Shares of Health Care sector company Natera moved 1.3% today, and are now trading at a price of $139.62. The Large-Cap stock's daily volume was 90,854 compared to its average volume of 1,304,772. The S&P 500 index returned a 0.0% performance.

Natera, Inc., a diagnostics company, provides molecular testing services worldwide. The company is based in Austin and has 4,424 full time employees. Its market capitalization is $19,064,010,752.

20 analysts are following Natera and have set target prices ranging from $37.0 to $251.0 per share. On average, they have given the company a rating of buy. At today's prices, NTRA is trading -27.58% away from its average analyst target price of $192.78 per share.

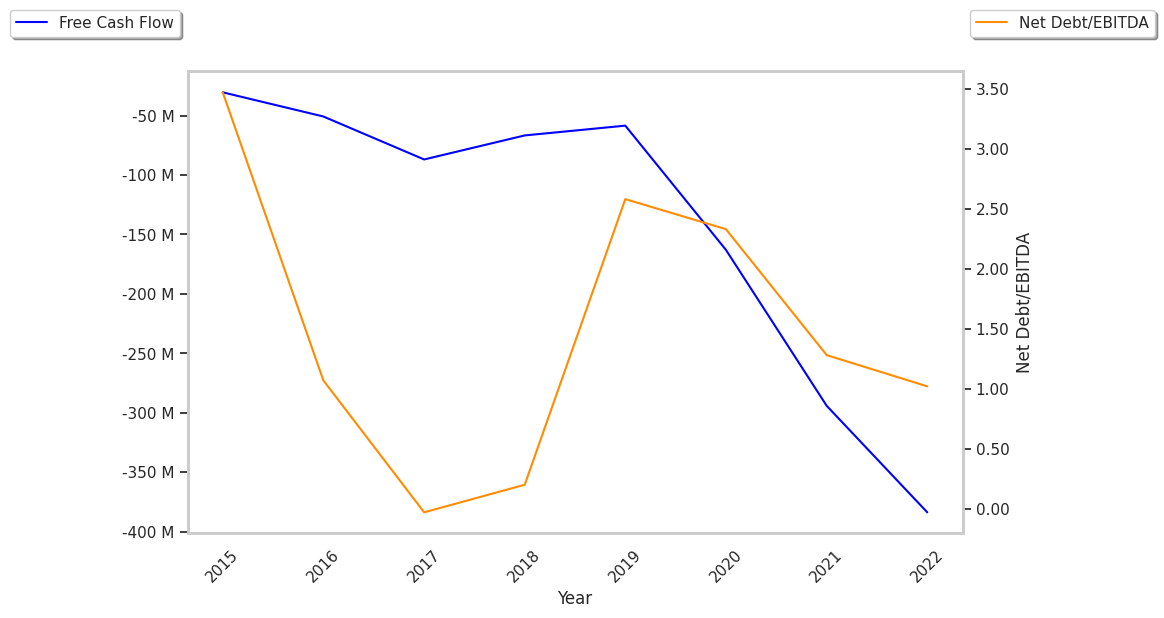

Over the last year, NTRA's share price has increased by 34.9%, which represents a difference of 17.1% when compared to the S&P 500. The stock's 52 week high is $183.0 per share whereas its 52 week low is $92.14. Natera has averaged free cash flows of $-223817500.0 over the last 5 years, but they have been increasing at a rate of 15.0%. Nonetheless, more cautious investors will probably avoid this stock until the business becomes firmly cash positive.

| Date Reported | Cash Flow from Operations ($ k) | Capital expenditures ($ k) | Free Cash Flow ($ k) | YoY Growth (%) |

|---|---|---|---|---|

| 2024 | 135,664 | 66,423 | 69,241 | 124.2 |

| 2023 | -246,955 | 39,199 | -286,154 | 40.28 |

| 2022 | -431,501 | 47,697 | -479,198 | -27.36 |

| 2021 | -335,236 | 41,030 | -376,266 | -86.16 |

| 2020 | -182,512 | 19,604 | -202,116 | -195.44 |

| 2019 | -63,444 | 4,968 | -68,412 |