We've been asking ourselves recently if the market has placed a fair valuation on Schlumberger. Let's dive into some of the fundamental values of this Large-Cap Energy company to determine if there might be an opportunity here for value-minded investors.

Schlumberger Is Undervalued at Today's Prices:

Schlumberger Limited engages in the provision of technology for the energy industry worldwide. The company belongs to the Energy sector, which has an average price to earnings (P/E) ratio of 18.35 and an average price to book (P/B) ratio of 1.6. In contrast, Schlumberger has a trailing 12 month P/E ratio of 11.4 and a P/B ratio of 2.21.

Schlumberger has moved -27.3% over the last year compared to 15.0% for the S&P 500 — a difference of -42.3%. Schlumberger has a 52 week high of $46.16 and a 52 week low of $31.11.

Growing Revenues and an Average Current Ratio:

| 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | |

|---|---|---|---|---|---|---|

| Revenue (M) | $32,917 | $23,601 | $22,929 | $28,091 | $33,135 | $36,289 |

| Operating Margins | -32% | -48% | 10% | 15% | 16% | 16% |

| Net Margins | -31% | -45% | 8% | 12% | 13% | 12% |

| Net Income (M) | -$10,137 | -$10,518 | $1,881 | $3,441 | $4,203 | $4,461 |

| Net Interest Expense (M) | $609 | $563 | $539 | $490 | $503 | $512 |

| Depreciation & Amort. (M) | $3,589 | $2,566 | $2,120 | $2,147 | $2,312 | $1,551 |

| Diluted Shares (M) | 1,385 | 1,390 | 1,427 | 1,437 | 1,443 | 1,436 |

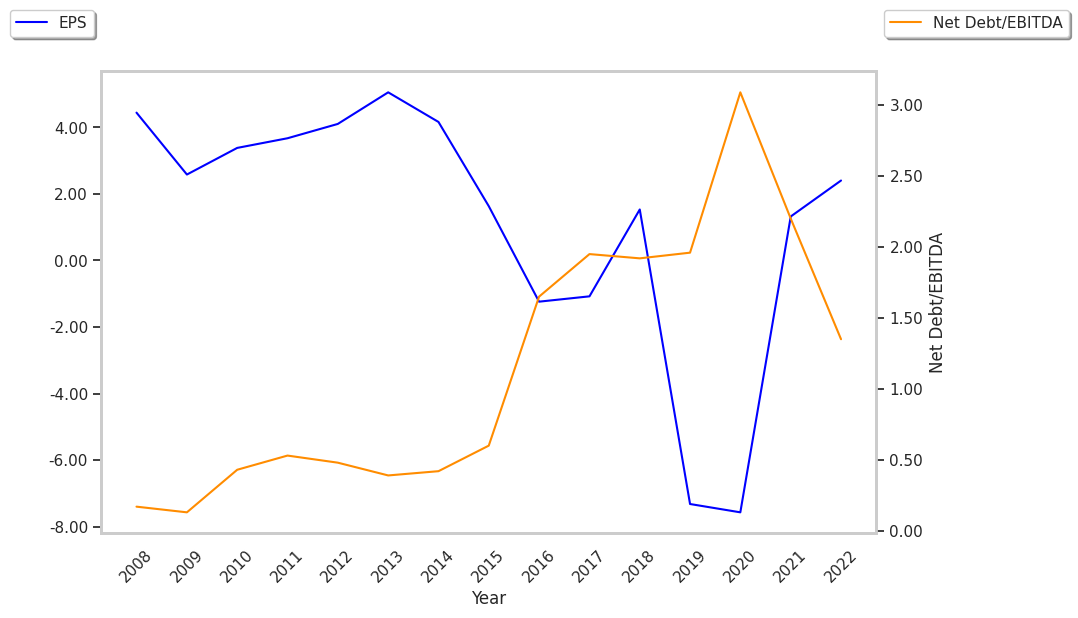

| Earnings Per Share | -$7.32 | -$7.57 | $1.32 | $2.39 | $2.91 | $3.11 |

| EPS Growth | n/a | -3.42% | 117.44% | 81.06% | 21.76% | 6.87% |

| Avg. Price | $34.76 | $19.66 | $28.35 | $39.35 | $52.04 | $33.37 |

| P/E Ratio | -4.75 | -2.6 | 21.16 | 16.19 | 17.64 | 10.63 |

| Free Cash Flow (M) | $3,707 | $1,828 | $3,510 | $2,102 | $4,698 | $4,671 |

| CAPEX (M) | $1,724 | $1,116 | $1,141 | $1,618 | $1,939 | $1,931 |

| EV / EBITDA | -9.12 | -4.97 | 11.62 | 10.35 | 10.98 | 7.65 |

| Total Debt (M) | $15,294 | $16,886 | $14,195 | $12,226 | $11,965 | $12,074 |

| Net Debt / EBITDA | -2.07 | -1.84 | 2.77 | 1.65 | 1.19 | 1.18 |

| Current Ratio | 1.19 | 1.23 | 1.22 | 1.25 | 1.32 | 1.45 |

Schlumberger benefits from strong operating margins with a positive growth rate, growing revenues and a flat capital expenditure trend, and positive EPS growth. The company's financial statements show generally positive cash flows and healthy leverage levels. Furthermore, Schlumberger has just enough current assets to cover current liabilities, as shown by its current ratio of 1.45.