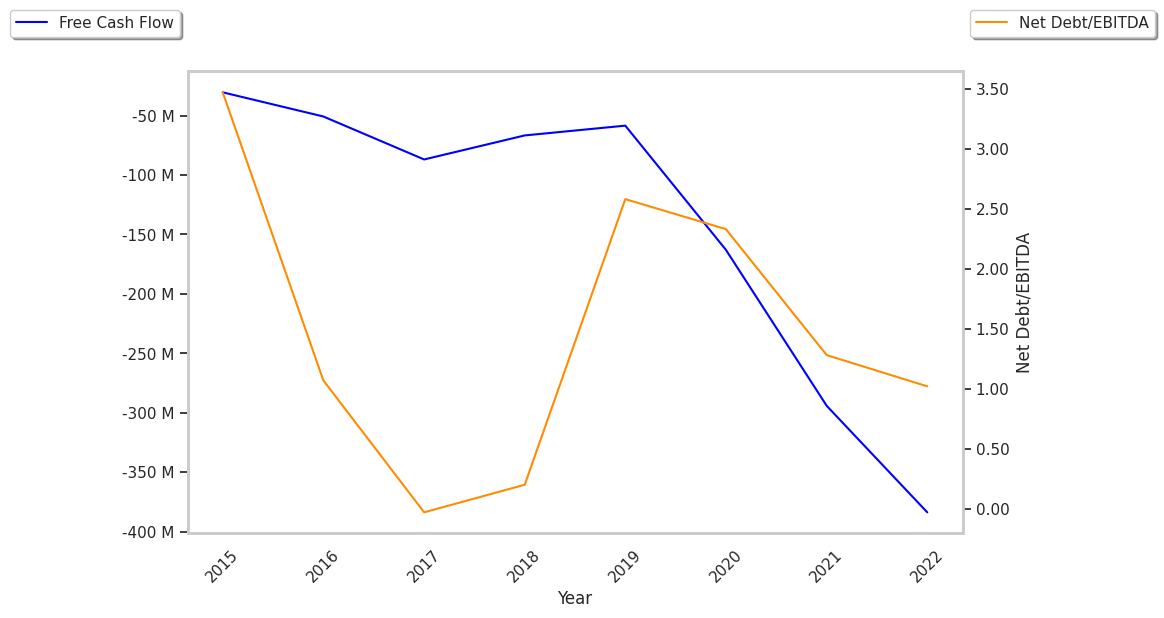

When we subtract capital expenditures from operating cash flows, we are left with the company's free cash flow, which for Natera was $69.24 Million as of its last annual report. Free cash flow represents the amount of money available for reinvestment in the business or for payments to equity investors in the form of a dividend. In NTRA's case the cash flow outlook is weak. It's average cash flow over the last 4 years has been $-223817500.0 and they've been growing at an average rate of 15.0%.

Another valuation metric for analyzing a stock is its Price to Book (P/B) Ratio, which consists in its share price divided by its book value per share. The book value refers to the present liquidation value of the company, as if it sold all of its assets and paid off all debts). Natera's P/B ratio is 16.39 -- in other words, the market value of the company exceeds its book value by a factor of more than 16, so the company's assets may be overvalued compared to the average P/B ratio of the Health Care sector, which stands at 3.19 as of the third quarter of 2024.

Since it has a negative P/E ratio., a higher than Average P/B Ratio, and negative cash flows with an upwards trend, Natera is likely fairly valued at today's prices. The company has mixed growth prospects because of a negative PEG ratio and weak operating margins with a positive growth rate. We hope you enjoyed this overview of NTRA's fundamentals. Be sure to check the numbers for yourself, especially focusing on their trends over the last few years.