Hershey may be undervalued with strong growth indicators, but the 22 analysts following the company give it an rating of hold. Their target prices range from $123.0 to $211.0 per share, for an average of $166.68. At today's price of $189.7, Hershey is trading 13.81% away from its average target price, suggesting there is an analyst belief that shares are overpriced for the stock.

The Hershey Company, together with its subsidiaries, engages in the manufacture and sale of confectionery products and pantry items in the United States and internationally. Based in Hershey, PA, the Large-Cap Consumer Staples company has 18,540 full time employees. Hershey has provided a 2.9% dividend yield over the last 12 months.

Hershey has a trailing twelve month P/E ratio of 23.3, compared to an average of 25.91 for the Consumer Staples sector. Considering its EPS guidance of $8.4, the company has a forward P/E ratio of 22.6.

Hershey is also overpriced compared to its book value, since its P/B ratio of 8.2 is higher than the sector average of 3.03. The company's shares are currently 151.7% below their Graham number, indicating that its shares have a margin of safety.

| 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | |

|---|---|---|---|---|---|---|

| Revenue (M) | $7,986 | $8,150 | $8,971 | $10,419 | $11,165 | $11,202 |

| Gross Margins | 45% | 45% | 45% | 43% | 45% | 47% |

| Net Margins | 14% | 16% | 16% | 16% | 17% | 20% |

| Net Income (M) | $1,150 | $1,279 | $1,478 | $1,645 | $1,862 | $2,221 |

| Net Interest Expense (M) | -$144 | -$149 | -$127 | -$138 | -$152 | -$166 |

| Depreciation & Amort. (M) | $292 | $295 | $315 | $379 | $420 | $292 |

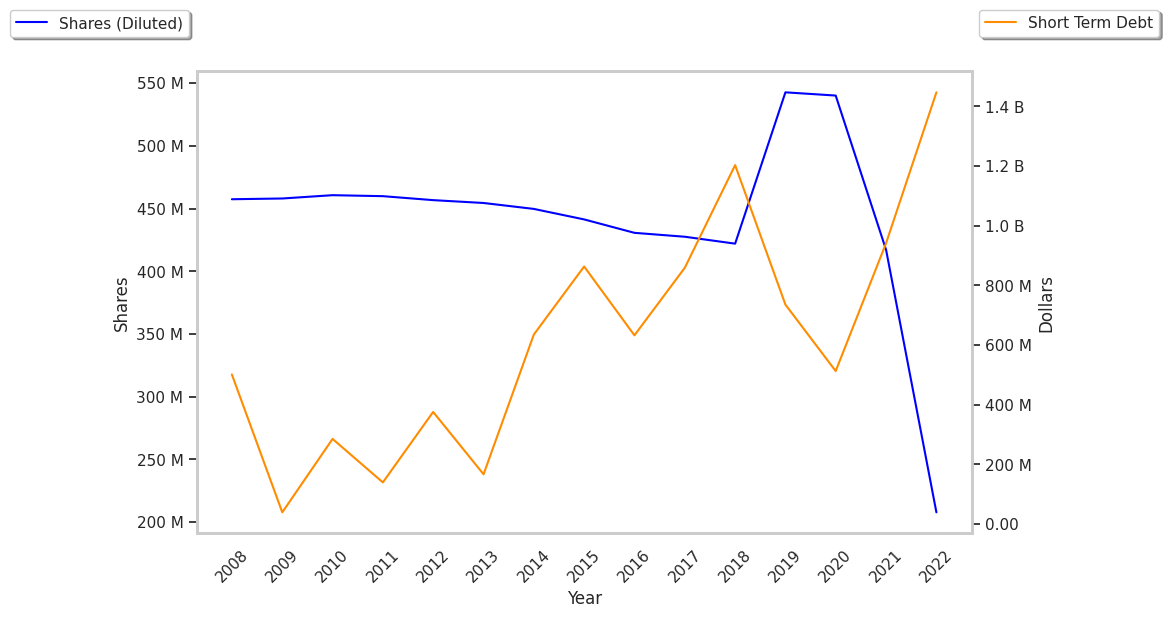

| Diluted Shares (M) | 209 | 210 | 207 | 205 | 204 | 204 |

| Earnings Per Share | $5.46 | $6.11 | $7.11 | $7.96 | $9.06 | $10.92 |

| EPS Growth | n/a | 11.9% | 16.37% | 11.95% | 13.82% | 20.53% |

| Avg. Price | $124.09 | $134.99 | $163.47 | $206.36 | $188.87 | $192.2 |

| P/E Ratio | 22.73 | 22.09 | 22.99 | 25.92 | 20.85 | 17.6 |

| Free Cash Flow (M) | $1,446 | $1,258 | $1,587 | $1,808 | $1,552 | $1,926 |

| CAPEX (M) | $318 | $442 | $496 | $519 | $771 | $606 |

| EV / EBITDA | 15.69 | 15.26 | 15.95 | 17.42 | 14.17 | 13.44 |

| Total Debt (M) | $4,234 | $4,529 | $4,089 | $4,098 | $4,094 | $4,400 |

| Net Debt / EBITDA | 1.98 | 1.63 | 1.59 | 1.38 | 1.24 | 1.15 |

| Current Ratio | 1.05 | 1.57 | 0.9 | 0.8 | 0.97 | 0.96 |